Meta Earnings Update: A quick look

Today, Meta submitted their Financial report for fiscal first quarter ending December 31. The thesis remains on track for me and I was especially impressed with the impressive revenue guide for Q1 2026.

Overview:

Meta’s strong performance in late 2025 and projected acceleration into 2026 is primarily attributed to a significant AI acceleration, which is enhancing both user engagement and monetisation efficiency.

Record-breaking holiday demand and AI-driven performance gains across its Family of Apps, including Facebook, Instagram, and WhatsApp, have been key contributors. The company’s rebuilt AI program and recommendation systems are driving incremental engagement through improved content ranking and personalisation, leading to higher watch times and user growth.

Sophisticated AI integration into the ad system, including advances in ad ranking, delivery, and new ad products, has significantly boosted advertiser demand and conversion growth, thereby increasing the average price per ad and overall ad revenue.

Key Financial Highlights

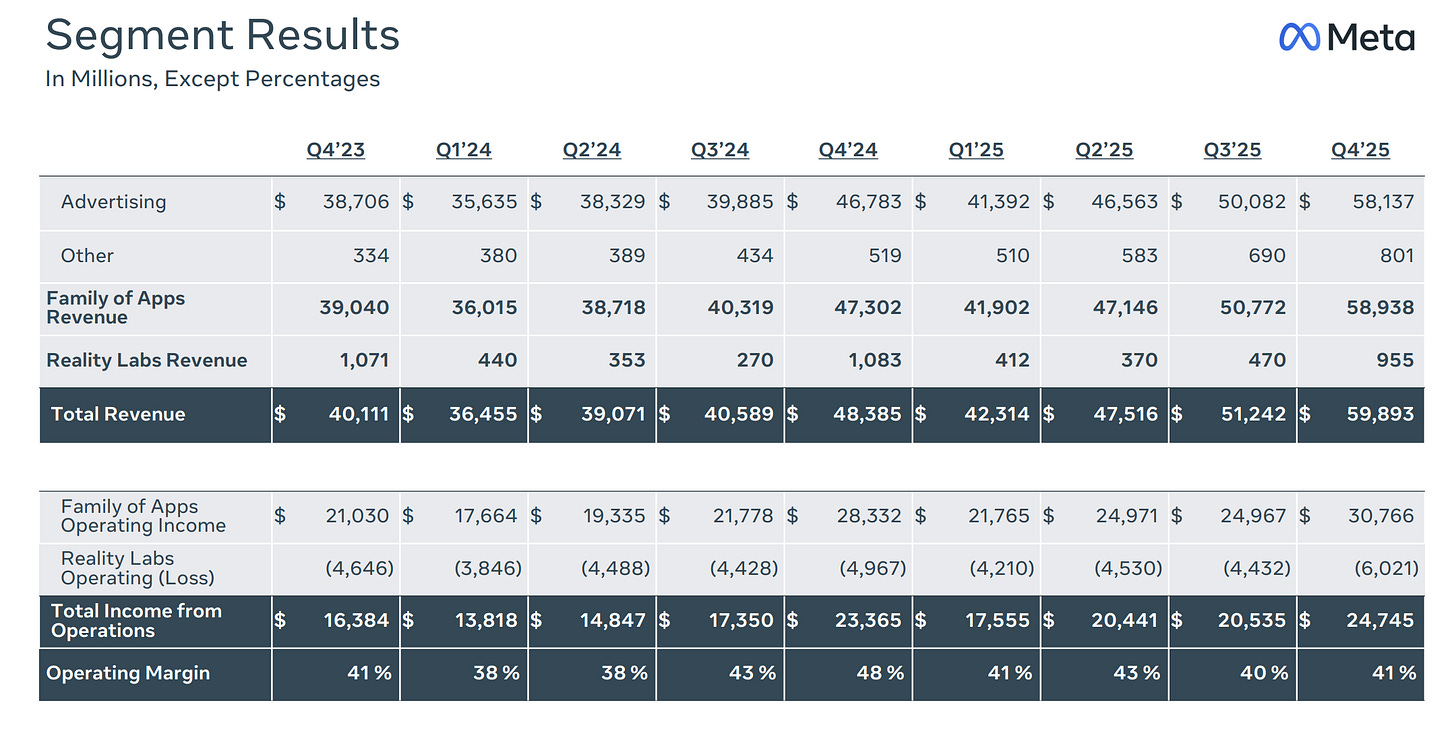

Total Revenue: $59.9 billion, up 24% year-over-year (23% constant currency).

Family of Apps Ad Revenue: $58.1 billion, up 24% year-over-year (23% constant currency).

Reality Labs Revenue: $955 million, down 12% year-over-year.

Family of Apps Other Revenue: $801 million, up 54% year-over-year, driven by WhatsApp paid messaging and Meta Verified.

WhatsApp paid messaging annual run rate: Crossed $2 billion in Q4.

Video generation tools revenue run rate: Hit $10 billion in Q4.

Ad Impressions: Increased 18% year-over-year.

Average Price Per Ad: Increased 6% year-over-year.

Operating Income: $24.7 billion, representing a 41% operating margin.

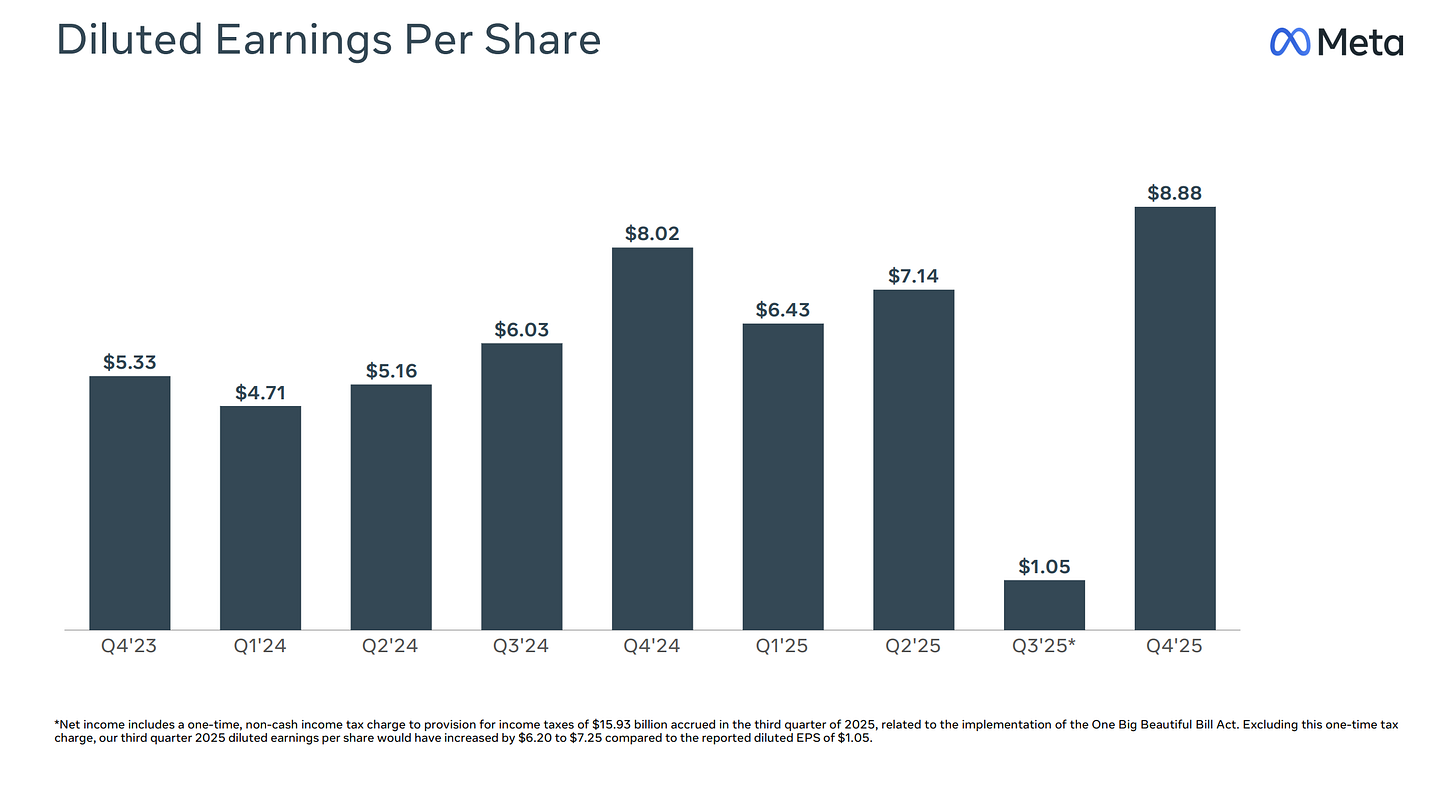

Net Income: $22.8 billion or $8.88 per share. (Up from 20.8B YOY)

Cash and Marketable Securities: $81.6 billion.

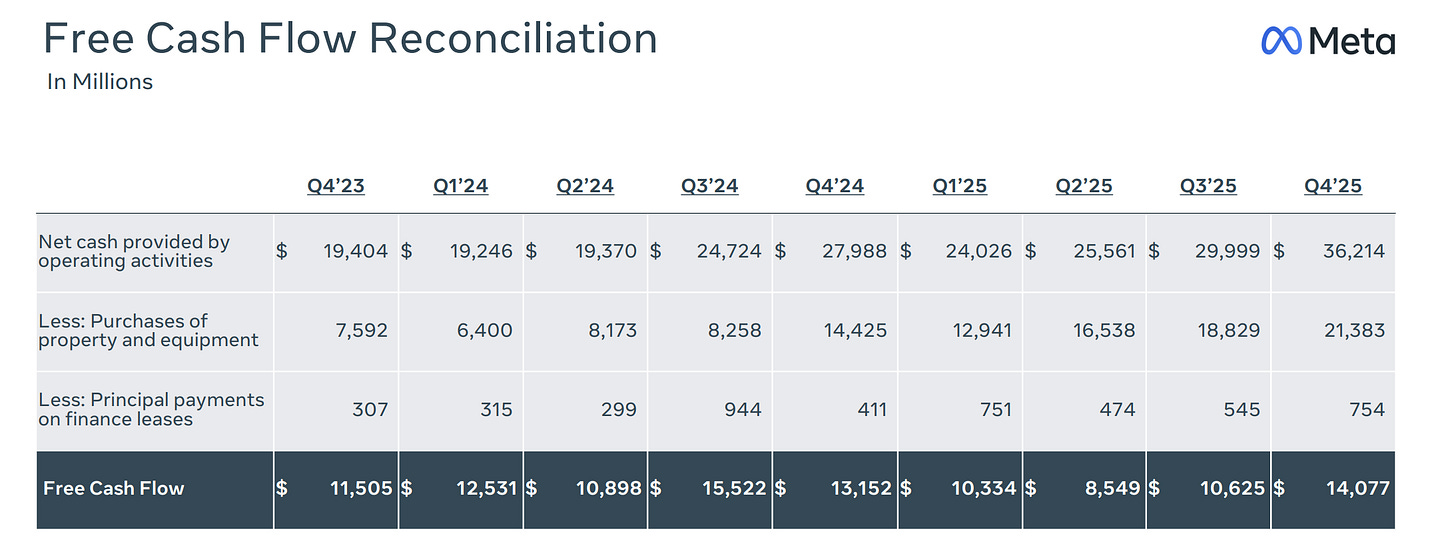

Capital Expenditures: $22.1 billion.

Free Cash Flow: $14.1 billion (FCF grew >3.4B despite almost 3B more capex QOQ)

Key Takeaways

We are all aware that Meta is undergoing a strategic shift, and according to Zuck prioritising a “major AI acceleration” to achieve “personal super intelligence.”

This involves rebuilding its AI program, integrating LLMs with recommendation systems to personalise user experiences and commerce, and developing new immersive media formats. A key goal is the widespread adoption of AI glasses, which saw sales more than triple YOY. Investment in Reality Labs will now primarily focus on these wearables, alongside making Horizon successful on mobile and VR profitable, with losses expected to peak in 2026. This was specifically mentioned in the call with RL losses to peak next year, and then taper off.

Meta is making significant infrastructure investments under “MetaCompute,” aiming for strategic advantage through efficiency in engineering, investment, and partnerships, including advancing its own silicon program. Internally, AI is dramatically transforming work, with agentic coding leading to a 30% increase in engineer output.

The company is also expanding monetisation avenues, with Threads rolling out ads globally and WhatsApp’s paid messaging already exceeding a $2B annual run rate, complemented by new AI-powered business assistants and media creation tools. Despite substantial infrastructure investment, Meta remains capacity constrained for compute resources through much of 2026.

Guidance

For the first quarter of 2026, Meta expects total revenue to be in the range of $53.5 billion to $56.5 billion, with foreign currency anticipated to be an approximately 4% tailwind to year-over-year growth. This is ~30% YOY growth at the mid point!

Full-year 2026 total expenses are projected to be between $162B billion and $169B, primarily driven by infrastructure costs (including third-party cloud spend, depreciation, and operating expenses) and employee compensation for technical talent, particularly in AI.

Reality Labs’ operating losses are expected to remain similar to 2025 levels.

Capital expenditures for 2026, including principal payments on finance leases, are forecast to be in the range of $115 billion to $135 billion, reflecting increased investment in Meta Superintelligence Labs and the core business. This is clearly very high and somewhat of a dampener for me.

Despite this substantial increase in infrastructure investment, the company anticipates delivering operating income in 2026 that is above 2025 operating income, with a full-year tax rate expected to be 13%-16%.

Current position and final thoughts:

Meta remains a leader in advertising, and now with significant AI acceleration, they are enhancing user engagement and monetisation efficiency. I purchased META shares not only because they were undervalued, but because I believe they possess one of the best advertising businesses in the world, with several monetisation levers they can pull to continue growing both the top and bottom lines.

Of course, I would like to see Reality Labs’ spend come down materially and see a definitive ROI on their investments. The thesis remains intact for me; I plan to hold my core shares, though at some point, I may trim this to a position size of approximately 5% in the portfolio.

Operating income for 2026 is underwhelming indicating capex is starting to bite into op margin. 27 will be even worse as capex this year will almost double again. ROIC is getting worse not better. Probably no more stock buyback. A lot of the rev growth is empty calorie until AI infra costs get under control.