Actionable Stock Set-up 8: Novo Nordisk (NVO)

We will be taking a look at the Investment Case for Novo Nordisk (NVO) in this write-up. It is the 8th entrant into the Actionable Set-ups series, this time for the Longer term.

Layout:

Overview of Novo Nordisk

Management

Financials and Valuation

Chart

My current position and plans

Overview

Novo Nordisk is a global healthcare company founded in 1923 and headquartered in Denmark. It is a global leader in the treatment of diabetes and more recently in obesity management. It has gained popularity in recent years due to the rise of GLP-1 (Glucagon-like-peptide-1) agonists, which have proven highly effective for both blood sugar control and weight loss, especially in Diabetics. The stock had a meteoric rise from 2020 until mid 2024 but is now down 60% or so in the last 1 year.

Core Products & Revenue Splits

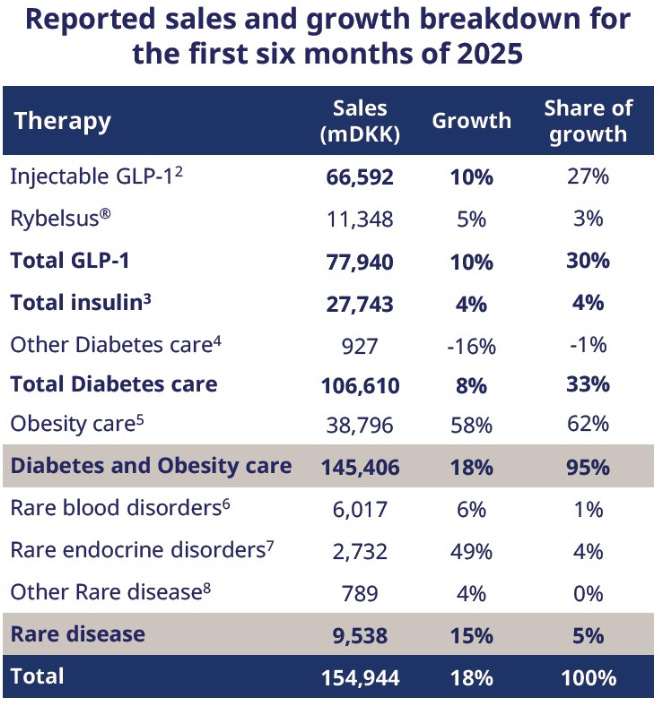

Novo Nordisk's business is dominated by their Diabetes and Obesity care, with a smaller contribution from Rare Diseases offerings.

Key Products:

Ozempic (semaglutide): A once-weekly injectable for Type 2 diabetes. It has proven to have significant blood sugar and weight loss benefits.

Wegovy (semaglutide): A higher-dose version of Semaglutide but crucially it is specifically approved and marketed for Obesity Management.

Rybelsus (semaglutide): The first and only oral GLP-1 agonist for Type 2 diabetes. This offers an effective alternative to Injectables.

Rare Disease Portfolio: Includes treatments for Haemophilia, Growth disorders, and other rare endocrine conditions.

Revenue Breakdown:

By Therapy Area:

Diabetes & Obesity Care: ~94%

Rare Diseases: ~6%

By Geography:

North America Operations: ~58%

International Operations: ~42%

We can see that the vast majority of the company's growth is currently coming from the GLP-1 franchise in the North American market, but International Operations are growing faster from a smaller base.

Bull Case:

NVO is dominant in huge, growing markets:

The global markets for diabetes and obesity are vast and expanding.

Currently around 589 Million are living with Diabetes and in 2050 it is expected that 850M will be living with Diabetes. Novo Nordisk is the global leader in the growing Diabetes Market.

It’s portfolio includes:

Oral agents: Rybelsus. The OASIS 4 trial has shown oral Semaglutide efficacy and safety profile is similar to that of Wegovy. This is very notable.

Injectable GLP-1’s: Ozempic and Victoza. Novo Nordisk currently has 52% of global GLP-1 Market

Insulins: Novo’s Insulin volume leadership is at 43.3%.

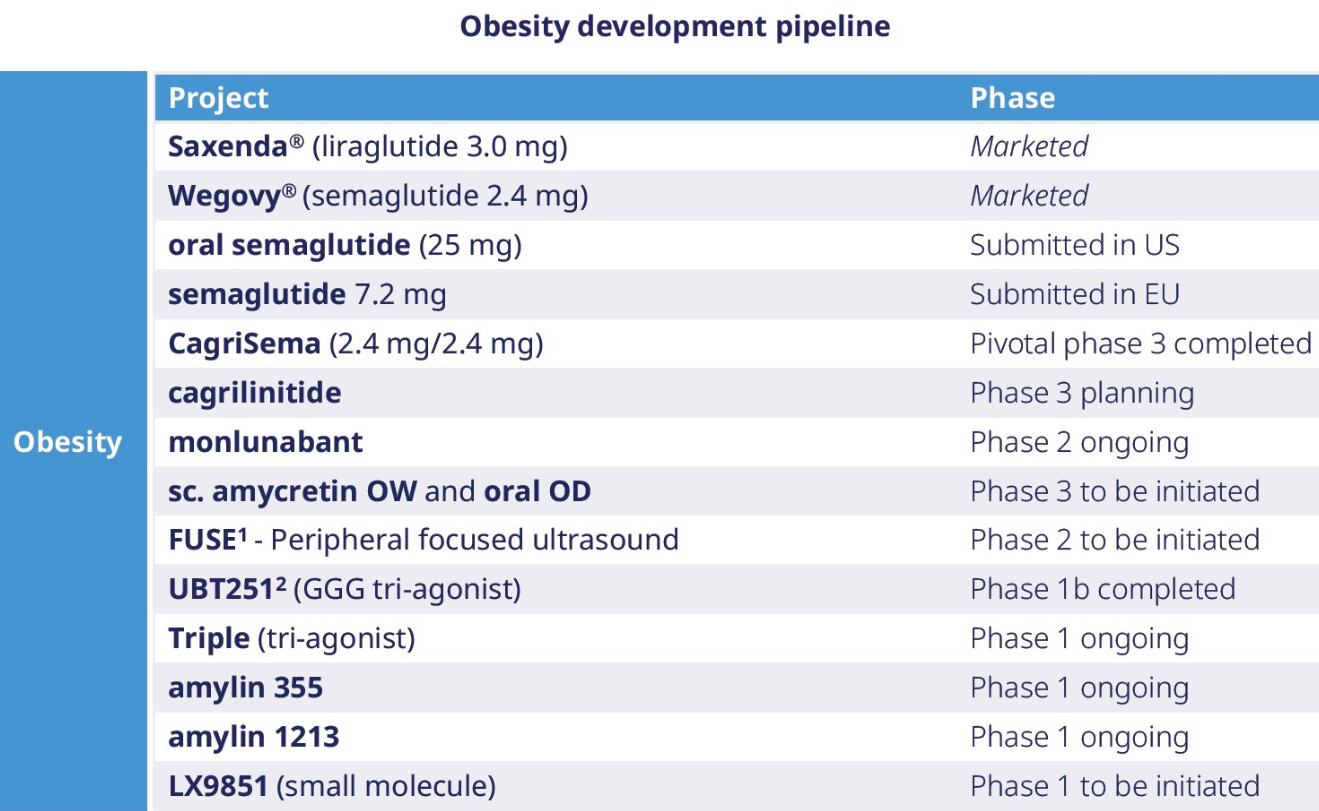

Pipeline Drugs: Oral Amycretin, CagriSema and Subcutaneous Amycretin. CagriSema could be a blockbuster successor to GLP-1 agonists.

When it comes to Obesity, more than 1.7 Billion people globally are overweight or obese. The global obesity market is growing substantially and Novo Nordisk has captured majority of the growth. It has 57% of Obesity Market Share. It could be correctly argued that its market share has declined from 81% to 57%, albeit in a rapidly growing market.

Furthermore, they are building a leading portfolio of treatment solutions for Obesity beyond just injectable GLP-1 Receptor Agonists.

Strong Brand:

"Ozempic" and "Wegovy" are globally recognised brands with immense patient and doctor loyalty. They are trusted and this gives them a significant competitive advantages. One such advantage is considerable pricing power.

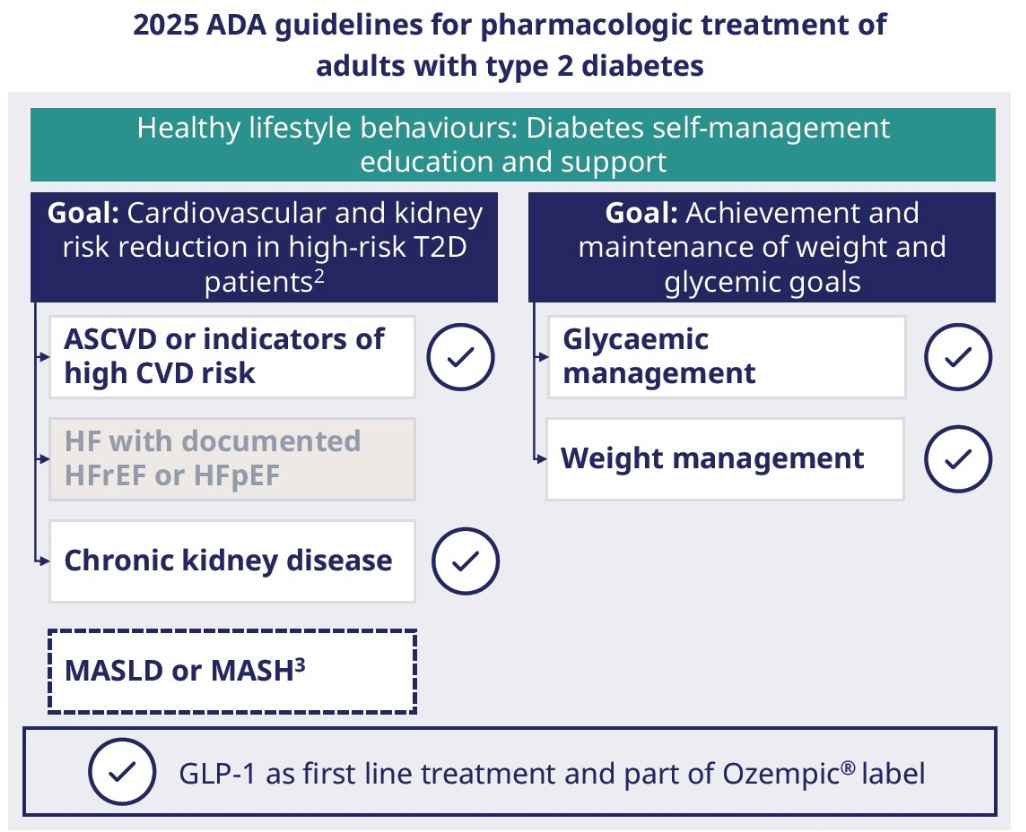

Label Expansion and New Use Cases:

Recent studies have demonstrated that the potential for GLP-1 drugs expands far beyond diabetes and obesity, thus increasing the addressable market. This includes Therapy areas with Unmet Medical Needs into which Novo Nordisk is expanding:

GLP-1 Agonist have proven cardiovascular benefits, as shown in the SELECT trial. This is highly significant, as cardiovascular disease is responsible for more than 32% of all global deaths.

There is also potential for approval of GLP-1 Agonists in treating metabolic dysfunction-associated steatohepatitis (MASH), a significant market with more than 250 million people affected worldwide.

Alzheimer's disease (AD): Semaglutide is advancing into Phase 3 studies for AD, based on promising data from several sources. These include RCTs, pre-clinical studies, and four real-world evidence trials that showed a reduced risk of dementia or AD with the use of GLP-1 agonists.

Chronic Kidney Disease and Sleep Apnoea.

The infographic below shows GLP-1s certainly have benefits beyond glycaemic control and it is reflected in the treatment guidelines.

Strong and Clear Pipeline beyond GLP-1’s:

Martin Holst Lange, chief scientific officer and executive vice president, R&D at Novo Nordisk. “We are now leading the way in developing next-generation treatments – such as combining cagrilintide with semaglutide, Cagrisema, or using it as a monotherapy – to better meet the needs of people living with diabetes and obesity”

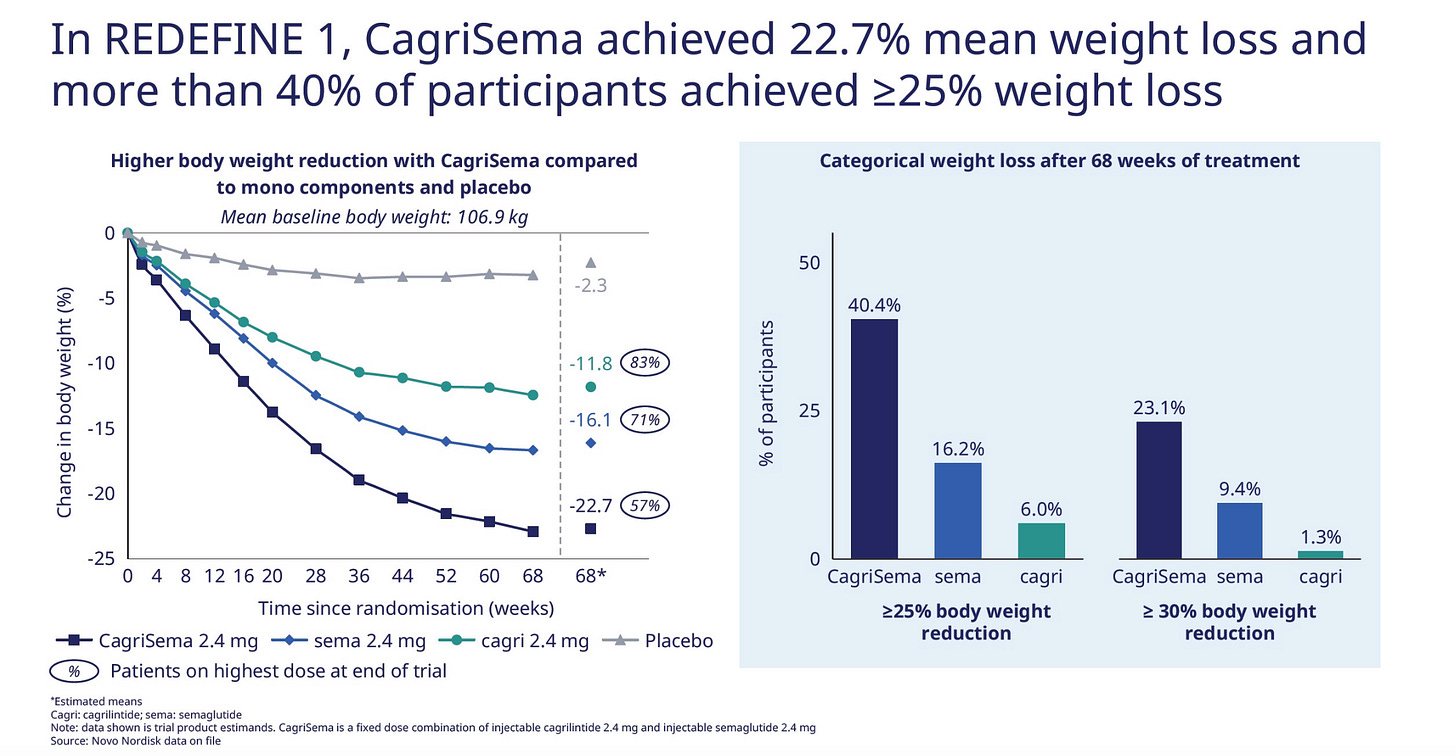

Novo's next-generation obesity drug, CagriSema (a combination of semaglutide and cagrilintide), is showing significant weight loss potential in trials such as REDEFINE 1. It has been in Phase 3 trials since Q3 2023. CagriSema also achieved superior reductions in Cardiovascular risk factors than mono components.

Novo Nordisk just this week presented data from a sub-analysis of the phase 3 REDEFINE 1 trial at the European Association for the Study of Diabetes congress 2025.

Positive results show that the average weight loss was 12.5 kg (11.8% body weight reduction) with Cagrilintide compared to 2.5 kg (2.3%) with placebo, after 68 weeks. For reference, Cagrilintide is a long-acting amylin analogue and so works differently than currently approved GLP-1-based treatments for weight loss)

Additionally, around 1 in 3 participants (31.6%) receiving cagrilintide achieved ≥15% weight loss, compared to around 1 in 20 participants (4.7%) receiving placebo.

Novo Nordisk will advance Cagrilintide into the dedicated RENEW phase 3 clinical programme which is due to start in Q4 2025.

This shows that Novo provides a clear path to continued market leadership even as the first generation of drugs matures.

Patent Protection and Competitive Advantages:

Novo’s leading position is protected by patents. Of note, Wegovy’s patent is identical to that of Ozempic.

Competitive advantages compared to biosimilars:

Novo Nordisk holds competitive advantages over Biosimilars in the realms of R&D, Commercialisation and Manufacturing.

Strategic Partnerships and acquisitions support future R&D. Recent examples are partnerships with Septerna and Lexicon Pharmaceuticals.

Regarding manufacturing specifically, Novo benefits from:

Economies of Scale

Decades of Experience with Volume production of core Yeast and Mammalian API platforms.

Leadership Change and Restructuring:

In May 2025, Novo Nordisk announced that Lars Fruergaard Jørgensen will step down from his role as CEO. The decision was made “in light of the recent market challenges Novo Nordisk has been facing, and the development of the company’s share price since mid-2024.”

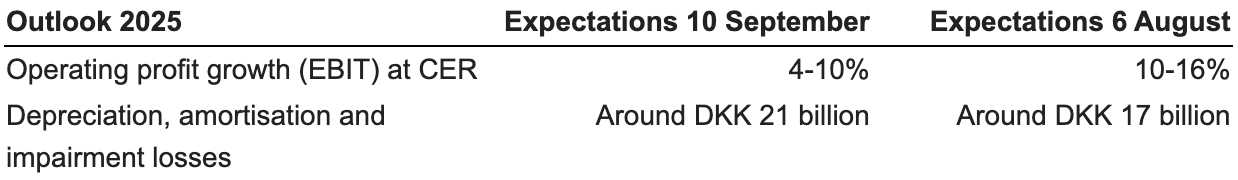

Maziar Mike Doustdar was named the new President and CEO of Novo Nordisk in July 2025. Since coming in, earnings guidance has been lowered to reset expectations. This should allow the new management to beat in coming quarters.

It was announced this week that Novo Nordisk is undergoing a company-wide transformation to “streamline operations and reinvest for growth.” Here is a summary of the key points:

Transformation to increase speed and redirect resources to growth opportunities within diabetes and obesity, aiming at reaching millions of untreated patients

Intention to reduce ~9,000 roles globally with the expectation to deliver DKK 8B of annualised savings by the end of 2026

One-off restructuring costs of DKK 8B leading to an updated full-year 2025 operating profit growth outlook of 4–10% at CER

On the change Mike stated: “Our company must evolve as well. This means instilling an increased performance-based culture, deploying our resources ever more effectively, and prioritising investment where it will have the most impact – behind our leading therapy areas.” I believe these changes are beneficial and crucial for the next phase.

Two decades of Consistent Cash distribution to shareholders

This is not to be taken lightly because, in that time period, not only have they demonstrated operational excellence, but they have also been returning capital to shareholders, including consistently increasing the total dividend per share each year.

The Bear Case (Risks & Concerns)

Competition:

They operate in a Duopoly and their primary competitor is Eli Lilly, whose dual-agonist drug tirzepatide is ‘Mounjaro’ for diabetes and ‘Zepbound’ for obesity.

Mounjaro (tirzepatide) has shown greater efficacy than Wegovy (semaglutide) for both diabetes management and weight loss.

In a 72 week head to head trial in obese, non-diabetics Mounjaro led to greater weight reduction.

Participants on Mounjaro lost an average of 20.2% of their body weight, compared to 13.7% for those on Wegovy.

They also achieved better results with regards to Blood pressure and Cholesterol

Other major Pharma companies (Amgen, Pfizer) are also developing their own obesity treatments.

Pricing and Reimbursement Pressure:

The high cost of these drugs is a major issue for governments and insurance companies. There will be pressure to lower prices, which could impact Novo Nordisk’s profit margins in the long term.

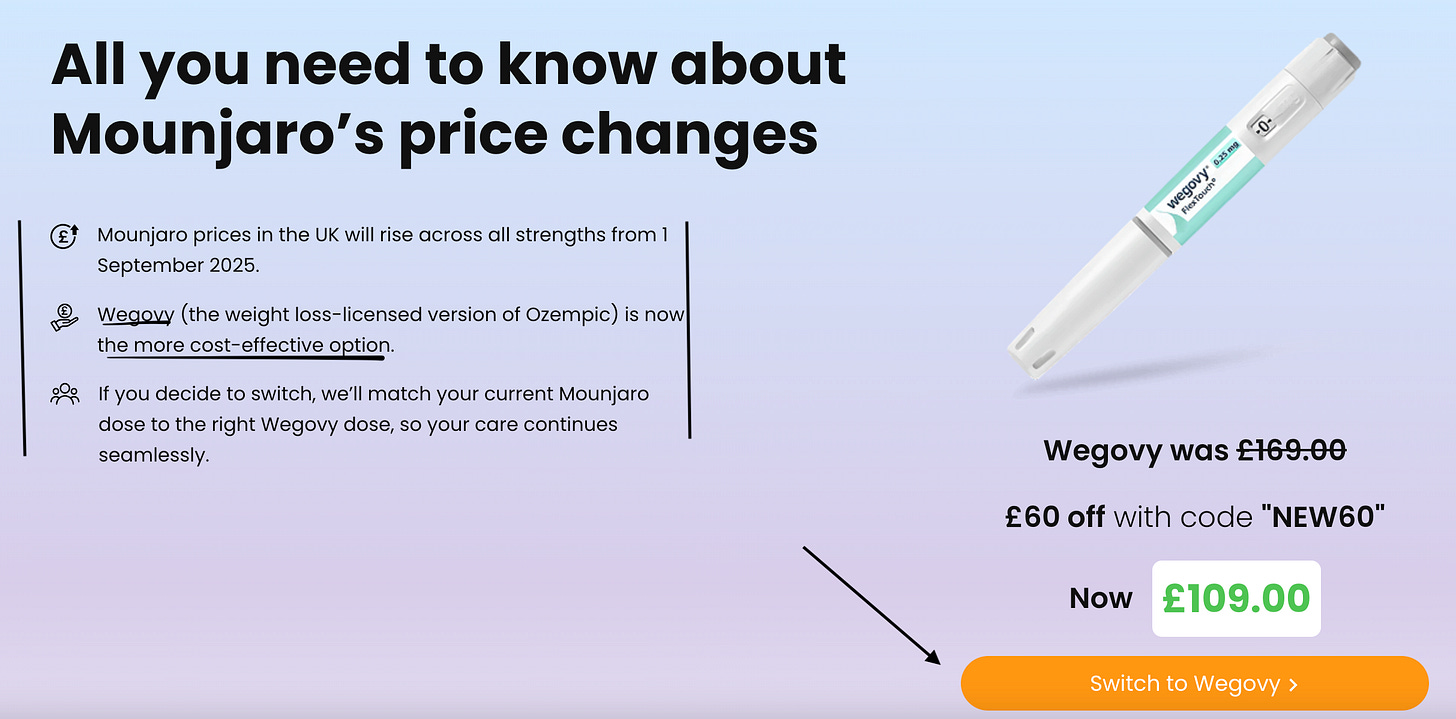

Interestingly, in the UK, Eli Lilly recently raised the price of Mounjaro for all dose strengths in the UK. This now leaves Wegovy as the cheaper option across lower and higher dosages by up to 30-60% in many cases

I have noted that several online pharmacies now advertise Wegovy as a suitable and significantly cheaper than Mounjaro, citing the price adjustment. I would not be surprised to see more UK patients, who are price sensitive, switch to Wegovy. I have included below screen grabs to demonstrate the kinds of advertising which I am alluding to above.

Practice of Compounding

Compounding of GLP-1’s has impacted Novo Nordisk’s business materially to the extent that management reduced the full year outlook due to lower-than-planned branded GLP-1 penetration impacted by the rapid expansion of compounding in the U.S. Clearly, if Compounding persists then this will continue to hurt Novo Nordisk.

However, Novo is focused on preventing unlawful compounding, exploring legal measures and in fact it is now illegal under U.S. compounding laws to make or sell compounded semaglutide drugs, except with rare exceptions:

A medically necessary alteration for an individual patient or

if the drug is on FDA's drug shortage list).

Long-Term Unknowns:

The long-term side effects of taking these medications for a prolonged period are not yet fully known, as their use has just recently proliferated

Patent expirations.

The significant volume of compounded GLP-1s in the U.S.has impacted Wegovy penetration. This practice if uncurbed will continue to hurt Novo Nordisk.

Management

Novo Nordisk has a two-tier management structure consisting of the Board of Directors and Executive Management.

The Board of Directors supervises the performance of Novo Nordisk, its management and organisation on behalf of the shareholders. It also participates in determining the company strategy.

Executive Management, in turn, has responsibility for the company's daily operations. The two bodies are separate, and no person serves as a member of both. Below we will take a look at the new CEO, Mike Doustdar.

Mike was formerly Novo Nordisk's executive vice president of International Operations. He has a strong track record of creating value and driving growth, and he brings with him extensive expertise and hands-on experience from across continents.

In 2007 he became general manager of “Novo Nordisk Near East”, based in Istanbul, taking full business responsibility across seven challenging markets, including Afghanistan, Iran, Iraq, Jordan, Lebanon, Pakistan and Syria. Under his leadership, the region achieved impressive growth, reaching 420 million DKK turnover and 230 million DKK operating profit whilst managing 150 employees across complex geopolitical landscapes. In 2012 he became VP of South East Asia.

In 2013 he was appointed senior VP of Emerging Markets and in 2015 he was appointed Executive Vice President of International Operations. One year later, the unit he was responsible for leading was further expanded to include all countries except the US and Canada.

The International Operations Unit that Mike led had almost 20,000 employees across five regions. Under his leadership, International Operations more than doubled sales to approximately 112 billion DKK in 2024. In his time as executive vice president and member of Novo Nordisk's Executive Management, he played a crucial role in shaping global strategy.

I believe he is a very astute choice for CEO not only because of the significant experience he brings but especially because he has managed a unit in tough geographies before. These Geographies are under-penetrated and can be markets in which Novo can grow much more in the future. For example, Wegovy could address the high unmet need for anti-obesity medications in Region China.

As CEO, Doustdar has initiated measures to improve efficiency, including a hiring freeze in non-critical areas and a restructuring of the company to maintain a sharper focus on its core therapeutic areas of diabetes and obesity.

Mike Doustdar in his own words:

“I started as a 21 year old in the mail room of our Vienna Office. I just wanted to do a decent job. I would never have imagined that one day I would be sitting in this chair. This company shaped who I am. It taught me what purpose really means, that our work helps millions of people live better lives every day.

But let’s be honest about where we are. The competitive landscape has completely changed. Two years ago, we were alone. Now everyone wants to play in Obesity and Diabetes. This means we need to move faster. Focus harder on what we do best. Be more precise about where we invest.

People who know me will tell you I love speed, I am direct and I love to win. But they will also tell you I care deeply about this company and the patients that we serve. We’ve built something incredible. Now we’re going to defend it and expand it, not just because we can but because the world needs us to. Let’s get to work”

Financials

At the time of writing, NVO has a Market Cap of $251.23B with Cash of $2.99B and Debt of $15.67B. Net Debt position is not ideal albeit it is down from $17.2B at the end of Q1.

TTM Performance:

Revenue TTM: $49.3B

Gross Profit TTM: $41.5B

Operating Income TTM: $23.5B

Net Income TTM: 17.5B

First 6 months 2025 Highlights:

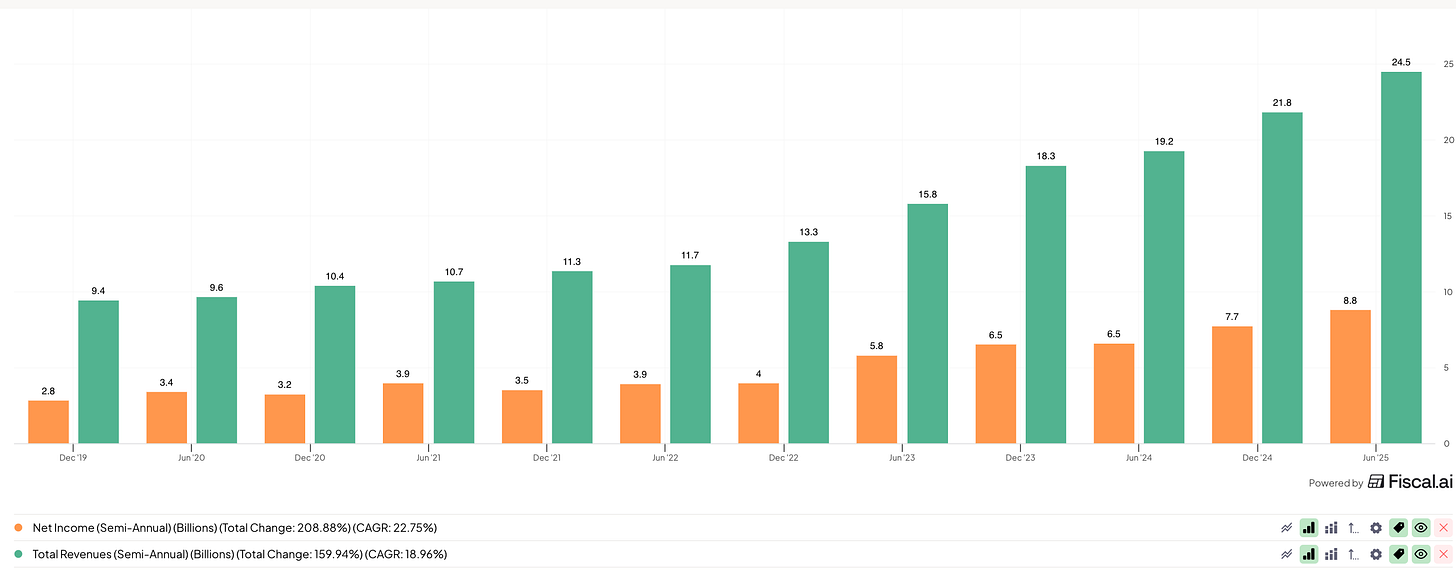

Revenues of DKK 154.9B DKK ($24.5B) which represented 18% increase on a constant currency basis

Operating Profit of DKK 72.2B ($11.4B) which represented a 29% increase on a constant currency basis.

GAAP Net Income of $8.8B up from $6.5B the prior year in the same period.

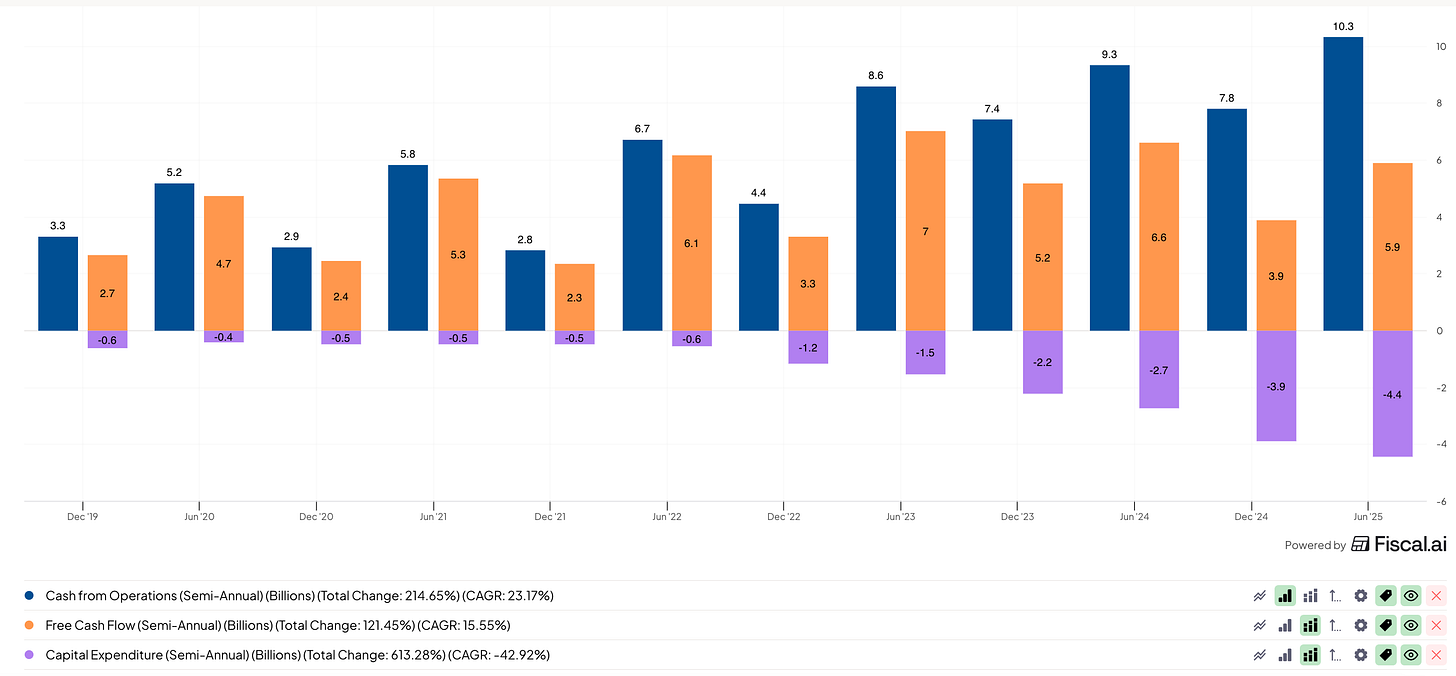

Cash flow from operations $10.3B up from 9.3B the prior year in the same period

Free Cash Flow of $5.9B down from $6.6B the prior year in the same period.

Valuation:

NVO trades at:

5.3x LTM EV/S, 5.3x NTM EV/S and 4x EV/S projected FY26 numbers,

11.2x LTM EV/EBIT, 11.6x NTM EV/EBIT and 9.1X EV EBIT on FY26 projected numbers.

14.1x PE, 13.9x NTM PE and 10.9x PE on FY26 projected numbers,.

25.5x EV/FCF, 27x NTM EV/FCF and 20x FY26 projected FCF.

The FCF multiples may seem higher than we would expect, but it must be noted that FCF has been impacted by the significant increase in Capex due to its large investments in expanding its manufacturing capacity (including expansion in the USA) to meet the demand for GLP-1 agonists.

When looking at P/E or EV/EBIT the stock is trading at all time low multiples whilst still consistently growing top and bottom lines.

Chart:

Currently trades at $57.2 RSI, 0.47% above the SMA 50 and 19.03% below the descending 200SMA.

-34.64% YTD

I like that the stock picked up off the bottom from their most recent ER and is up around 28% off the lows. It has most recently reclaimed the descending SMA 50 and the flattening SMA 20.

There has been positive news developments of late to which the stock has responded well. Clearly this chart needs a lot of work and time.

A realistic initial upside target from a technical perspective is a gap fill to the $67/68 level.

My current position and plans

I am currently long with an average cost of 50.9. It is roughly a 4% position for me. Although I bought my first couple of tranches in the 45s, the stock moved up very quickly, so I have been averaging up via DCA since then.

I plan to hold this position for the foreseeable future. While it could be a volatile ride as it is news-sensitive, I believe NVO has the potential to reach $70 in the next twelve months (NTM). Furthermore, the restructuring changes implemented by management could pave the way for a much higher move in the coming years.

Thank you for reading and if you enjoyed this post, please leave a like and Restack.

Subscribe to the plan that best suits your needs (free or premium), and I'll see you in the next one!

What do you think about the pricing power if WH controls the prices?