Alibaba Earnings Update: A quick look

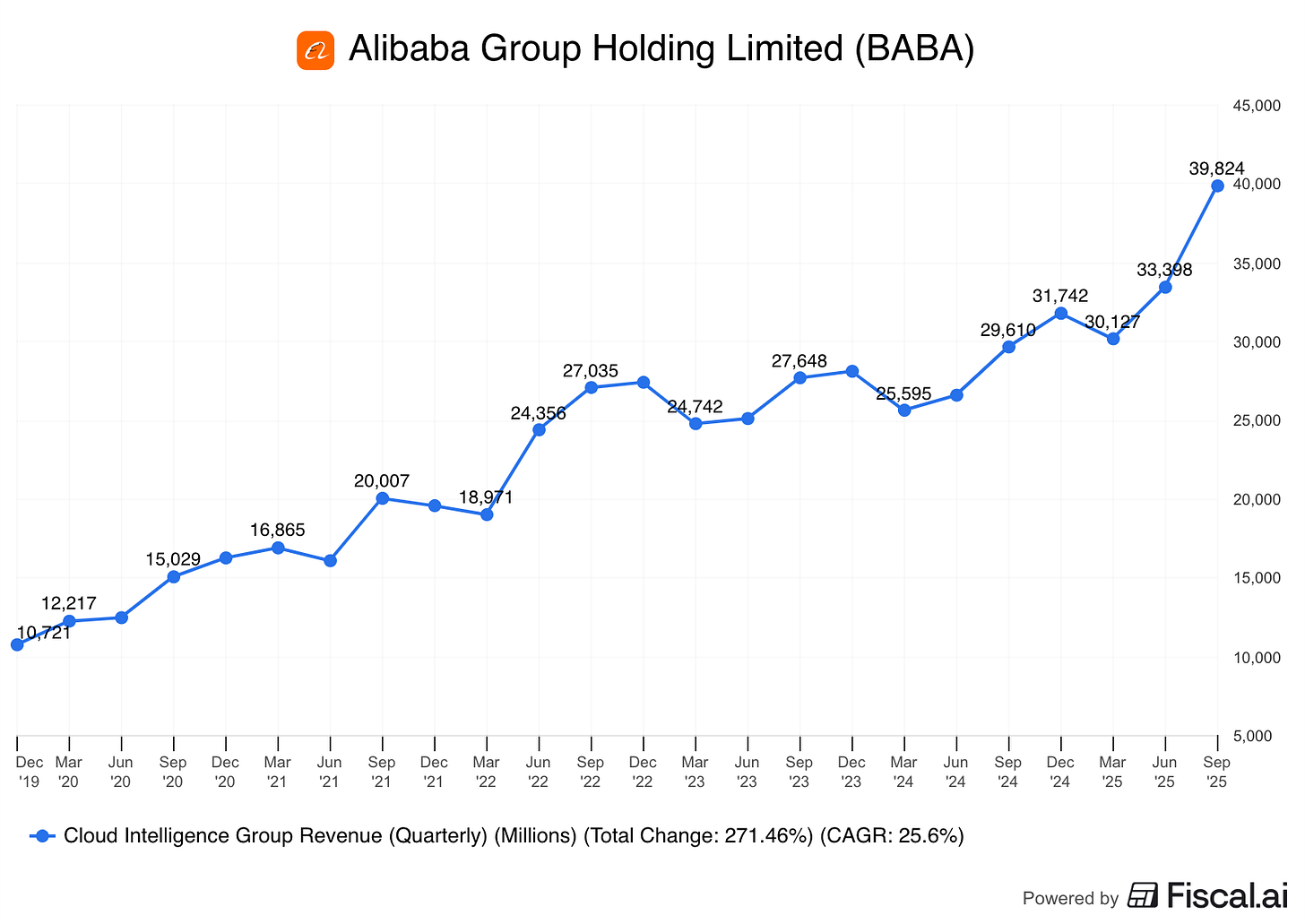

Today, Alibaba submitted their Financial report for fiscal second quarter ending Sept. 30. The thesis remains on track for me and I was mostly impressed with the Cloud Intelligence Revenue Growth.

If it is your first time here, read the below post on how to navigate the SixSigmaCapital Website and subscribe to the option that suits.

Overview:

Alibaba Group continues to show steady growth with total revenue increasing 15% year-over-year (excluding Sun Art and InTime). The growth is primarily driven by strategic investments in its core businesses: AI+ cloud and consumption.

On the AI front CEO Eddie Wu stated:

“Robust AI demand further accelerated our Cloud Intelligence Group business, with revenue up 34% and AI-related product revenue achieving triple-digit year-over-year growth for the ninth consecutive quarter,” and

“Certainly, we see that customer demand for AI is and remains very strong. In fact, we are not even able to keep pace with the growth in customer demand … in terms of the pace at which we can deploy new servers,”

The China e-commerce Customer Management Revenue (CMR) grew 10%, supported by significant investments in the quick commerce business which improved unit economics and expanded scale. However, these strategic investments, especially in quick commerce and AI+ cloud infrastructure, led to a decrease in adjusted EBITDA and a free cash flow outflow. This reinvestment strategy is done with the intention to secure long-term market leadership in these areas.

Alibaba remains one of the leading AI players in the world and it’s Qwen app surpassed 10 million downloads within the first week of its public launch. The app is powered by Alibaba’s Qwen artificial intelligence models.

Key Financial Highlights:

Total Revenue: RMB 247.8 billion a 5% YOY increase versus 242.65 billion yuan the previous year.

Like-for-like Revenue Growth (excluding Sun Art and InTime): 15% year-over-year

Alibaba China e-commerce Group Revenue: RMB 132.6 billion, an increase of 16%

China e-commerce Customer Management Revenue (CMR) Growth: 10%

Quick Commerce Business Revenue Growth: 60%

Cloud Intelligence Revenue Growth: 34% YOY to 39.8 billion yuan versus expectations of 37.9 billion yuan

This is a key metric investors were looking at and increased from 26% YOY Growth in previous quarter.

Cloud Revenue from External Customers Growth: 29%

AI-related Product Revenue Growth: >100% for ninth consecutive quarter, now over 20% of external cloud revenue.

Adjusted EBITDA: Decreased 78%

AIDC Adjusted EBITDA: Profit of RMB 162 million

GAAP Net Income: RMB 20.6 billion, a decrease of 53%

Operating Cash Flow: RMB 10.1 billion, a decrease of RMB 21.3 billion year-over-year

Free Cash Flow: Outflow of RMB 21.8 billion

Net Cash Position: $41 billion

Key Takeaways

Full Stack AI strategy:

Alibaba is aggressively pursuing a full-stack AI strategy, positioning Alibaba Cloud as a leader in China’s AI cloud market: their market share is larger than its next three competitors combined.

BABA’s flagship model, QN3 Max, is noted for its global leadership in coding and agent tool use benchmarks.

Commerce:

The quick commerce business has demonstrated significant operational improvements, with unit economics loss per order reduced by 50% since July-August, driven by optimised order mix, higher average order value and economies of scale in logistics.

The integration of quick commerce with the broader Alibaba ecosystem is accelerating, with approximately 3,500 Tmall brands onboarding their offline stores. AMAP also achieved a historical high of 360 million DAU’s, with its new Street Stars feature significantly boosting engagement.

The company is aiming for quick commerce to generate CNY 1 trillion in GMV for the platform within three years.

Capex likely to be adjusted upwards due to accelerating demand:

The CEO stated the previously mentioned RMB 380 billion CapEx plan for three years might be “on the small side” given the current robust and accelerating demand for AI infrastructure, which is currently outstripping supply.

Alibaba prioritises investment in foundation model training and high-efficiency utilisation of AI resources through its Bai Lian platform, alongside internal and external inference services, with a preference for external customers utilising a full suite of cloud services.

The industry is expected to face supply-side bottlenecks for AI components for at least the next two to three years, indicating sustained demand.

Guidance

The September quarter likely to be the peak for quick commerce investments, with a “significant sizing down” expected in the next quarter, subject to dynamic adjustments based on market competition. This should be beneficial for margins.

China e-commerce CMR growth is projected to slow in the upcoming quarter due to a base effect from the payment processing fee introduced last year.

Alibaba reiterated their focus on securing medium to long-term market share through decisive investments in consumers, merchants, and platform upgrades, which may lead to short-term fluctuations in CMR and EBITDA. AIDC’s adjusted EBITDA may also fluctuate due to tactical investments in select markets, while Cloud will continue to invest in customer growth and technology innovation.

Current position and final thoughts:

Alibaba remains a leader in AI and e-commerce. Given the expected fluctuation in quarterly numbers, this is not a short-term trade for me. Rather, the thesis is that they will maintain leadership and grow market share in the long run. I am holding my core position (house shares) and I plan to add slowly, as I believe the valuation is very attractive relative to its market position.

Fiscal AI Annual Sale

The folks over at Fiscal AI are having their annual sale. This is a terminal that I use each day for research and I would recommend checking them out on their website. You may consider using this link to get 30% off: FiscalAI

If you have any questions reach out to ryan.henderson@fiscal.ai