Actionable Stock Set-ups (1&2): Robinhood and Hims & Hers

Shorter-Term

Going forward I will have a series in which I will outline actionable set-ups that look promising. The stock set-ups will be classified as either Shorter term (0-6M) or Longer-Term (6M-3Y)

The Actionable Set-ups I like for the Shorter term are: HOOD and HIMS.

Robinhood Markets Inc. is an American Fintech Company well-known for pioneering commission-free trading of stocks, ETFs, options, and cryptocurrencies through its (very) user-friendly mobile app and web platform. The company's Mission Statement is to "democratise finance for all," aiming to make investing more accessible, particularly to younger and first-time investors. It has gained significant popularity since 2020.

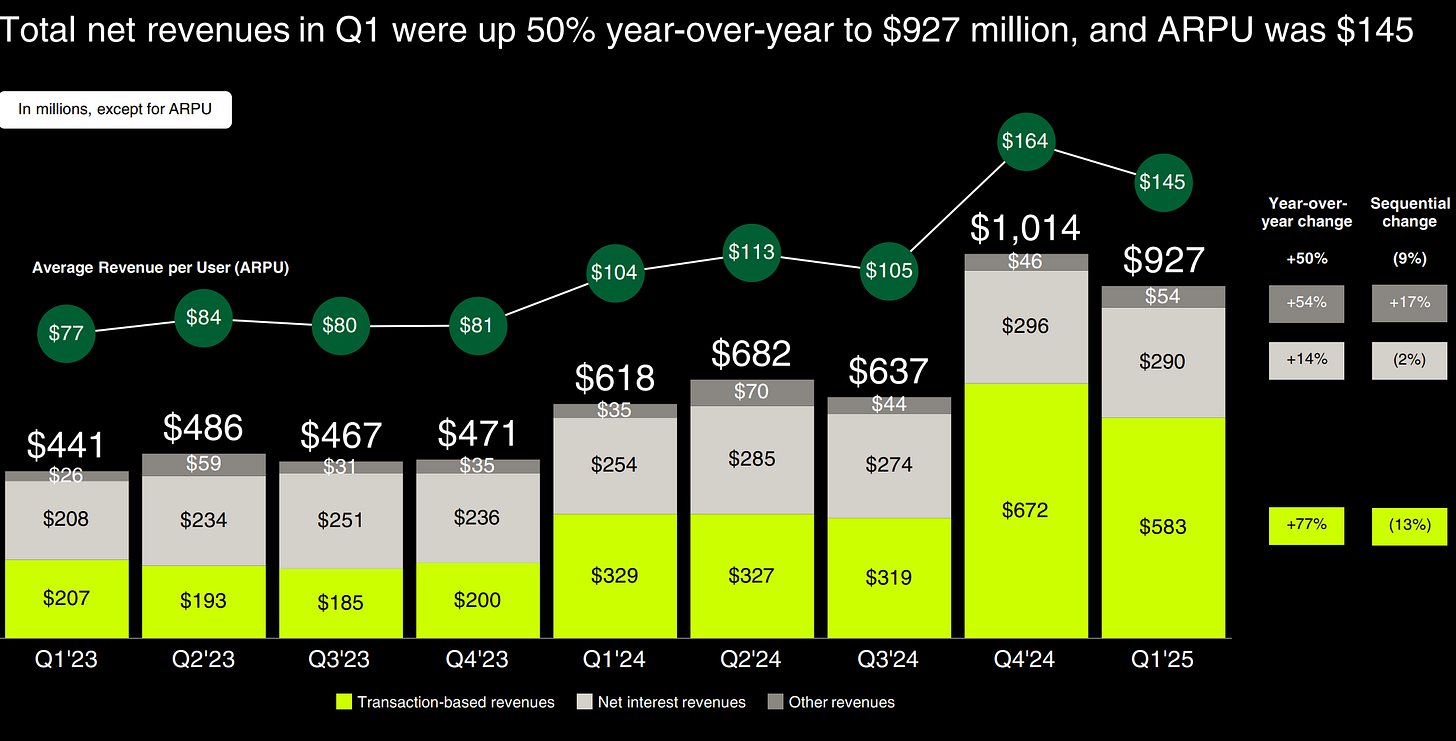

A major source of its revenue is from Payment for order flow but also generates significant revenue from Interest Income , Options and increasingly Crypto trading (see chart below). Despite challenges in the recent past with the Gamestop Episode and their general gamification of Investing, Robinhood continues to be a major player in the retail brokerage landscape, expanding its services to include retirement accounts and other financial products.

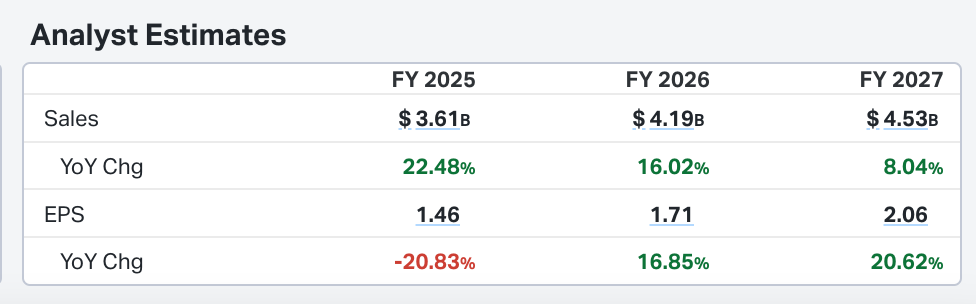

Hood trades at 38x trailing and estimated mid 40’s forward earnings multiple. Analyst estimates for the next few years are as follows:

I have been involved in this one twice in recent years. Initially went long at $9 in Nov ‘23 but exited at $17 and then saw it run to $66 without me. In the recent April pullback I re-entered at $33. It is now ~$66 7 weeks later.

Hims & Hers Health Inc. (HIMS) is a tele-health company operating on a direct-to-consumer (DTC) model, providing access to medical consultations and a wide range of prescription plus over-the-counter medications, primarily for sensitive or stigmatised conditions. The company initially focused on men's health issues like hair loss and ED, later expanding to women's health plus other areas such as mental health, skincare, and more recently, weight loss. Low friction subscription strategy of connecting consumers with licensed healthcare professionals, enabling online consultations and discreet delivery of prescribed treatments and wellness products.

The company has experienced significant growth in recent years and aims to disrupt traditional healthcare delivery by making it more convenient and affordable. Their platform leverages technology, including “MedMatch” to personalise treatments and improve efficiency. The Stock has been on a tear recently, primarily due to underlying business performance. Of note, they raised $1B via convertible senior notes offering.

Hims trades at 51x forward earnings and analyst estimates are as follows:

I have been involved in HIMS since late 2023 from $6 rode it up to 70’s reducing 85% of shares in late 50’s to 71.98 and have done some judicious trading in between to juice my gains. When stock was in 70’s called for it to reach mid 30’s minimum and likely mid 20’s. I still own my shares from cost basis of $6. I have accumulated shares since then at $31.9 and recently off-loaded some of these mid 50’s to 64 level. Stock is now currently again in the mid 50’s.

So, how to trade these two stocks or what price to accumulate them at?

Both these stock are leaders and as such trading close to ATH. Whilst they have rich multiples, they are not unreasonable.

HIMS:

There are two ways to play this. Firstly, stock has been finding support in recent days in the low 50’s which coincides with the EMA 20. We recently took a shorter term trade from 52 to 56 which we banked. If re-tests 20SMA could take a position with a tighter stop and play for re-test of ATH (and beyond) of 72.98. Street high estimate is 85.00 currently, I think if previous ATH is surpassed 85.00 will be reached. A wild card in the HIMS trade also is the near 33% SI and potential for short squeeze.

Second way is to wait for a market correction and the stock will likely trade back down to the $35-$40 which coincides with the previous breakout level and the 50SMA. At $40 the stock would also be trading at sub 30x forward EBITDA whilst growing >30%, a more favourable fundamental set up. A wild card in the HIMS trade is the fact it has a 35%

HOOD:

Robinhood just achieved an ATH close for daily and weekly charts. It is forming a cup and handle. If closes convincingly above the current 52 week high then I think we can see 82 and above that 104. Interestingly current street high target is $105.

If cup and handle holds then think one can buy the pivot into strength and clear skies above. If invalidated or on market weakness, then I think $50 is in play which coincides with the 50SMA and also level at which broke out from recent inverse H&S.

HOOD trades at a valuation of mid 40’s forward multiple but has been surpassing analyst estimates consistently for the last few years.

Both these stocks with appropriate attention to risk, I think can be very fruitful positions for a portfolio. Managing risk is to be done by using stops or paying attention to one’s position size.

Thanks for reading, subscribe if not done already and see you for the next one!