Monthly Portfolio Update

Plus Market Thoughts

Market thoughts:

Equity Markets have enjoyed another strong month with the Dow, S&P 500 and Nasdaq Composite putting up +3.56%, +4.37% and +5.73% MTD performances respectively. Back-drop wise markets continued to rally on the back of Trump’s Tariff delays. There was the Israel-Iran war which was fleeting.

My perspective remains that there is more than enough to be worried about with regards to the US economy and Markets. Yet despite the geopolitical and macroeconomic uncertainty, markets have exhibited remarkable resilience. This is notable. I am not a fan of large Tariffs and if they proceed as intended by the Administration this will hurt the average american and SMB.

We did get another inflationary print with regards to the PCE (Feds preferred metric). Core PCE printed at 2.7% (YOY) versus 2.6% as expected and 0.2% MOM vs 0.1% expected. My expectation is that rates will remain as they are. Fed Chairman Powell recently stated that he “expects policymakers to stay on hold until they have a better handle on the impact tariffs will have on prices”

I had said last month that I am no longer of the opinion we have to adopt a Bear Market Strategy but ratherwe are entering a new up-trend. That is still my working hypothesis as of today.

Below we will look at:

Where we are in the markets at Indices Level,

Review Key Indicators,

SixSigmaCapital Swing trades in the last Month,

Portfolio updates plus YTD performance.

My plans for Navigating the weeks ahead.

SixSigmaCapitals historical performance has been:

2023: +94%

2024:+61%

Equity curve since switching to my current brokerage in the last few years is below.

Indices:

S&P 500:

Currently trades at 6,173.07 (5.19% YTD)

It is 6.26% above the 50SMA. RSI is 70.21.

Trading at 24.09 x trailing earnings and 23.17x forward earnings (per WSJ)

Nasdaq Composite:

Currently trades at 20,273.46 (5.15% YTD)

It is 8.66% above the 50SMA. RSI is 70.74.

Trading at 31.95 trailing earnings and 29.15 forward (per WSJ)

Other Indicators I like to look at:

10 Year T-Note: 4.283%. Now -6.38% YTD. It has decreased notably by >4% down in last month.

CPC (Put to Call Ratio) is subdued at 0.75. >1 usually indicates Fear and >1.5 can be Extreme.

Vix: Is 16.32. That is in the lower range of where we have been in the last 6M. Note that in April we did get a >60 print. I have included a chart below showing the Vix over time and Nasdaq Comp underneath it: you can see extreme readings always have been a buying opportunity in medium term.

British Pound vs USD: 1.373 and up 11.01% YTD! $ is weakening significantly.

Fear and Greed Index currently at Greed and is reading 65.

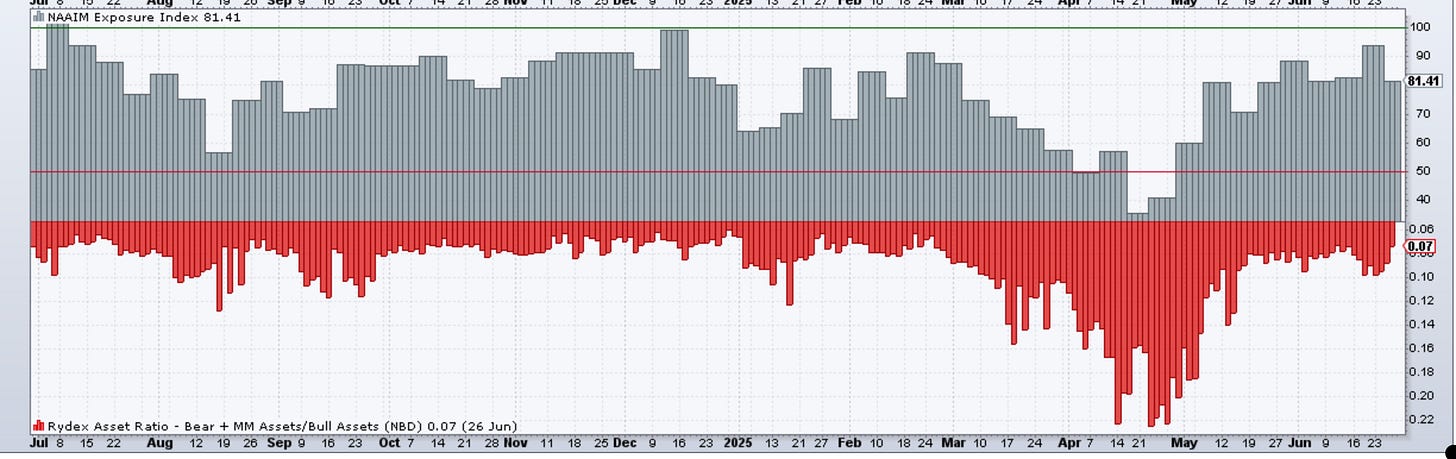

NAAIM Exposure Index is 81.41

SixSigmaCapital Swing trades June 2025:

June has been a pretty active month having partaken in a few opportunistic swing trades plus some portfolio changes (I will discuss these further below in the Current Positions section)

$U exited at 27.2 early June for a gain of >20%

$ASTS for 60% booked in 10 days.

$CRCL bought at 90. Exited 5 sessions later at 164 for ~83% gains. This was an 8% position so a real portfolio mover.

$OSCR in at 14.49 and trimmed 1/2 for 50% gain 3 sessions later.

$COIN- In at 207 and remains open here at ~350

$VOYG- took a 20% loss on 1% position allocation

$CHYM- took a 8% loss on a 1% position.

Current Positions in size order:

Cash: ~14 % due to booking gains on the way up from April re-bound. Was 0.1% on April 11th when I had exhausted the cash.

AMZN: 13%. It is a core holding, scooped up some in April in the 165-175 range but in DCA territory below 210 IMO.

GOOGL: 11%. A core holding, trades way below market multiple despite their AI offerings. I believe it will re-rate up.

AMD: ~7% . I built this position in the downturn at a cost average of 103 and it has rebounded well off the bottom. Will benefit from increased AI spend. Had said it can trade at mid 100’s this year and we are currently in mid-high 140’s.

BABA: ~4.5%.

PDD: ~4.5%. Recently had a tough ER.

JD.L: ~4%. Strong print recently plus the strong NKE ER will serve as a boon for this stock. Tariff clarity and resolution will be another tailwind.

SE : ~4%. SE has been on a tear, up 52% YTD and 123% in the last year. Think this could keep going up and to the right next few years.

COIN: ~4%. Had said when it was 207 that think we can trade 300 this year is now ~350 with a breakout and ATH close. 400 logical target above. Note around 20% (was less prior to this run up) of my COIN exposure is via a leveraged ETF product, at 400-420 I will be a seller of this.

KWBP (KWEB): ~3.0%. Offers broader exposure to Chinese tech and Internet companies. Reduced in Jan run-up, added some in early April.

XYZ: ~3.0% A tumultuous stock and difficult to endorse but they are now shipping products with a sense of urgency. I think this stock could trade north of 80 again soon. Holding my shares, if we tested upper range (80-90) I may sell some.

MSFT: ~3.0% A core holding.

UBER 3% (new)

SNOW: ~2.5%. Has rebounded from recent lows of 120’s where I added and now post recent ER is north of 200.

STNE and PAGS: ~4% combined. Both are in my Brazil basket. performing very strongly YTD +90% and +46.5% respectively.

MANU: ~2%. It was a new position initiated in May low 13’s now >18.

GRG.L ~2%. UK based franchise with a low multiple, growing top line and SSS growth. Offers a a ~3.4% yield also. Holding.

TMDX: ~2%. Up >120% from lows and recent data looks promising for another strong Q.

HOOD: ~2%. Re-started this in April at $33. Has been a leader in the current market. Getting a little extended ~90% above 200SMA.

TDOC: 2%. New

CLPT: ~1.7%. Precision delivery and access to the Nervous System.

OSCR 1% weight. New.

TW.L: ~1% weighting. UK listed house-builder with a low multiple and 7% yield.

PYPL:~1% weight

VOYG: ~1% weight

Short PLTR: ~1.2% position. Will keep increasing as it moves up.

Portfolio changes in the last month:

Exited my HIMS on the NVO news. It was a 1.7% position for me with the cost being in low $6 nominally but in reality they were house shares given the amount of profits I had booked since November 2023. I did not like the way management responded to the NVO legal threat and I was happy to exit at this juncture.

Exited my small positions in ASTS and TGEN for 60% and 25% gains respectively.

Initiated a position in OSCR at 14.498. It is a tech-enabled Health Insurance company which had a favourable technical set-up plus very low valuation. Growing profitably with a seasoned CEO. Interestingly has similar forward PE to UNH!

Initiated a position in TDOC at $8. The set-up is such that it trades at huge discount to peers, 0.7x Sales and has a EV/FCF yield in mid-teens. The acquisition of UpLift should help the struggling BetterHelp portion of the business. I think it is an interesting turn-around into 2026. Reports earnings July 25th.

Re-entered UBER in the low to mid 80’s where I have been accumulating. Previously I owned from 60 to 84 but I am in for round 2 with aim to increase to a 5% position. UBER remains a cash flowing company which has an undemanding valuation and will continue achieving many partnerships going forward.

Watchlist or Favourite set-ups over next few months:

I feel my favourite names are already in the portfolio. So these will be names I will be focusing on the most. The specific ones and levels I am interested in are below:

AMZN buyable here for LT but 160/170 would be v good R/R

AMD buyable 105-120 but ~95 would be very good R/A

BABA buyable here but 100-105 better

XYZ I have enough but at 55 would likely add

CLPT 10-11. I will be adding

COIN: Street has woken up to this now and so dips may be shallow. As little extended think could see them however. Re-trace to 300 would be better R/R

GOOGL: Good levels here already but 165-155 good zone to accumulate.

HOOD: 65-67 initially but on a deeper pullback 58-62.

OSCR: 14-15 represent a strong technical accumulation zone.

PAGS: 8-9 is a buy. At ~7 a very strong buy

SE: Not a demanding valuation here but 120-130 strong buy

STNE: 13’s is a buy, 11-12 a very strong buy (see my write up on STNE/PAGS also)

TMDX: 94-100 I would add.

UBER: has very good and fair valuation here. But Mid 70’s would be better accumulation zone.

YTD performance:

YTD is +30.14%. To try mitigate the effect of the dollar I am trying not to sell US holdings into £ but rather into $. I am very pleased with my YTD especially when I consider my 2 biggest positions have been somewhat laggards yet I am vastly outperforming the S&P which is +5.19% YTD.

Closing Thoughts and Looking Ahead:

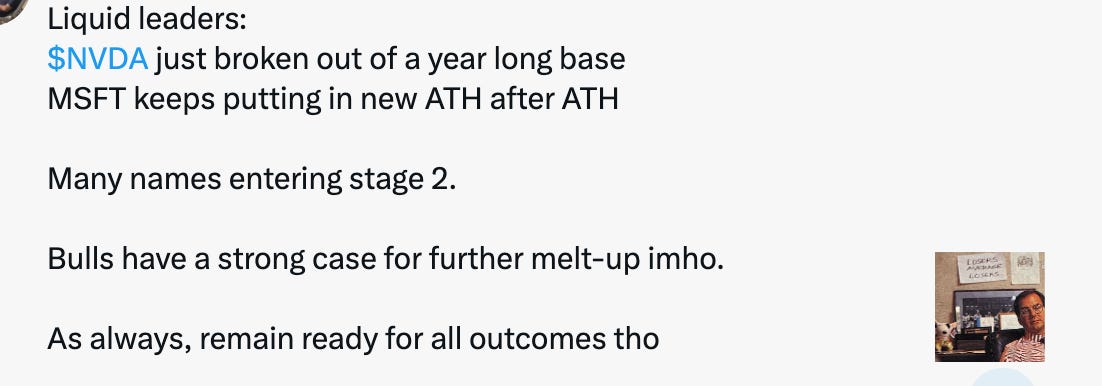

Indices have now breached new ATHs, and as I posted recently, liquid leaders such as NVDA and MSFT are breaking out and making new ATH’s. This is not bearish.

Hedge Funds and Mutual Funds remain underweight in their exposure to Tech and this could be a reason why the disbelief rally could yet have room to run further. Furthermore, any dips keep getting bought and the trend remains undoubtably strong. Seasonality is also in the favour of Bulls. Sometimes overbought conditions lead to more overbought conditions!

My plan with Navigating the Markets here is I am not likely to add any meaningful exposure but sitting on my hands to see if we can run further. If we run to the 6400 level on SPX I am likely to reduce my exposure further. If we get a pullback, first levels on SPX to watch will be mid 5800 which represents a -5% pullback from here.

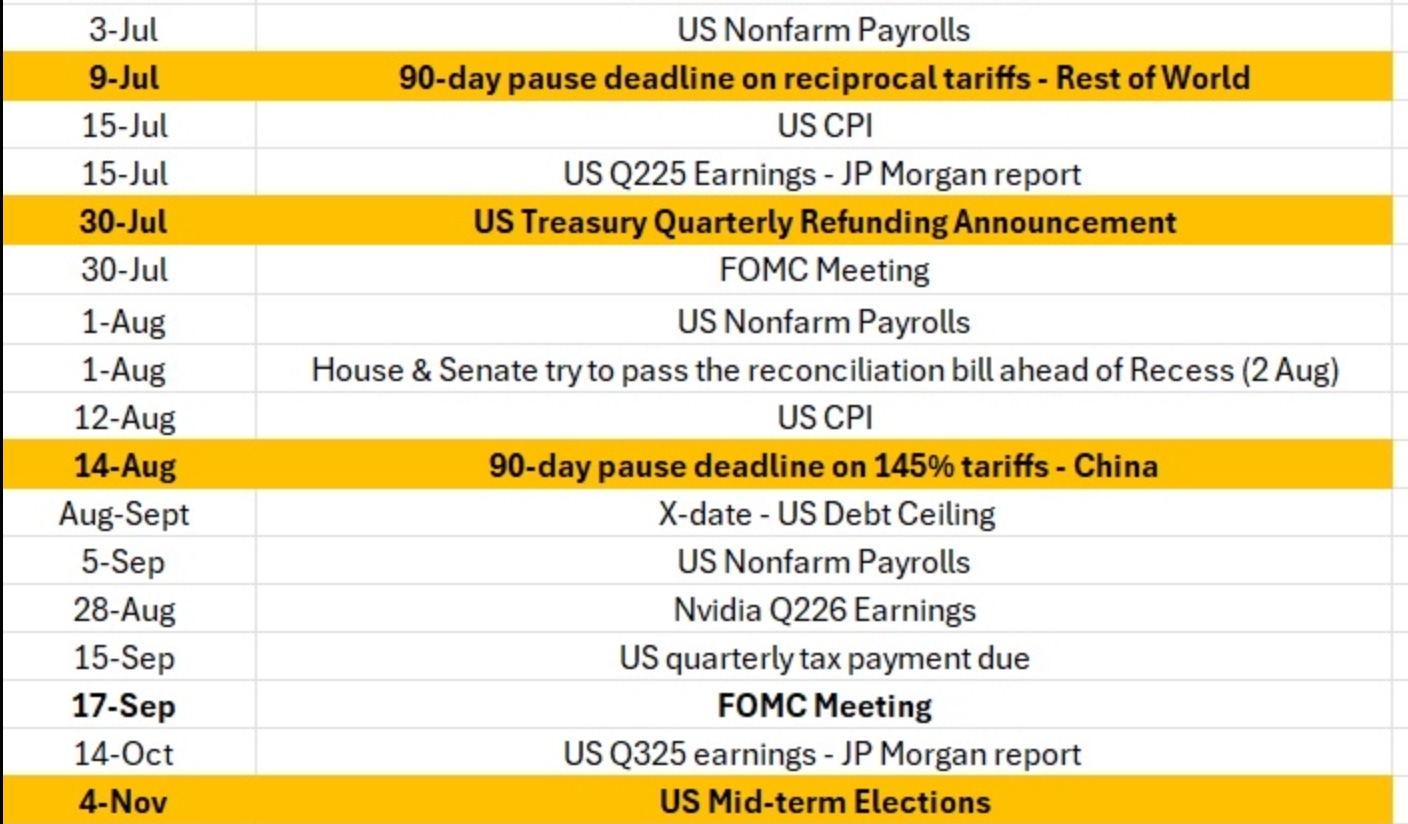

Briefly to touch on the weeks ahead, we do have several Key US events upcoming to keep an eye on. See below:

I am (presumably like yourselves) a net buyer of stocks in the Long-Term but I will always be looking to buy on peak fear and sell when there is complacency and greed. Trading around a core will help me to keep exposure at the level I am comfortable with.

Thank you for reading, supporting the service and See you for the next one!!

Thanks for the portfolio update!

Thanks for the update SSC, a nice summary of current state of the market and I found the last section extremely helpful where you mentioned if a stock is buyable hear or better if it pulls back to a certain level. Thank you