Minimising Drawdowns

This is slightly different from my usual style of posts, but I wanted to share some thoughts on minimising drawdowns.

Making money in public markets is difficult enough, but keeping it is arguably even tougher. As market participants, we must accept that drawdowns are inevitable; the key, however, is to keep them manageable. Below, we examine several techniques one can use to minimise them. Please note that this is not meant to be an exhaustive list, but simply an initial guide.

I am also working on a post discussing how to manage one’s portfolio in a bear market, which will be much more in-depth and covers possibly one of the most important concepts in investing. Stay tuned for that.

Some techniques one can use to minimise drawdowns

Cash position

All else being equal, holding cash reduces your drawdown in proportion to the amount of cash held. For example, if you have a 10% cash position and your holdings drop by 10%, your total portfolio would only decline by 9%. Similarly, with a 20% cash position, that same market drop would result in an 8% portfolio loss instead of 10%. You get the idea.

I would recommend to read my write up below for further insights on the benefits of cash as a position:

Using trailing stops to downsize positions

The core strategy here is to systematically downsize positions to reduce market exposure.

Trailing stops can be applied to either the entire position or just a portion of it. For instance, if you wish to hold a stock long-term despite a trend breakdown, a sensible compromise may be to sell a portion of it when a key moving average is violated. Specifically, if a stock closes below the 50-day SMA for the first time in a recent run, it may signal a ‘change in character.’ At that point, it may be wise to cut the position fully or partially. If the price continues to decline, well then you will have successfully minimised the impact on your portfolio.

If you are generally unsure when to sell, I would certainly recommend you take a look at my “Sell Rules” post below:

Hedging:

Oliver Wendell Holmes famously said, “Prophesy as much as you like, but always hedge.”

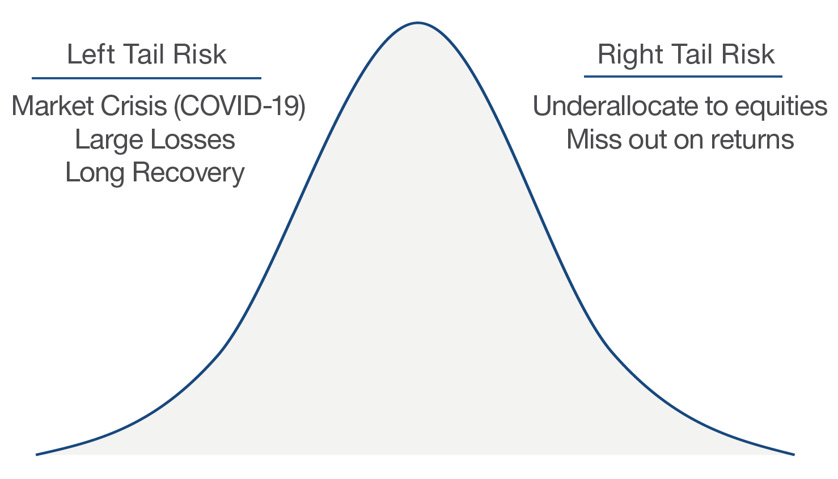

The goal of hedging is not necessarily to make money, but to mitigate “left-tail” risk. It should be viewed as insurance: it is there for the rare instances when you truly need it. During market declines, a hedge offsets portfolio losses and becomes a valuable source of liquidity as they can be sold to buy new hedges or purchase equities at lower prices.

One simple strategy (besides holding cash) is to purchase longer-term put options when the S&P 500 falls below a key moving average, such as its 21-day EMA. The logic for this is crashes typically occur from oversold conditions, not all-time highs; therefore, it is prudent to apply hedges once initial weakness appears. There are various other ways to hedge but sometimes simple is best.

New Money

When it comes to putting new money to work, patience is very important, especially in a downtrend.

A useful tip is to only invest when there is an extreme dislocation, or if the chart shows signs of basing and an emerging uptrend. Specifically, look for a base accompanied by moving averages cross-over such as the 5 EMA crossing over the 20 EMA to confirm a possible trend change.

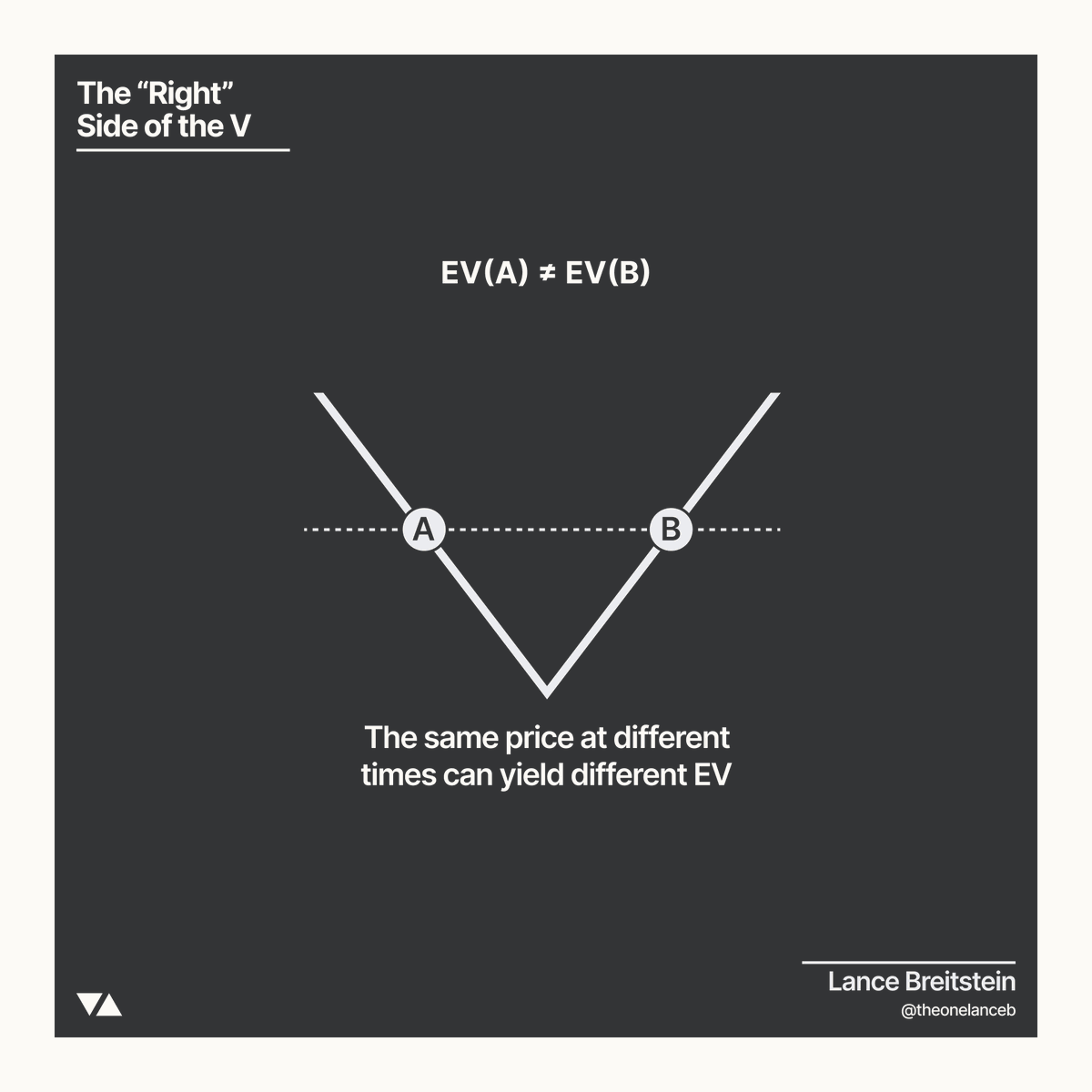

Furthermore, consider taking smaller initial positions and ideally buying on the ‘right side of the V.’

Lastly, it can’t be understated how important it is to wait for market conditions to become favourable before sizing up.

Diversification

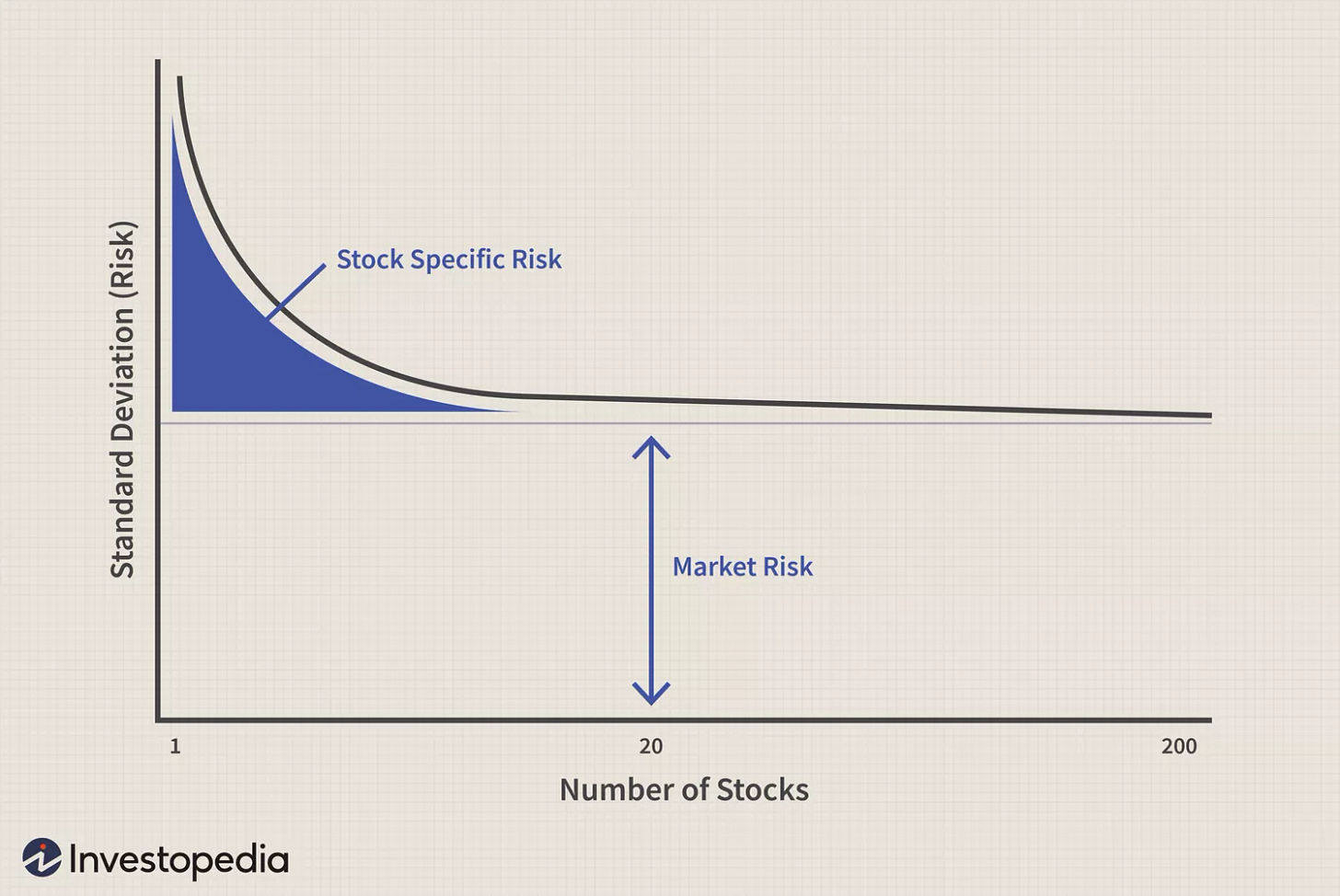

Diversification, when done correctly, can be useful. The simple idea is to have exposure to different, uncorrelated factors so that not every position acts the same, ensuring some positions are working when others are not. As an example, if you own five data centre stocks, then in reality you own one position, as they are likely all correlated. Beyond a certain point however, the benefits of diversifying erode quickly.

Thank you for reading, ensure to subscribe to the plan that suits and see you for the next one!