Actionable Stock Set-ups (4 & 5): PagSeguro and StoneCo

Longer Term (6M-3Y)

The next 2 Stocks featured in the Actionable Set-ups series, this time for the Longer term are STNE and PAGS.

PagSeguro (PAGS)

PAGS is a Brazilian fintech company that provides a comprehensive end-to-end digital banking ecosystem. Primarily focused on consumers, individual entrepreneurs and small to medium-sized businesses in Brazil, PAGS offers a variety of solutions beyond just payment processing. This includes free digital accounts (PagBank), point-of-sale and mobile devices, various online and in-person payment methods, prepaid cards, loans, investments and business management tools. Their mission is to democratise financial services in Brazil's often concentrated and under-penetrated market.

PagSeguro's business model is primarily reliant on transaction revenue, charging fees for processing payments through its platform. A significant and growing part of their revenue also comes from financial services, particularly through PagBank. PagBank offers value-added services like enabling merchants to receive instalment payments faster. PagBank also has a super-app with a wide range of financial functionalities that make it a one-stop shop for both payments and banking.

In terms of Market position, PagSeguro is a significant player in the Brazilian fintech landscape due to it’s strong presence in both digital payments and digital banking. They were an early innovator in mobile POS solutions, gaining a first-mover advantage with informal merchants. Their connection to UOL Group, a leading Brazilian internet company, provides them with high brand awareness and a lower CAC. PagSeguro aims to differentiate itself through its integrated payment and banking ecosystem, catering to the specific needs of its target customer segments in a market that still has considerable room for growth in financial inclusion.

CEO: They currently have a co-CEO structure with Ricardo Dutra (CEO of UOL, ex CEO of PAGS 2016-2022) and Alexandre Magnani ( CEO since 2022, ex COO and ex Mastercard). They are both PAGS veterans with extensive industry experience. Management have been well aligned with shareholders.

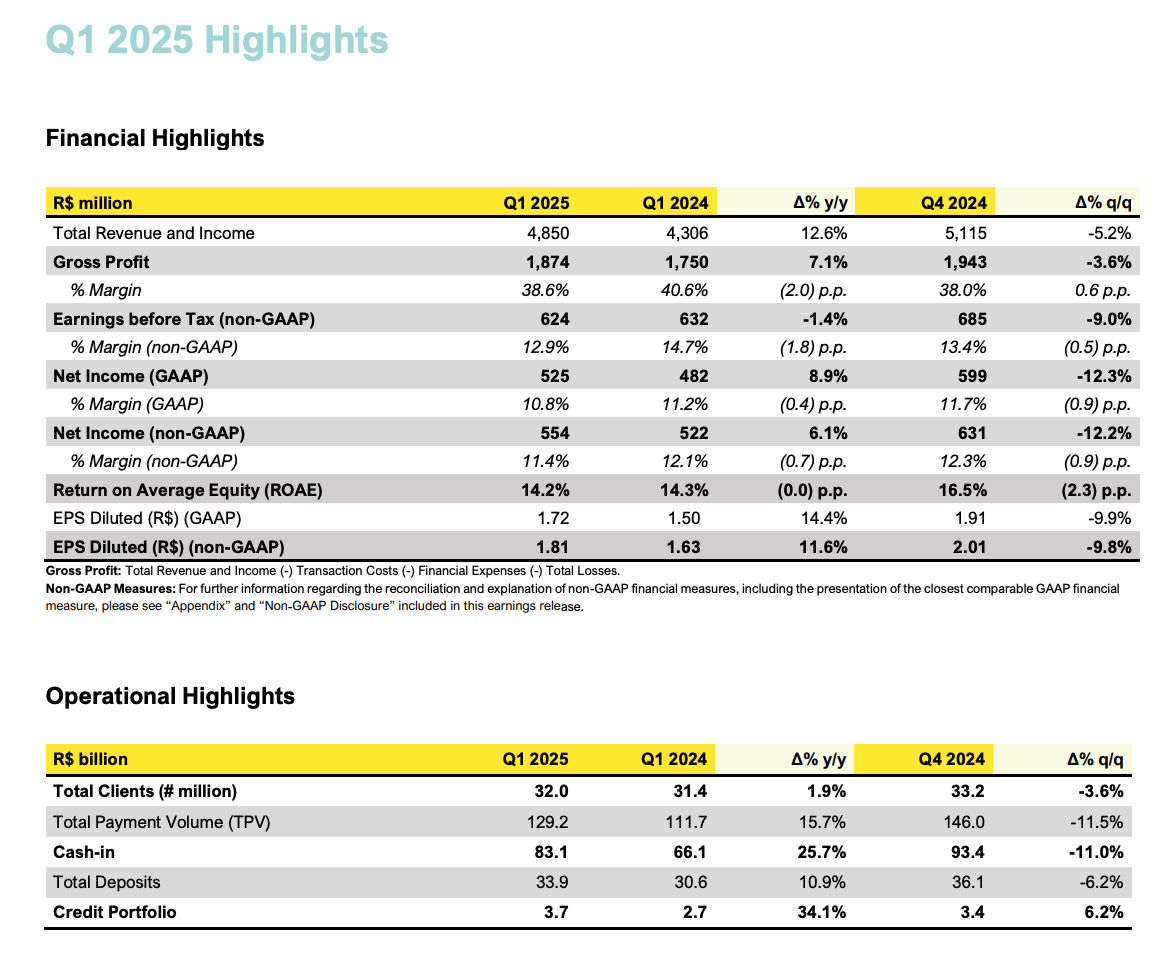

Below you can see Q1 highlights for PAGs where they delivered a robust quarter (taken from ER Deck)

PAGS trades at 7.5x trailing earnings and 6.4x NTM. EPS is expected to grow 19%, 13% and 11% in coming years. PEG is comfortably <1. Notably it also trades at 1x book value.

StoneCo Ltd (STNE)

STNE is a leading Brazilian financial technology and software solutions provider. It primarily serves micro, small, and medium-sized businesses (MSMBs) in Brazil. The company offers a comprehensive, cloud-based platform that integrates various financial services, including payment processing (for credit/debit cards and Pix), digital banking, and credit solutions. For reference, Pix is a real-time payment system in Brazil that is developed and operated by the Central Bank of Brazil. It allows individuals, businesses, and government entities to send and receive funds instantly, 24 hours a day using various methods like Pix keys (email, phone, etc.), QR codes, or account details.

Beyond core financial offerings, StoneCo also provides a suite of software solutions such as Point-of-Sale systems, Enterprise Resource Planning , Customer Relationship Management tools. Also, e-commerce integration which caters to diverse sectors like retail, food services, and gas stations. This integrated approach aims to help businesses manage their operations, connect with customers, and drive growth in-store, online, and mobile channels.

StoneCo's revenue is also primarily driven by transaction-based fees from its payment solutions. It is bolstered by subscription services for its software and digital banking platforms, along with interest income from credit products offered to merchants. A key differentiator for StoneCo is its "Stone Hubs”. This is a franchised distribution network that provides local sales and personalised customer service. These hubs provide localised sales, personalised customer service, and technical support, fostering deeper relationships with their merchant clients. This high touch approach does set them apart from competitors. The company consistently focuses on innovation, including features like split-payment processing, multi-payment processing, and recurring payments for subscriptions.

Brazil has a highly competitive fintech market but STNE has established a significant market presence by focusing on its target MSMB segment with tailored solutions and a strong customer-centric approach. They have a disciplined capital allocation approach as evidenced by share buybacks and optimising funding costs by converting client deposits into time deposits. The company aims to continue expanding its integrated ecosystem and leveraging its strong brand to drive further market penetration and profitability.

CEO: STNE changed CEO in 2023, the new CEO is Pedro Zinner. He brings pedigree with him and holds >25 years of experience in strategy, risk management and finance. Zinner joined Eneva in 2016 as Chief Financial Officer and was at the forefront of its financial restructuring and IPO. In 2017 to 2022 he became the CEO of Eneva leading it’s transformative journey to position the company as a leading integrated energy corporation in Brazil. The stock chart in his time as CFO then CEO is a thing of beauty from ~0.5 in 2016 to $15/$16 in 2022 (see below). I back him to do continue doing a good job at STNE.

STNE has just had a strong quarter and year, where they grew profitably whilst also returning capital to shareholders. They maintained 2025 guidance as below. Revenue grew with ROE expansion and also cost of services declined.

Below you can see Guidance for 2025 and 2027, taken from ER Deck.

They also offered 2027 guidance with a projected 27% EPS CAGR from 2024 until 2027.

STNE currently has a 8.4x NTM earnings multiple. PEG is comfortably <1. Trades at 1.9x book. As you can see above management have guided for >15 R$/Share which is ~$2.66 USD. So stock is currently at ~5x ‘27 earnings.

Below I will discuss the key differences between PAGS/STNE, potential headwinds and tailwinds, how to trade these two stocks plus what prices to accumulate them at. Subscribers can also ask further questions in Subscriber Chat.

Some key differences between PAGS and STNE

1. Different Target Market & Distribution Strategy:

PagSeguro ($PAGS): Traditionally, PagSeguro has focused on the micro-merchant and individual entrepreneur segments .

StoneCo Ltd. ($STNE): StoneCo has primarily targeted small and medium-sized businesses (SMBs), particularly formal retailers with physical stores. As above one of their key differentiator is the"Stone Hubs" model, a proprietary and franchised physical distribution network across Brazil.

2. Vary in their Product & Ecosystem Focus:

PagSeguro ($PAGS): strong emphasis on its PagBank digital banking ecosystem. PagBank provides a comprehensive "super-app" experience, integrating payments, digital accounts, credit, investments, and more for both individuals and businesses. This positions them as a digital bank that also offers payment processing.

StoneCo Ltd. ($STNE): Offer an integrated platform of financial and software solutions. This allows them to become a more integral part of a merchant's overall operations, potentially creating stickier relationships and higher switching costs.

3. Competitive Approaches differ:

PagSeguro ($PAGS): Initial success came from disrupting the traditional acquiring market by Democratising access for micro-merchants. Their association with UOL Group (major Brazilian internet company) provides them with high brand awareness and a broad reach. They often compete on accessibility and broad appeal, particularly through their digital banking offerings.

StoneCo Ltd. ($STNE): Directly competes with larger, more established players and traditional banks in the SMB segment. They aim to win over merchants by offering superior service and more comprehensive solutions than just payment processing.

In short, while both companies offer overlapping services, PAGS strength lies in its broad appeal to micro-merchants and its robust digital banking platform, often leveraging a more digital distribution model. StoneCo differentiates itself with a more personalised, high-touch sales and support model through its physical hubs, coupled with a deeper integration of software solutions tailored for more formal SMBs.

Tailwinds and Headwinds:

Tailwinds for PAGS, STNE and Brazilian Economy:

Slowing of the tightening cycle +/- lower Interest Rates down the line

Young, Underbanked population increasingly getting On-boarded

EPS growth

Buybacks

Multiples at all-time low.

The likely USD de-valuation should be a boost for the Brazilian Real (current 1$ is 5.54 Brazilian Real)

Headwinds for Brazilian economy and as an extension both PAGS and STNE are:

High interest rates (current Selic Rate is 14.75%) potentially stifling investment,

deep-seated fiscal imbalances,

persistent inflationary pressures,

vulnerability to global commodity markets,

ongoing political uncertainty contribute to a bearish outlook for the Brazilian economy.

How to trade these two stocks/what price to accumulate them at?

Both have a similar profile, trading at PEG of significantly <1 and trade at single digit PE (PAGS 6.3x, STNE 8.6x). Their multiples are in the lowest decile in each of their respective histories. They both offer the trifecta of EPS growth, room for multiple expansion and are buying back shares.

PAGS: Subscribers were informed that it was a strong buy in the mid $8 range and especially between the 50SMA and 200SMA i.e. $8.04 and $8.89. In a very weak market we may trade as low as $7 which was a prior support level and also would match the ~5.4x multiple at which stock previously bottomed. One could purchase now and bolster either on test of 200SMA or low $7 support (see chart below)

Ultimately, however at ~$9 the stock is very cheap and I would not be surprised to see it double in 2 years, or trade at $14 this year at which point it would still only trade at 9x earnings and PEG of <1. Of note, Street high price target is $14.26 currently. Some news today is Board of Directors have approved an additional special dividend of $0.12 per share.

Chart:

STNE: Subscribers alerted in low 13’s that STNE is buyable now. However, if not in accumulate small then one could wait for 50SMA retest and then bolster the position at 200SMA. At ~$11 the stock would be at 7x NTM earnings and a level I probably will add more at. That being said, I would not be surprised to see STNE at >$18 this year and $27 in the next 24M’s (10x ‘27 earnings). Of note, Street high target is $22.84 currently.

Technicals wise, it has been trading in a somewhat tight range between the high 12’s and high 14’s in recent weeks (see BB on Chart). A 50SMA re-test would be at $13.08 but stock could feasibly re-test the 200SMA at 10.9 during market weakness. As of the 16th June ‘25, we can see it is trying to break out the Pennant or Triangle to the upside.

Chart:

I own both of these stocks. My current basis on PAGS is 8.42 after averaging more on Friday. My current basis on STNE is has risen from $9.67 to 10.69 after adding more on Friday.

Frankly, even though they have both done well YTD (see chart below) I expect both these stocks to be able to double from current levels within 3 years.

Deep Value with Momentum can be a powerful combination and as such these two under-owned stocks could be very fruitful for a portfolio. As always, Managing risk is to be done by deploying stops or paying attention to one’s position size.

Thanks for reading, subscribe if not done already and see you for the next one!