Monthly Portfolio Update

Plus Market Thoughts

Market thoughts:

Equity Markets have enjoyed another strong month with the Dow, S&P 500 and Nasdaq Composite putting up +3.95%, +4.33% and +5.11% performances respectively. Back-drop wise markets continued to rally on the back of Trump’s Tariff delays.

My perspective remains that there is enough to be worried about with regards to the US economy and Markets over the medium term. However, despite the geopolitical and macroeconomic uncertainty, markets have exhibited remarkable resilience. This is notable.

I am not a fan of large Tariffs and if they proceed as intended by the Administration my belief is this will hurt the average American and SMB. However, on the tariff front there does seem to be progress with the announced Trade deal with Japan. Now the two big ones that remain are the EU and China.

In June we did get another inflationary print with regards to the PCE (Feds preferred metric). Core PCE printed at 2.7% (YOY) versus 2.6% as expected and 0.2% MOM vs 0.1% expected. PCE for July is due to come out the 31st. My expectation is that rates will remain as they are for the foreseeable and Fed Chairman Powell has recently stated that he “expects policymakers to stay on hold until they have a better handle on the impact tariffs will have on prices”

Last month I had stated “Hedge Funds and Mutual Funds remain underweight in their exposure to Tech and this could be a reason why the disbelief rally has room to run further. Furthermore, dips keep getting bought and the trend remains undoubtably strong. Seasonality is also in the favour of Bulls. Sometimes overbought conditions lead to more overbought conditions!”

This is what transpired. Now, however, things could be changing, as institutions have much more significant exposure and seasonality no longer favours the bulls.

Format for the rest of the update is as follows:

Indices Review

Key Indicators

SixSigmaCapital Swing trades Recap

SixSigmaCapital Performance: YTD and since Inception

Current Positions in size order

Portfolio changes in the last month

Watchlist and Favourite set-ups over next few months

Closing Thoughts

Also, just to briefly mention it was a big month for the Community as we surpassed 1000 subscribers! As a token of appreciation, I have initiated a once only 15% off for early adopters (or 29% on the Annual plan) redeemable in the next 8 days. The demand has been fantastic, and it is very much appreciated. See below:

Indices:

S&P 500:

Currently trades at 6,388.64 (8.86% YTD)

It is 4.92% above the 50SMA. RSI is 76.21.

Trading at 24.85x trailing earnings and 24.03x forward earnings (per WSJ)

Nasdaq Composite:

Currently trades at 21,108.32 (9.48% YTD)

It is 6.06% above the 50SMA. RSI is 74.77.

Trading at 32.72x trailing earnings and 30.01x forward (per WSJ)

Key Indicators:

10 Year T-Note: 4.386%. Now -4.13% YTD. It has increased by >2.5% in last month.

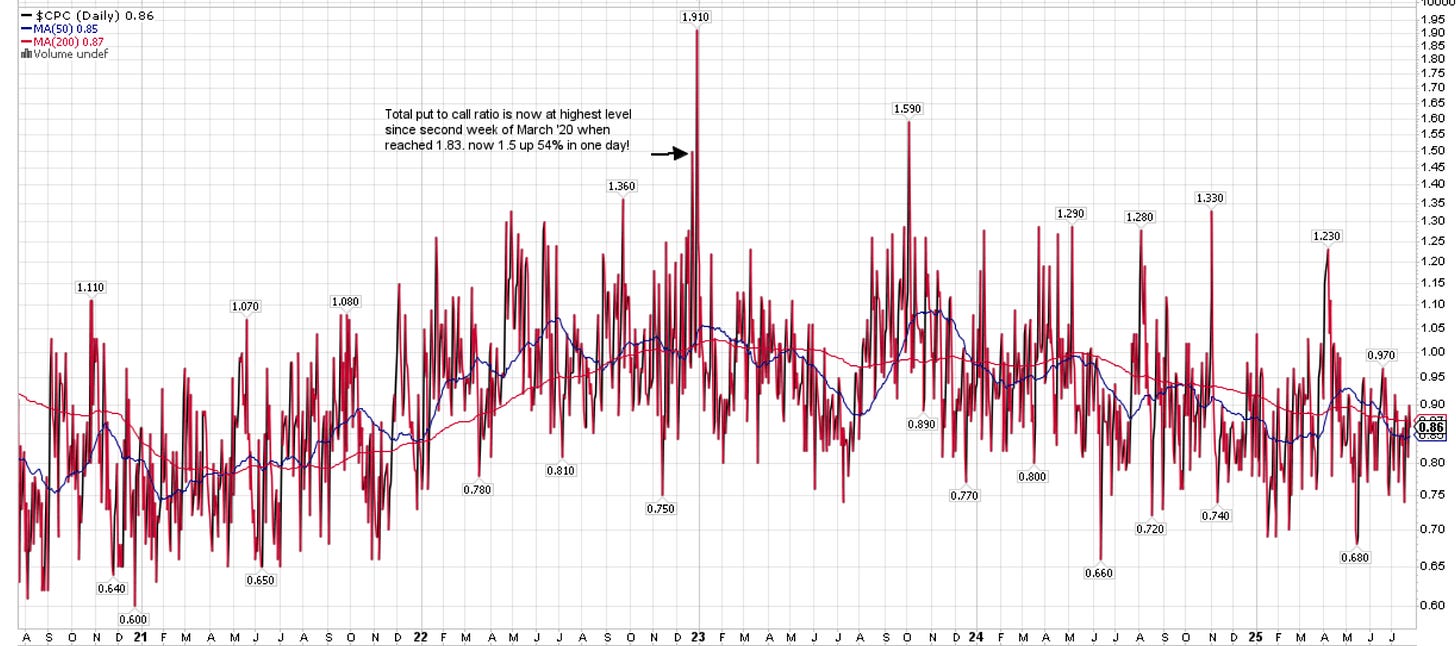

CPC (Put to Call Ratio) is subdued at 0.86. >1 can indicate Fear and >1.5 can be Extreme.

Vix: Is 14.93(!). That is in the lower range of where we have been in the last 6M. Note that in April we did get a >60 print. I have included a chart below showing the Vix over time and Nasdaq Comp underneath it: you can see extreme readings always have been a buying opportunity in medium term.

British Pound vs USD: 1.344 and up 8.71% YTD! $ has weakened significantly YTD.

Fear and Greed Index currently reads 74 which is almost Extreme Greed.

NAAIM Exposure Index is 81.07 (was in low 30’s in April)

SixSigmaCapital Swing trades in the last Month:

July has been an active month having partaken in a several opportunistic swing trades plus some portfolio changes (discussed further below)

ETH 2.4k to 3.77k and booked some for 58% in 18 days

COIN was 207 when pitched, reduced some at $430-$440 for >100% gains

BTBT traded twice for >30% gains; Round 1 30% gainer in a day and then Round 2 >30% in 7 days.

CRCL traded from 174 to low 220's for 26% gains in <2 weeks

TGEN initiated a position and it moved 40% the same day! Trimmed 40% of the position to book some gains.

OSCR reduced 60% of the position for a 7% loss on Round 2 (50% gains from Round 1 have not been included otherwise)

Performance: YTD and since Inception of SixSigmaCapital (Equities Only)

2023: +94%

2024: +61%

2025: +37.4% YTD

TWR since Inception of SixSigmaCapital is thus 329% or a 4.29x of the portfolio.

TWR of S&P 500 in the same period is +72.8% or a 1.728x return.

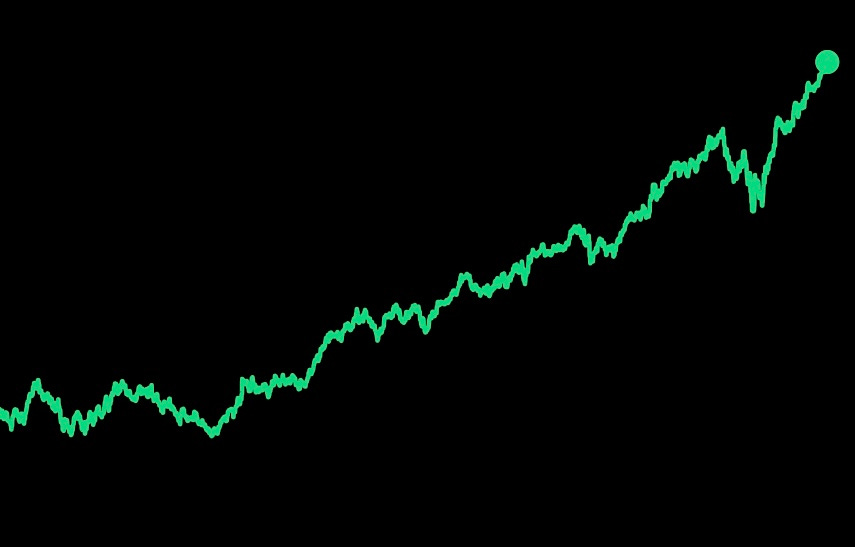

Equity curve since switching to my current brokerage in the last few years is below:

Current Positions in Size Order with Cost Basis: