JD Sports Fashion Plc: Actionable Stock Set-Up (3)

Longer Term (6M-3Y)

Below are my brief thoughts on JD sports (JD.L) a sports fashion retail business with global footprint that I think is an interesting set up at 77. The Summary can be viewed at the bottom of the write-up.

JD Sports, is a British multinational retailer specialising in sports fashion and outdoor wear. Has expanded significantly to become a leading global player with an extensive presence across physical stores and online platforms. They offer branded sports and casual wear, including major international names like Nike, Adidas, and The North Face, as well as its own exclusive brands. Operating on an omni-channel model (Revenue is split 76% in store, 22% online and 2% other), JD Sports aims to provide customers with a seamless shopping experience across various touchpoints.

It is broadly structured into several key divisions:

• JD: This represents the core sports fashion retail business. This segment is the largest contributor to the group's revenue and focuses on the latest trends in athletic-inspired footwear and apparel, often featuring exclusive product lines and collaborations. It includes the main JD stores globally and related banners such as Size? and Footpatrol, which cater to sneaker and streetwear enthusiasts with their curated selection of products. This division also extends to the company's fitness ventures, such as JD Gyms.

• Complementary Concepts: This segment encompasses a collection of brands that offer distinct retail propositions, often targeting specific demographics or market niches within the sports fashion and lifestyle sectors. These concepts are strategically acquired to broaden the group's reach and appeal. Examples include North American retailers like DTLR and Shoe Palace, which have strong cultural connections and offer a range of athletic footwear, apparel, and accessories. In Europe, brands like Sizeer fall under this category, providing a differentiated sports fashion offering.

• Sporting Goods & Outdoor: This division focuses on the wider sporting goods and outdoor leisure markets. It includes well-established UK outdoor retailers such as Go Outdoors, Blacks, and Millets, offering equipment, clothing, and accessories for various outdoor pursuits like camping, hiking, and cycling. The segment also includes sports retailers in European territories, such as Sport Zone and Sprinter, which have a stronger emphasis on sports participation and equipment alongside apparel and footwear. This segment allows JD Sports to capture a broader customer base with interests in active lifestyles and outdoor activities.

Financials/valuation

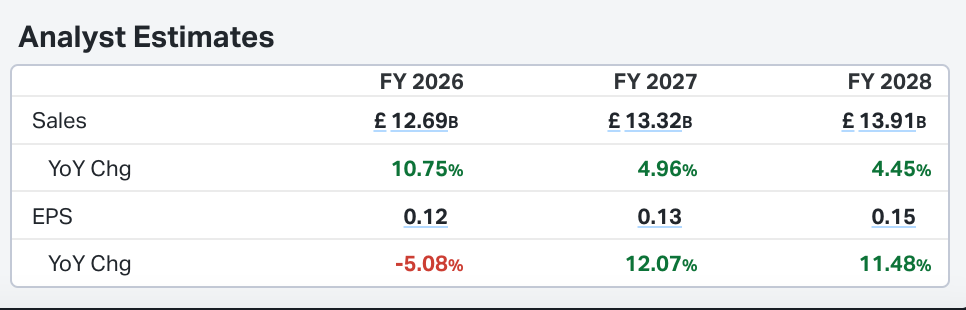

Trades at 0.7x sales, 1.4x EV/GP, 8.5x trailing Net income and 6.8x forward net income. Historically has traded at more of a low double digit forward PE. Current dividend yield is 1.25% (dividend was hiked by 11% recently). They have continued to show organic revenue growth and earnings and expected to continue going forward as guided by Management also. Analyst Estimates below:

Balance Sheet is as below

Risks:

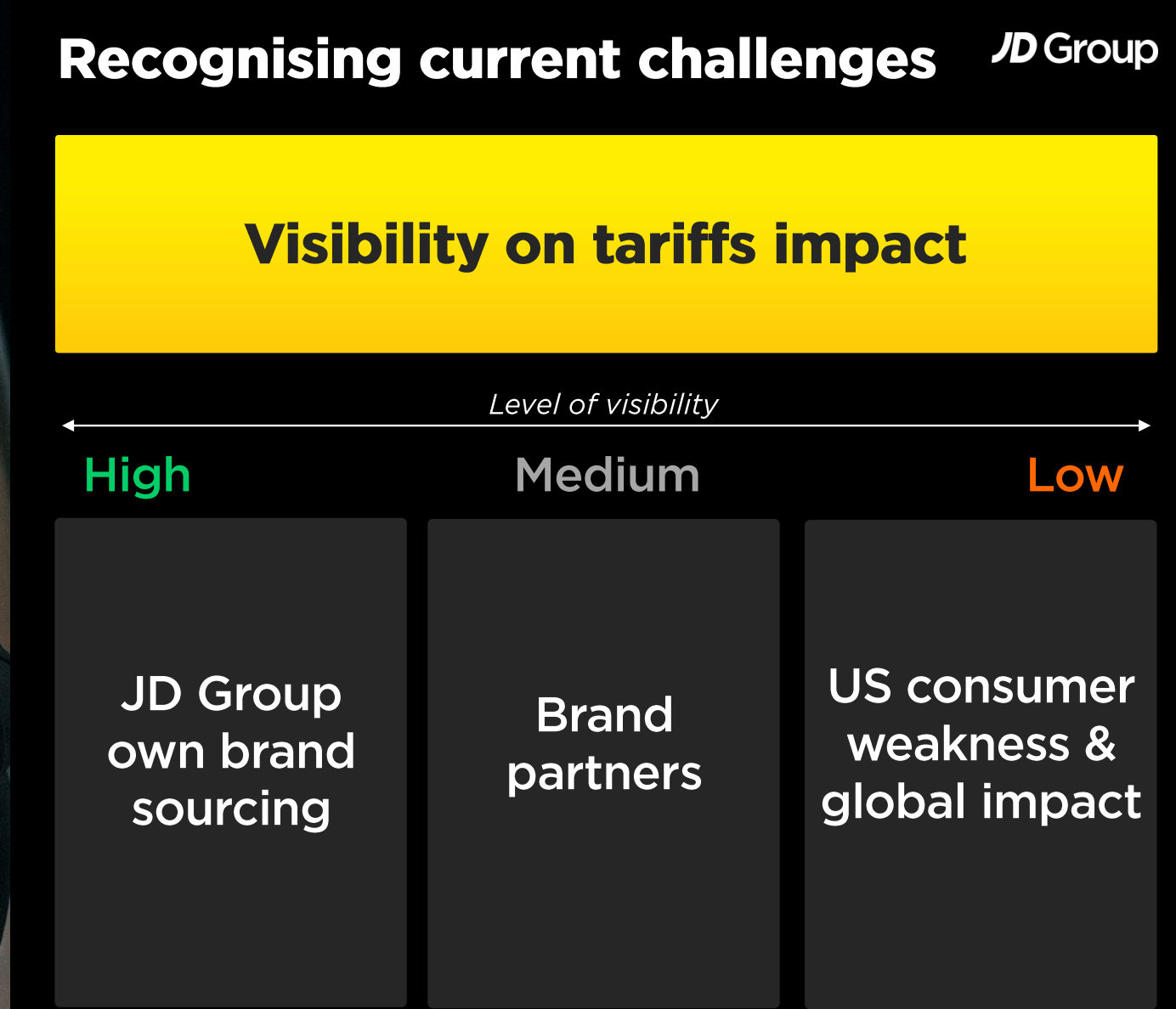

It is tariff impacted given the worldwide nature of the business. When it comes to the US consumer and global Impact, management have said they have low visibility on tariffs impact (see chart)

45% of their sales are from Nike so there is concentration risk. We know Nike has been asking for special tariff exemptions from the Trump admin, this remains to be seen. Furthermore, the UK has imposed some measures re National Insurance which have increased the cost of doing business for them.

Technicals:

Stock is beaten down and trading below both 50SMA and a descending 200SMA. Of note, it has rebounded from lows in April where reached as low as 61. In recent days has been selling off but on below average volume. Not a constructive chart currently, would like to see April lows held and then move to flip and hold 200SMA.

Summary:

JD sports is a sports fashion retail business with global footprint that continues to grow its presence in the sports fashion and outdoor retail Landscape. They are leveraging the strengths of its core JD brand while also developing and integrating complementary businesses to enhance its market position and offer a diverse range of products and experiences to consumers worldwide

The investment can be summarised in the following points:

Operating at scale in a growing market

Positioned well to gain share in North America and Europe

Strong multi-branded business model

Customer focused omni-channel model

Operationally efficient, growing profits ahead of sales

Strong Cash Generation and disciplined capital allocation

Tariff resolution would be a boon for this stock. In my opinion stock is very cheap at 77 and I think stock has a pathway to get to 120-130 in next 12M which would still put it at a PE of 10 and still PEG of <1. I am long with a ~5% position at cost average in mid to high 80’s. I have been a buyer on pullbacks in the 65-90 zone but probably won’t increase size materially from here.

Thanks for reading, subscribe to the tier that suits you (if not done already!) and see you for the next one!