Actionable Stock Set-up 10: Amkor Technology (AMKR)

Long-Term

In this edition of Actionable Stock Set ups myself and Michel will be taking a look at the Investment Case for Amkor Technology (AMKR). It is the 10th entrant into the Actionable Set-ups series, this time for the Long-Term.

Layout:

Overview of Amkor Technologies

Bull and Bear Case

Management

Financials and Valuation

Chart

Current position and plans

Amkor Technology is one of the world’s largest providers of outsourced semiconductor packaging and test services or ‘outsourced semiconductor assembly and test (OSAT) services’

In simple terms, after a chipmaker designs and manufactures a semiconductor chip, Amkor steps in to:

Package the Chip: They transform the bare semiconductor die (the chip) into a finished, protected product that can be integrated into electronic devices (like phones, computers, cars, etc.). This involves advanced packaging technologies like:

Flip Chip Packaging (for CPUs, GPUs, and networking)

Wafer-Level Packaging (WLP)

System-in-Package (SiP) modules

High-Density Fan-Out (HDFO), which is critical for AI processors and high-performance computing.

Test the Chip: They provide comprehensive electrical and system-level testing services to ensure the packaged chips are fast, reliable, and perform to specifications.

AMKR plays a critical role in the final stage of chip manufacturing, when delicate silicon components are encased in protective and performance-enhancing housings that ensure both durability and electrical connectivity.

They deliver a broad range of advanced packaging solutions, including 2.5D/3D integration and system-in-package (SiP) technologies, which are increasingly vital for high-performance computing, artificial intelligence and next-generation mobile devices.

Strategic Partners:

Amkor works with a wide range of leading companies across the entire electronics supply chain, including the world’s largest semiconductor designers, foundries, and electronics manufacturers (OEMs).

Key partners and major clients that are frequently mentioned in their business and strategic announcements are discussed below.

Major Customers

Apple: Apple is a major customer, particularly for advanced mobile chipset packaging. Amkor has publicly designated Apple as the “first and largest customer” for its new multi-billion dollar advanced packaging and test facility being built in Arizona. Amkor packages the Apple silicon (chips) produced at the nearby TSMC wafer fabrication plant.

NVIDIA: As a leader in high-performance computing and AI, NVDA is a crucial partner. Amkor’s expertise in advanced packaging technologies like High-Density Fan-Out (HDFO) and 2.5D integration is essential for NVIDIA’s AI accelerators and GPUs. Jensen has highlighted the importance of Amkor’s new U.S. facility in “bringing this capability home.”

Qualcomm: As a major supplier of mobile chipsets, Qualcomm is a key customer for Amkor’s communication segment packaging and test services

Advanced Micro Devices: Amkor partners with AMD for advanced substrate and packaging development for its high-performance computing products.

It’s worth noting that Apple represents an estimated 30-40% of Amkor’s total revenue, highlighting both the strength of this strategic relationship and the customer concentration risk discussed in the bear case section.

Semiconductor Foundries (Partnerships)

Amkor has strategic partnerships with major foundries to provide a seamless front-to-back manufacturing chain:

TSMC : Amkor has a close collaboration with TSMC, particularly in Arizona. TSMC will contract advanced packaging and test services from Amkor’s new facility to support customers who use TSMC’s adjacent wafer fabrication facilities. They collaborate on technologies like TSMC’s Integrated Fan-Out (InFO) and Chip on Wafer on Substrate.

GlobalFoundries: Amkor has a strategic partnership with GlobalFoundries to establish the first at-scale back-end facility in Europe at Amkor’s Porto, Portugal site. This significantly strengthens the European semiconductor supply chain for key markets like automotive

Key Segments

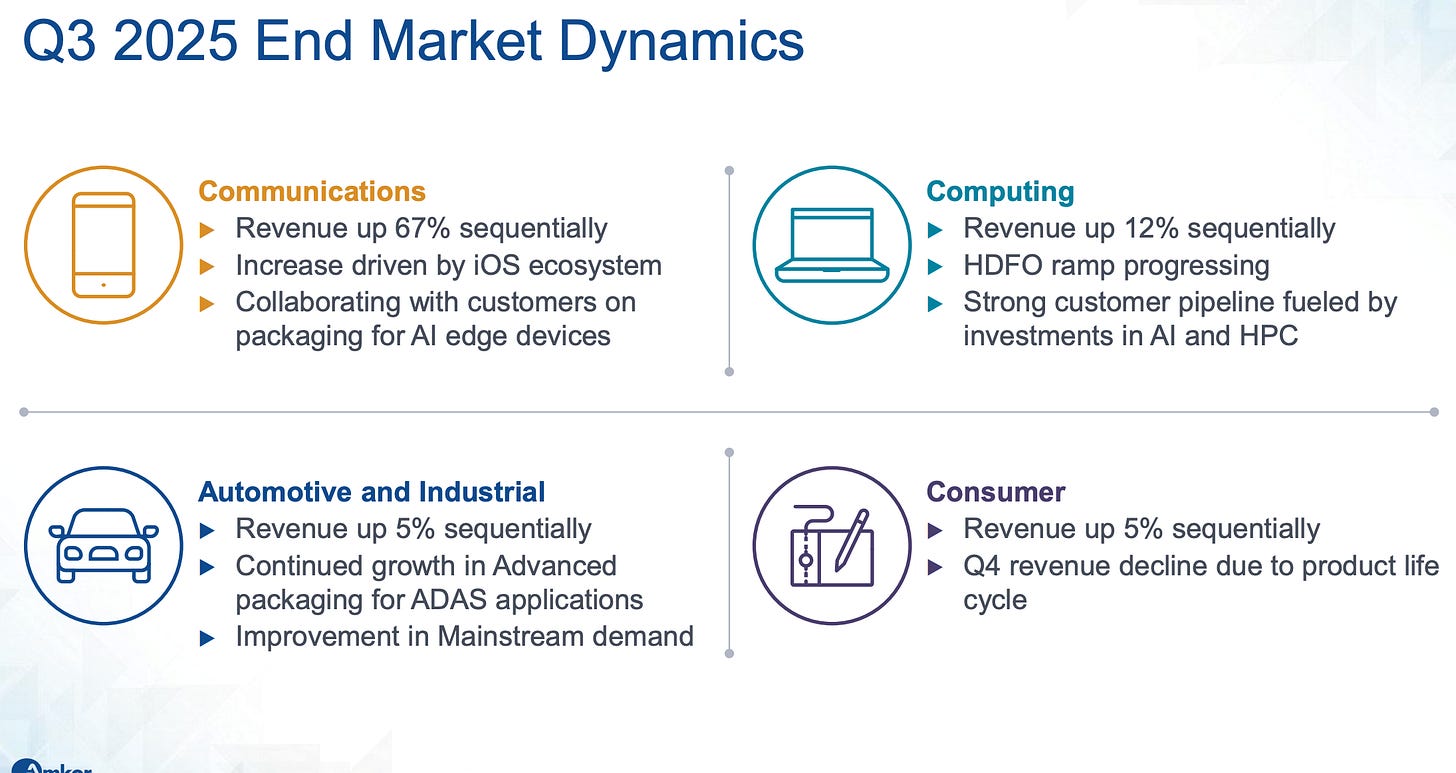

Amkor serves four main end markets: Communications, Computing, Automotive & Industrial and Consumer:

Communications: Driven by smartphone launches and the iOS ecosystem, Amkor packages high-performance mobile processors and related components for leading OEMs like Apple and Qualcomm.

Computing: Benefiting from the surge in demand for AI and HPC, which require advanced packaging for high-density components like AI accelerators and high-bandwidth memory (HBM).

Automotive & Industrial: Providing robust and reliable solutions for automotive electronics, power management, and safety-critical systems. Partners include Infineon Technologies and other automotive/industrial players, securing the supply chain for power systems, ADAS, and safety-critical chips.

Consumer: Covering devices like wearables and other electronics, with services used by major consumer brands including Samsung and Sony.

Structural growth trends

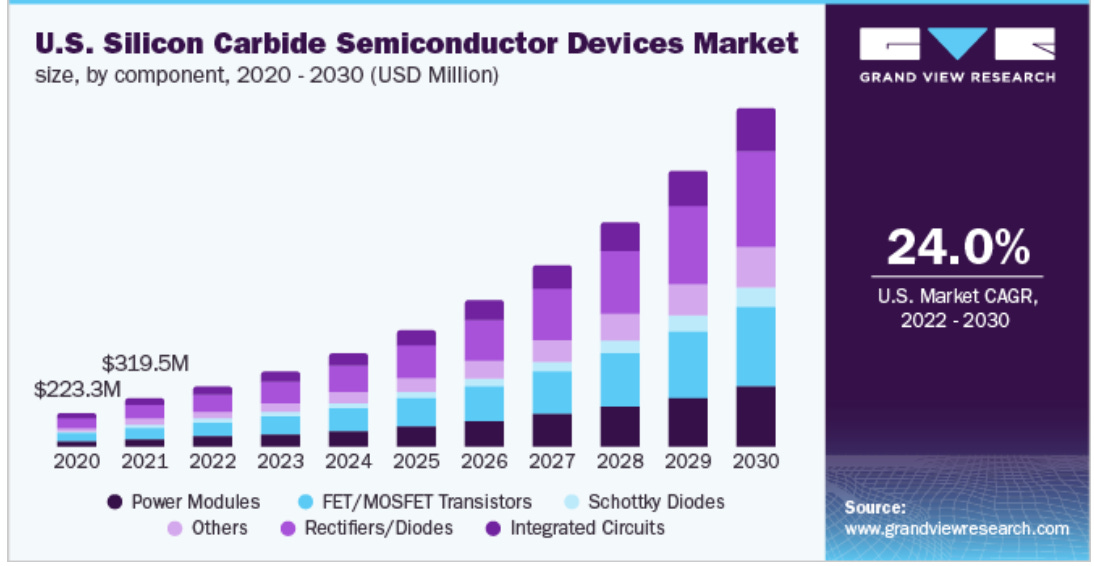

Trends like IoT, AI, and EV/SiC adoption are giving a real boost across all segments, driving higher demand and more valuable solutions. In particular, Amkor has carved out a strong position in the rapidly growing silicon carbide (SiC) segment, a material that represents a generational leap in semiconductor performance. SiC handles heat better, uses energy more efficiently and switches faster than traditional silicon, making it ideal for demanding applications.

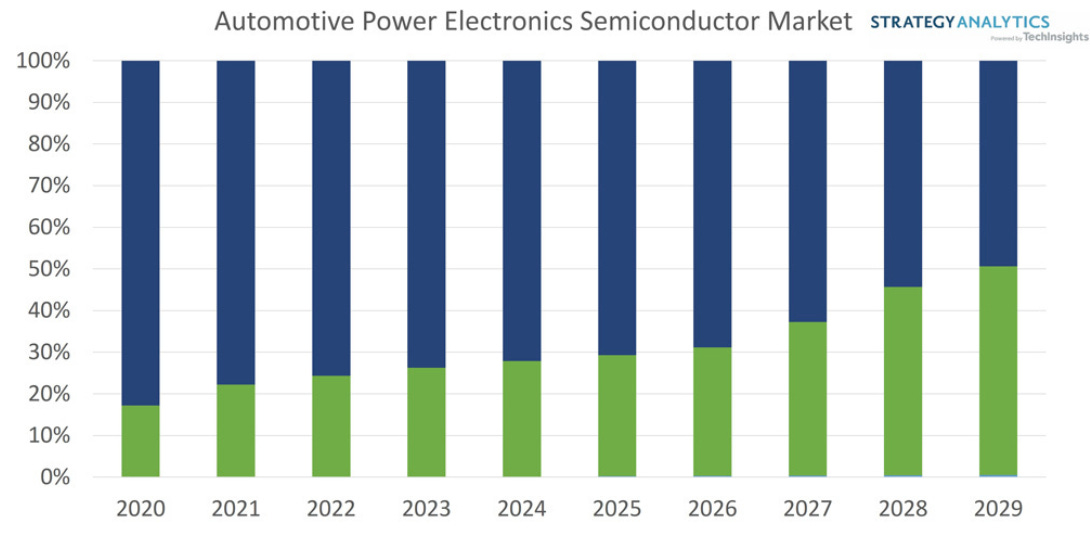

The EV market is driving much of this adoption. Analysts project that over 50% of battery electric vehicles will incorporate SiC powertrains by 2027, up from around 30% today. SiC enables faster charging, longer driving ranges and improved energy efficiency, directly addressing the challenges faced by Amkor’s automotive customers.

Beyond EVs, SiC is increasingly used in solar and wind inverters, industrial power electronics and data center power supplies. While the overall SiC semiconductor market is projected to reach $10.4 billion by 2030 at a 23.8% CAGR, the EV and power electronics segment alone is expected to grow even faster, at 39% CAGR through 2026, highlighting the strong tailwinds from automotive applications.

While SiC device technology itself has become widely adopted across the industry, packaging these advanced semiconductors presents distinct technical challenges that create meaningful barriers to entry. SiC devices operate at significantly higher temperatures (often exceeding 200°C), which demands specialised materials, processes and quality systems that legacy silicon packaging facilities cannot easily replicate.

This expertise gives Amkor a significant competitive advantage. Companies strong in traditional silicon production are not necessarily prepared to transition smoothly to SiC packaging. The specialised know-how, precise manufacturing processes and quality standards create substantial switching costs, positioning Amkor as a trusted, strategic partner rather than a commodity supplier.

As one of the first OSATs to commercialise SiC packaging at scale, the company has established manufacturing expertise, strong customer relationships and a proven track record, advantages that become increasingly valuable as the technology scales.

Bull case

Amkor Technology operates at the forefront of several powerful structural growth trends in the semiconductor industry:

Automotive:

Automotive sector remains a key growth driver for Amkor. Modern cars are increasingly becoming “computers on wheels,” integrating chips for safety, connectivity and energy efficiency. The automotive semiconductor market is expected to grow from $71.2 billion in 2025 to approximately $130.4 billion by 2035 (Gartner, 2025). Automotive-related revenue accounted for ~16% of Q3 2025 revenue.

Autonomous and assisted driving further amplify demand: the ADAS and autonomous component market is projected to expand at a 12.1% CAGR through 2033, reaching $93.7 billion (Straits Research, 2025), while McKinsey estimates the broader autonomous driving ecosystem could reach $300–$400 billion by 2035.

Consumer/Internet of Things (IoT):

Connected devices are expected to reach ± 20 billion by 2025 and exceed 40 billion by 2034 (Statista, 2025), accelerating demand for compact, energy-efficient semiconductors.

Amkor’s capabilities in packaging sensors, connectivity chips and low-power modules, including fan-out wafer-level packaging, contribute ~14% of Q3 2025 revenue.

Computing and high-performance computing (HPC):

These remain critical growth vectors, representing about 19% of Q3 2025 revenue. This segment is expected to grow more than 15% in 2025, reaching $90 billion by 2030 (IDC, 2025), fuelled by AI and data-intensive workloads. Amkor’s advanced thermal management and high-density interconnect technologies, such as 2.5D/3D packaging, support this expansion.

Smartphones and tablets:

Amkor’s largest segment at 51% of Q3 2025 revenue, continues to benefit from 5G adoption, premiumisation and more powerful mobile processors. The aforementioned long-standing partnerships with OEMs like Apple, Qualcomm and TSMC provide stability.

On-shoring via Arizona Expansion: a strategically important move

Amkor new advanced packaging and testing campus in Arizona, will be the first of its kind in the US. The project has backing from Apple, Nvidia, TSMC and it fits with the US government’s CHIPS for America initiative. The Arizona campus will enable high-volume, advanced packaging domestically, streamlining the supply chain for Apple silicon produced at nearby TSMC facilities and accelerating the development of AI, high-bandwidth memory (HBM) and co-packaged optics solutions.

On Amkor’s new Arizona facility Nvidia CEO Jensen Huang said “Amkor’s new Arizona facility is a defining milestone in bringing this capability home. Together, we are rebuilding the supply chain, on-shoring the AI technology stack that turns energy into intelligence and secures America’s leadership for the AI century”

Apple COO Sabih Khan: “Amkor’s new facility will package and test the Apple silicon produced at TSMC Arizona, just down the road. We’re proud to invest in Amkor through Apple’s American Manufacturing Program, which is a key part of our $600 billion commitment to create jobs and accelerate innovation right here in the USA”.

US Secretary Howard Lutnick: “President Trump’s leadership is bringing all stages of semiconductor manufacturing back to the United States. Our partnership with Amkor will bring high volume advanced packaging to the USA for the first time, supporting our leading AI industry capabilities and American innovation.”

Global Footprint: While headquartered in the US, Amkor has an extensive operational base with production facilities and product development centre’s located in key electronics manufacturing regions worldwide, primarily in Asia (Korea, Japan, China, Philippines, Taiwan, Vietnam) and Europe.

It is not often you hear US government officials and C-suite executives of the world’s leading companies talk about a mid-cap company like this. This level of support from both industry leaders and government could create a “too important to fail” dynamic, providing meaningful downside protection and the potential for additional government support through subsidies, tax incentives, or strategic contracts.

Amkor is effectively positioning itself as a strategic national asset: the only pure-play U.S. based OSAT operating at scale.

Bear case

While the long-term growth outlook is strong, several risks remain:

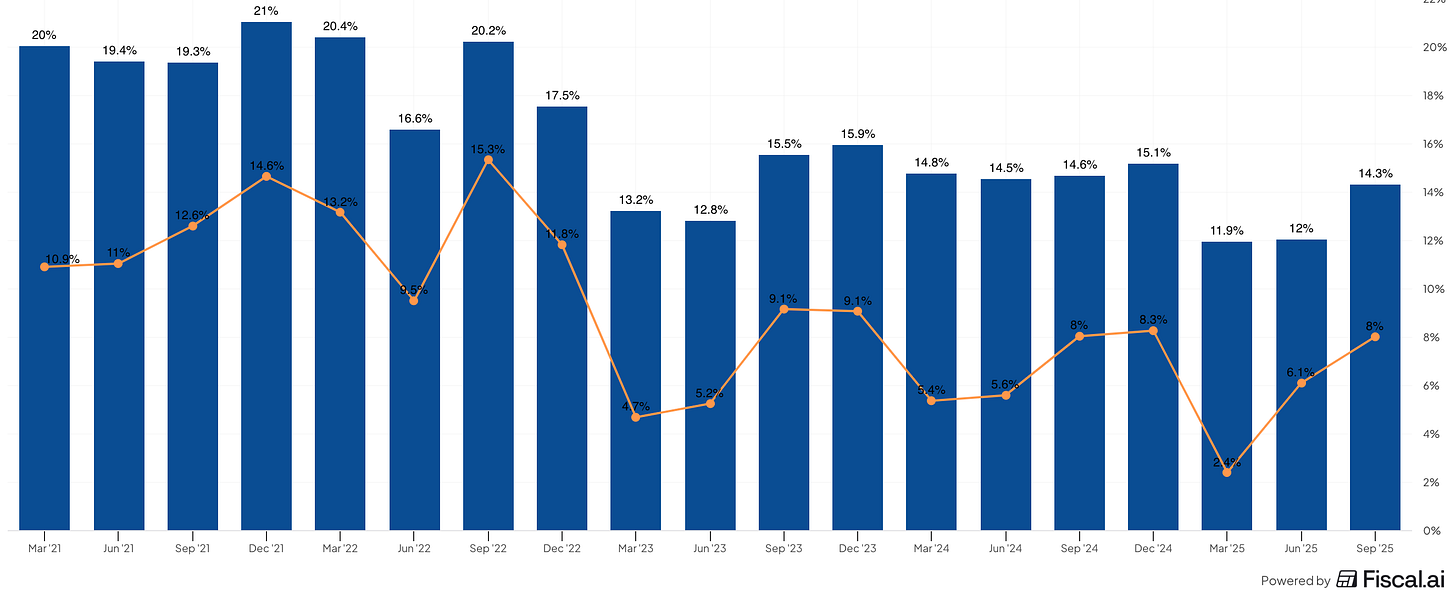

Semiconductor demand is cyclical and as capital expenditure is ramping, margins could come under increasing pressure. Bears would argue that we are in a bull cycle yet the Gross Margins and Operating Margins remain underwhelming. Gross Margins are currently in the low teens and Operating margins are 8%. Just a few years ago they were ~20% and ~15% respectively.

The Arizona facility is Amkor’s first major greenfield facility in the US and execution risk shouldn’t be underestimated (looking at you, Intel). Workforce availability, permitting delays, and yield ramp-up in a new geography present real challenges. If there are delays beyond mid-2027 then budget overruns could be a material concern.

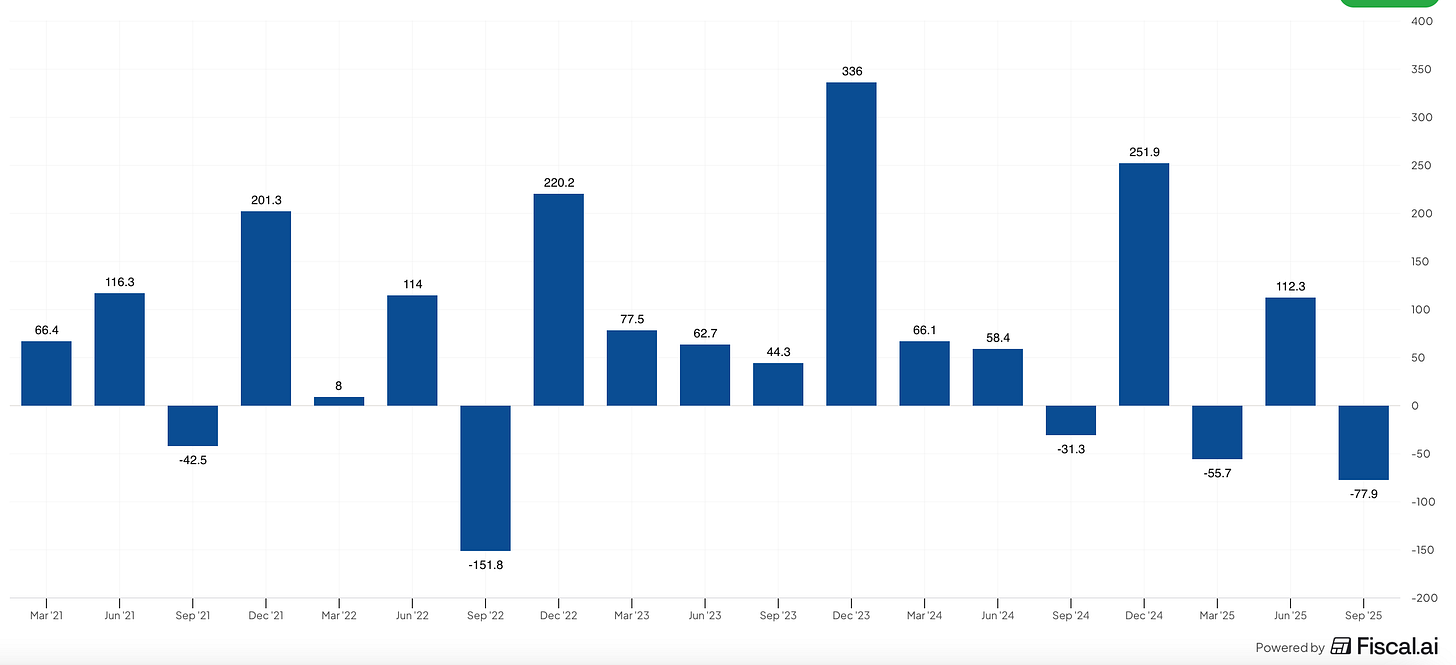

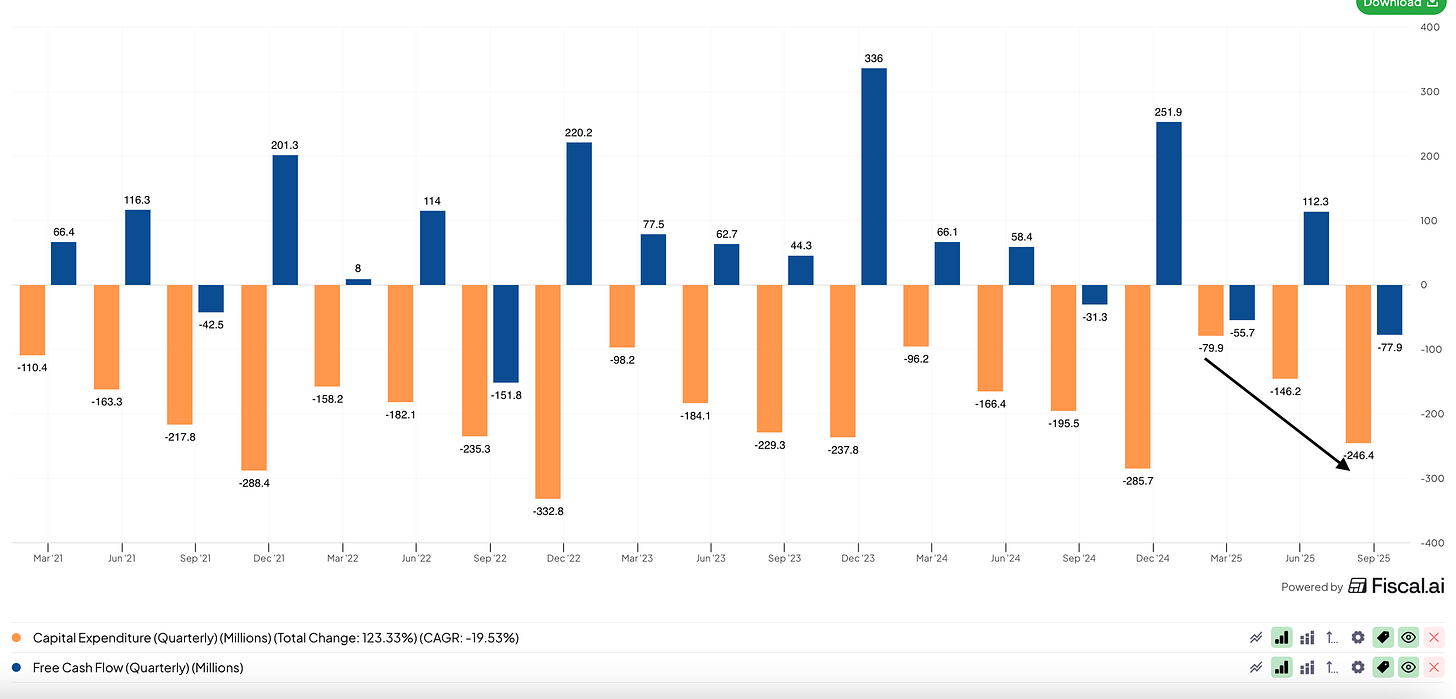

FCF is likely to take a material hit in upcoming years due to the rise in Capex and in fact their most recent quarter plus 3 of the last 5 have actually been FCF negative quarters.

SiC packaging remains technically complex with potential yield and reliability challenges.

Competition from in-house packaging efforts at TSMC and Samsung could limit pricing power. Furthermore, TSMC will still control the highest-margin advanced packaging.

If ASE Technology (the largest OSAT globally) or other competitors announce their own U.S. facilities, Amkor’s competitive moat could narrow.

Customer concentration is a risk. With Apple and Nvidia as the main anchors, any delays, smaller orders, or insourcing could hit the bull thesis.

Management

President and CEO

Giel Rutten joined Amkor in 2014 and served as Executive Vice President of Advanced Products until June 2020 after which point he has served as CEO.

He has more than 30 years of experience in the global semiconductor industry. Before joining Amkor, he served as CEO of Ledzworld, an LED technology company and served as Senior Vice President for the Business Unit Home in NXP. Previously, he joined Philips Semiconductors in 1984 and took on various key management positions in the areas of general management, marketing, operations and engineering in Europe, Asia and the United States. He holds a Master’s degree in Physics and Chemistry from the University of Nijmegen, the Netherlands.

What makes Rutten’s background particularly interesting is his Philips Semiconductors heritage. This division later became NXP Semiconductors and spun off equipment maker ASML, two of Europe’s most successful semiconductor companies. Having started in 1984, he saw firsthand the evolution from early European chip manufacturing to today’s advanced packaging era. That kind of long-term perspective across multiple technology cycles is rare.

Mr. Rutten has however, recently informed the Board of Directors of his intention to retire as President and Chief Executive Officer at the end of 2025. He will remain a member of the company’s Board of Directors. Kevin Engel, the current COO, will be succeeding Mr. Rutten as President and CEO, effective January 1, 2026.

Kevin Engel, Current Chief Operating Officer and Incoming President and CEO

Kevin Engel was appointed Executive Vice President, Chief Operating Officer in February 2025. Prior to this he served as Executive Vice President, Business Units. Mr. Engel joined Amkor in 2004 as part of the acquisition of Unitive Electronics and has held various management positions within Amkor US and Taiwan. Prior to joining Amkor, Mr. Engel worked in engineering at National Semiconductor and has held various positions in the semiconductor manufacturing and packaging industry for more than 27 years. Mr. Engel holds a Bachelor of Chemical Engineering from Auburn University

Ms Kim said “Kevin is an industry veteran with more than twenty years of experience with Amkor. He is uniquely qualified to lead the company when Giel retires and to continue the company’s close collaboration with leading semiconductor companies”

An internal promotion like this means they have prioritised continuity over change. The board clearly believes in the strategy and trusts Engel to deliver on Arizona and the HPC/AI opportunity.

James J. Kim (Founder and now Chairman Emeritus)

Mr. Kim founded Amkor Electronics, Inc. (AMKR predecessor) in 1968 whilst still a law student and served as its Chairman from 1970 to April 1998. Mr Kim took the company public in 1998 and served as Amkor’s Chairman and Chief Executive Officer from September 1997 until October 2009.

He stayed on as executive chairman of the Board until October 2024, Mr. Kim retired as Executive Chairman of the Board of Directors. The Board of Directors recognised Mr. Kim’s extraordinary contributions to the company by bestowing on him the honorary title of Chairman Emeritus.

Chairman of the Board since 2024 is Susan Kim, James Kim’s daughter. She had previously served as Executive Vice Chairman since August 2020.

It’s worth nothing that the Kim family still owns around ± 7% of the company through a series of trusts. That continued ownership adds a layer of stability and helps keep the company’s strategic decisions aligned with a long-term view.

The rest of the Corporate Management Team is as below:

In our view the management team is strong and represents some of the most experienced semiconductor professionals and visionaries in the industry.

Financials and Valuation

Financials

At the time of writing, AMKR has a Market Cap of $8.09B with Cash & Inv. of $2.11B and Debt of $1.89B. AMKR is Net Cash positive, Debt to Equity ratio is 0.4 and Debt to TTM EBITDA sits at 1.7x.

TTM Performance:

Revenue TTM: $6.449.1 (B)

Gross Profit TTM: $870.7 (M)

Operating Income TTM: $416.9 (M)

Net Income TTM: $ 307.8 (M)

Q3 2025 Highlights:

Revenues of $1.987B which represented a 6.7% increase YOY

Operating Income of $158.9M which is up from 149.4M YOY (Q3 24)

GAAP Net Income of $126.6M up from $105.6M in the same period.

Cash flow from Operations $168.5M up from $168.2M YOY (Q3 24)

Free Cash Flow of (77.9)M down from (31.3)M YOY (Q3 24)

In terms of end markets, Communications is the largest and also grew fastest sequentially, Revenue grew 67% sequentially (QOQ). The iOS ecosystem drove this increase.

Valuation:

AMKR trades at:

1.2x LTM EV/S and 1.1x NTM EV/S.

7.7x LTM EV/EBITDA, 6.5x NTM EV/EBITDA and ~6.2x FY26 EBITDA.

26.8x LTM PE, 22.4x NTM PE and 20.2x PE on FY26 projected numbers,.

35.6x P/FCF, (92)x NTM EV/FCF and (141)x FY26 projected FCF.

In our opinion, Amkor offers a compelling growth opportunity compared with many other semiconductor and packaging players. Returns are somewhat modest for a growth tech: ROE stands at 14.8% and ROIC at 12.4%, which is low for the capital invested today but should improve as the Arizona facility ramps up and volumes increase.

Free cash flow will be under pressure over the next 2–3 years due to peak capital expenditures for Arizona facility build out, but this is a temporary tradeoff for long-term structural growth. The Free Cash Flow multiples reflect the increased capital expenditures.

Chart and Technicals

Currently trades at $32.16, 15.22% above the 50SMA and 43.71% above the 200SMA.

RSI 59.38

+23.64% YTD

AMKR remains in an uptrend with all the key MA’s trending above the other. Since May AMKR has respected the 21 EMA including today as it held that level. For academic purposes AMKR did undergo a Golden Cross in late August.

For a new entry, further normal pullbacks to the EMA 21 may provide an entry. However, for more value minded individuals (where lower is better!) a pullback to the SMA 50 would be preferable.

There is a gap fill at $36.15 from 29th July 2024 which would be a logical upside level , and beyond that would be the previous high in recent years of $43.37 reached on 16th July 2024.

Current position and plans

SixSigmaCapital does not hold a position at the time of writing.

Michel has a full position and below are his final thoughts and plans for his position. (Also ensure to subscribe to his substack if you have enjoyed this write up)

The Arizona facility changes everything for Amkor. By bringing advanced packaging to the U.S, the company is cementing its role as a key partner for top semiconductor players, positioning itself in fast-growing AI and computing markets whilst taking full advantage of the on-shoring trend in semiconductor manufacturing. This isn’t slowing down anytime soon.

Amkor has already proven its technical and commercial capabilities, but the real volume ramp will come once the Arizona facility reaches full production, keeping the story partly a “show me” one for investors. With current valuations and the strong tailwinds from both existing partners and government support, I felt confident taking a full position around $31.

Why this is a comfortable “show me” story?

Companies like Apple, Nvidia and TSMC don’t commit to $7 billion projects lightly. Apple is even investing directly via their American Manufacturing Program.

Structural tailwinds: SiC adoption, AI packaging and automotive electrification are decade-long shifts, not fads. Amkor has an early-mover advantage in SiC and is the only American OSAT with scale.

Government support: The CHIPS Act funding and political support reduce execution risk. The US government wants this to succeed.

Holding period: 5 years minimum. Volume ramp in Arizona begins late 2028 / early 2029, but I see the real payoff coming in 2029-2032 as phase 2 comes online and margins expand through economies of scale.

Thank you for reading and if you enjoyed this post, please leave a like and Restack.

Subscribe to the plan that best suits your needs (free or premium), and will see you in the next one!

Phenomenal deep-dive! Your synthesis of AMKR's strategic positioning is exceptional. The connection between the Arizona facility, national security interests, and AMD's advanced packaging needs creates a powerful moat. I particularly appreciate your nuanced discussion of the SiC barriers to entry - the thermal management expertise isn't easily replicated. The 'too important to fail' framwork around government support is brilliantly articulated. Michel's 5-year hold thesis with 2029-2032 payoff window is compelling given the capex cycle.