Actionable Stock Set-up 7: Harrow Inc (HROW)

Longer Term

We will be taking a look at the Investment Case for Harrow Inc (HROW) in this write-up. It is tentatively the 7th entrant into the Actionable Set-ups series, this time for the Longer term.

Layout:

Overview of Harrow Inc

Management

Financials

Chart and Technicals

My current position and plans

Harrow Inc (HROW)

Harrow, Inc. is a U.S.-based pharmaceutical company exclusively dedicated to the discovery, development, and commercialisation of ophthalmic therapies. Their business model is centred on providing a comprehensive portfolio of eye care medications to ophthalmologists, optometrists and patients.

Harrow's commercial portfolio includes a range of branded products designed to address several eye conditions. This table below neatly presents them by product name, active ingredient and indication.

Beyond its branded products, Harrow also operates ImprimisRx which is its compounding pharmacy segment. ImprimisRx provides customised ophthalmic formulations. The company's strategy involves both acquiring established ophthalmic products and developing its own pipeline of new therapies.

The Bull Case for HROW

Pure-Play Ophthalmic Focus:

Harrow offers direct exposure to the U.S. ophthalmology market, which is experiencing long-term growth driven by an ageing population and an increasing prevalence of eye diseases like dry eye. Increasing use of screens likely will increase this trend. Furthermore, the increasing prevalence of conditions such as Hypertension, Diabetes and Morbid Obesity means Ocular pathology will keep increasing.

VEVYE “Harrows Most Valuable Asset”:

The cornerstone of the bull case is the successful commercial launch of VEVYE since Jan 2024. It is a novel treatment with FDA approval for dry eye disease, which is a large and underserved market. VEVYE has the potential to become a major revenue driver (already is!) and capture significant market share. In the earnings call CEO Mark Baum alluded to the fact that VEVYE is easily Harrows Most valuable asset and also stated: “On VEVYE, we believe we are on a glide path to generate at least $100 million in VEVYE revenues this year and perhaps much more”. Revenue from VEVYE has actually grown >35% QOQ and increased 8x YOY.

Early success in securing commercial payor coverage is another key positive indicator and in the earnings call CEO Baum stated “Early VAFA program data has been very promising, with new VEVYE prescription volumes at PhilRx more than quadrupling and prescribers increasing by over 4X, all while maintaining a strong average selling price”. The following statement is very notable: “less than two months into implementation, VAFA’s early momentum has surpassed our expectations, reinforcing my conviction that this groundbreaking initiative is one of the most impactful and potentially financially transformative in Harrow’s history”

Established and Growing Portfolio:

Beyond VEVYE, the company has several other revenue-generating branded products (see earlier table). Whilst net revenues from this portfolio were softer in Q1, we should expect revenues from these products to steadily contribute more to Harrow’s overall revenue. This diversified portfolio mitigates reliance on a single drug or indication. The pass-through reimbursement status for TRIESENCE , which became effective on April 1st 2025, is expected to boost its adoption meaningfully. On the call they also reiterated their confidence in growing unit demand for IHEEZO through the remainder of the year.

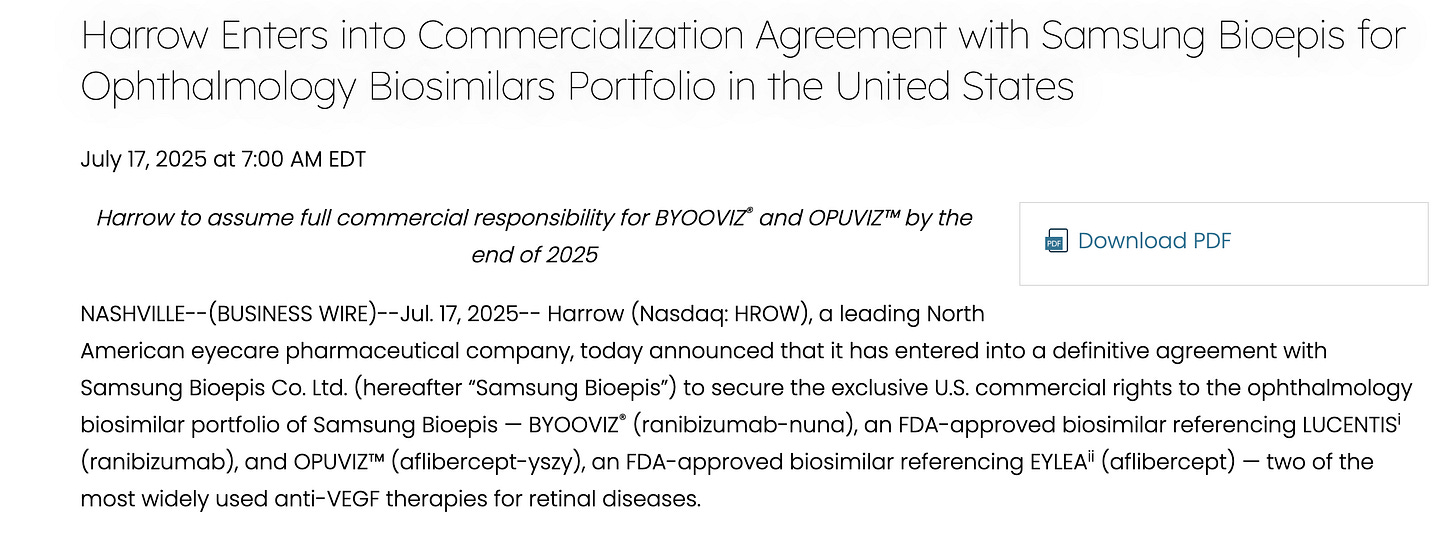

Furthermore, as recently as July 17th, Harrow entered into a commercialisation agreement with Samsung Bioepis for Ophthalmology Biosimilars Portfolio in the United States i.e. BYOOVIZ and OPUVIZ. These are anti-VEGF therapies for conditions such as Age-related macular degeneration, Diabetic Macular Oedema and Retinal Vein Occlusion.

Project Beagle:

A recent initiative under which the management team is doing a 360-degree review of opportunities to offer ImprimisRx customers a Harrow-owned, FDA-approved alternative to a compounded formulation.

Example of this is when VAFA program included 25,000 patients who had historically been prescribed Klarity-C Drops®, a compounded cyclosporine 0.1% product manufactured and distributed by ImprimisRx. This shift will boost VEVYE revenues and overall margins.

Aggressive Growth Strategy:

Management has demonstrated a clear strategy of acquiring undervalued or non-core assets from larger pharmaceutical companies and successfully commercialising them. Management said in Q1: “we remain committed to pursuing strategic acquisitions that add high-quality ophthalmic pharmaceutical assets to our best-in-class U.S. commercial platform”. History suggests this will be a benefit for Harrow Inc.

Experienced Management:

The company is led by a management team with vast experience in the ophthalmic pharmaceutical space. This is critical for navigating the complexities of drug development, FDA approval, and commercial launches. Thus far they have been successful and in the shareholder letter CEO said: “Stockholders should count on us to leverage our commercial platform and all-star commercial team and opportunistically add new impactful ophthalmic products to our portfolio”

Incentive structure:

There is a very interesting incentive structure whereby CEO Mark Baum will receive approximately 890k shares (~3% of company, ~$90m pretax) if stock touches $100 but gets zero if stock does not hit $50. Likewise, the CFO gets paid big, approximately $40m of stock if HROW hits $100. This “bet big on yourself” deal is certainly interesting given the stock is currently ~$32.

Minimal and Manageable Tariff Impact:

Internal analysis by the company found that hypothetical implications of the current proposed tariff structure on ‘24 gross margins would have been approximately 0.52% in total, 0.11% from branded products, and 0.41% from compounded products.

They would expect the impact to be even more muted in 2025, given that higher-margin branded products now account for a larger share of revenue and that management is working to source certain ImprimisRx components from secondary suppliers subject to lower tariff rates

The Bear Case for HROW

Execution Risk on VEVYE Launch: The bull thesis relies heavily on the successful commercialisation of VEVYE. A slower-than-expected uptake, failure to secure continued broad insurance coverage, or manufacturing hurdles (some drugs are manufactured abroad still) could severely impact future revenue and profitability.

Competition: The market for dry eye disease is highly competitive, with established players and other emerging therapies. Harrow will need to maintain significant S&M spend to differentiate VEVYE and compete with rivals.

Significant Debt Load: To fund its acquisitions, particularly the purchase of VEVYE, Harrow has accrued a substantial amount of debt. Currently debt sits at 230M which has almost tripled since the end of 2022. The company has shifted to marginally FCF positive in the most recent quarter but servicing the sizeable debt is something to keep an eye on.

Potential for Dilution: Launching a new drug is expensive and the company has in its recent past been operating at a loss. If VEVYE does not ramp as intended (9 figures in revenue this year) then Harrow may dilute as it has done previously. Share count is up 20% in the since July 2023.

U.S. Market dependence: Harrow's exclusive focus on the U.S. market means it is at the whim of domestic healthcare policy changes, pricing pressures from insurance companies and regulatory decisions by the FDA.

Management

CEO:

Mark L. Baum serves as the Chairman and Chief Executive Officer. His background is in finance and law, which has heavily influenced the company's growth-by-acquisition approach. He has founded several other companies including Eton Pharmaceuticals (ETON), Surface Opthalmics and Melt Pharmaceuticals.

Of interest, Mr. Baum serves on the board of the Ophthalmology Foundation, which works with eye care professionals and professional societies to enhance and provide ophthalmic education, focusing on low-resource and underserved countries.

Other key executives:

Andrew R. Boll (Chief Financial Officer): His role is a critical to navigating the company's aggressive growth strategy given by nature significant capital is required for drug launches.

John P. Saharek (Chief Commercial Officer): Leads the sales and marketing efforts. His team is directly responsible for the successful commercial launch and market uptake of key products like VEVYE® and IHEEZO®, which is the cornerstone of the company's investment case.

Financials

Harrow has a Market Cap of $1.22B with Cash of $70.18M and Debt of $230M. Net Debt position is not ideal; management are actively speaking to existing lenders and several prospective partners regarding opportunities to refinance/repay portion of the outstanding debt.

TTM Performance:

Revenue TTM: $212.86M

Gross Profit TTM: $158.64M

Operating Income TTM: $4.77M

Net Income TTM: ($21.696M)

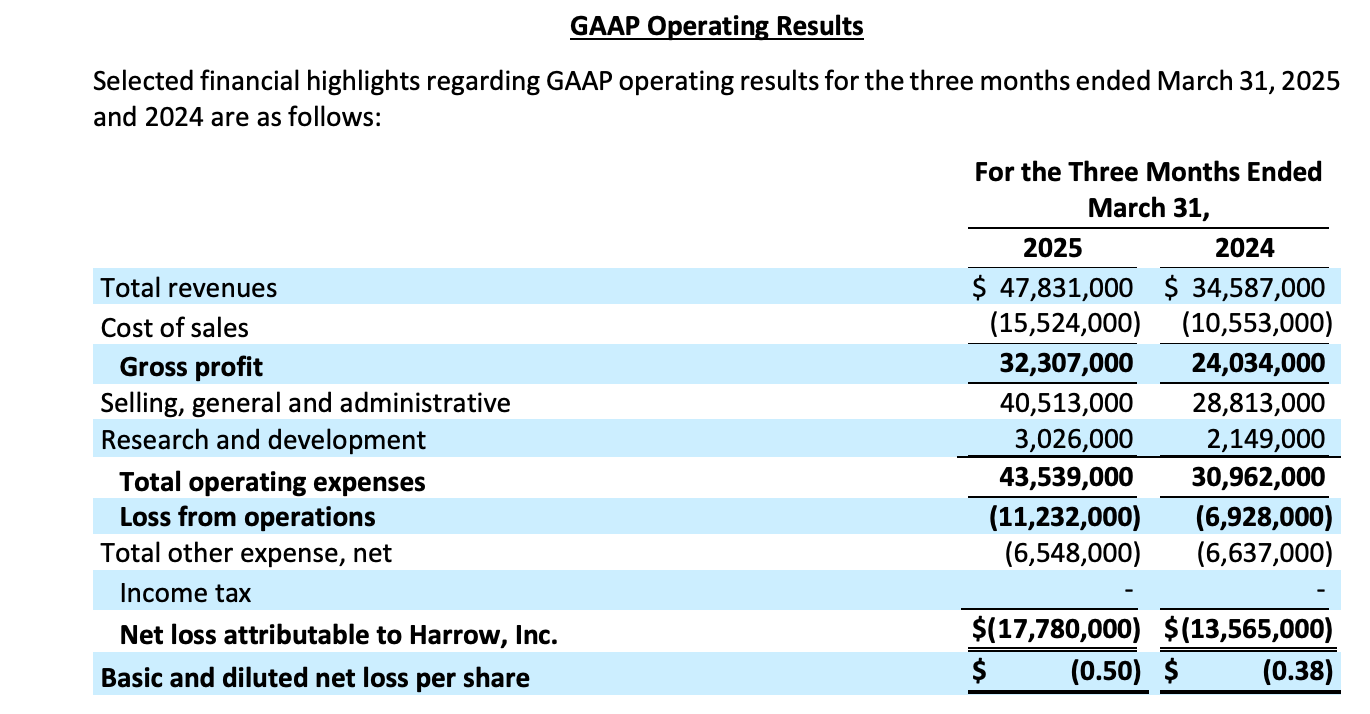

First-Quarter 2025 Highlights:

Revenues of $47.8 million, a 38% increase over $34.6 million recorded in prior-year period

VEVYE revenues increased to $21.5 million, a 35% increase from $16.0 million in the fourth quarter 2024

Cash flow from operations reached a record high of $19.7 million

GAAP net loss of $(17.8) million

Adjusted EBITDA of $(2.0) million

Cash and cash equivalents of $66.7 million as of March 31, 2025

Note that Harrow’s business follows a predictable seasonal pattern. The first quarter is typically the weakest due to factors like insurance deductible resets and distributor stocking. Performance then generally improves throughout the year, with the fourth quarter being the strongest, driven by year-end patient and distributor purchasing.

CEO reiterated that they are on track to surpass the 280M revenue guidance. This is an aggressive guide and would represent 40% top line growth if met. Impressive.

Valuation:

HROW trades at Trades at 6.5x EV/s and 4.4x NTM EV/S. Trades at 29.6x NTM earnings estimates. Although, in 2027 EPS is expected to reach $4.14 (see below) which puts it at 8x projected 2027 earnings.

Clearly if those estimates are met, and stock holds even a market multiple, then current valuation is compelling and stock will be much higher from todays levels. Lots of growth required.

Chart:

Trades at $33.21 , RSI 49.49, 1.46% above SMA 200.

I like that the stock picked up off the bottom in April and has been grinding up mostly with low volatility.

Recent re-test of the SMA 200 has held but now stock is sitting at confluence of key MA’s. With the upcoming ER on 11th August, a high volatility event, we should expect the stock to move decisively in either direction.

My current position and plans

I am long at cost average of 32.4. I expect that this upcoming ER will serve as a high volatility event but as long as earnings are in line and revenues are trending strongly, I plan to hold this position for the foreseeable.

However, given HROW is somewhat of a more uncertain bet, my position sizing does reflect this and it sits as a 3% position.

Lastly, before I go, if interested in the stock I highly recommend you to listen to the Earnings webcast via the link below. It was refreshing to see a CEO with great enthusiasm!

https://edge.media-server.com/mmc/p/49t73qpx/

Thank you for reading. Subscribe to the plan that best suits your needs (free or premium). I look forward to seeing you for the next one!