Monthly Portfolio Update

Plus Market Thoughts

Market thoughts:

Equity Markets have enjoyed another robust month with the Dow, S&P 500 and Nasdaq Composite putting up +1.47%, +2.48% and +4.13% performances respectively.

As per last month, my perspective remains that there is enough to be concerned about with regards to the US economy and Markets over the medium term. However, despite the geopolitical and macroeconomic uncertainty, markets have exhibited remarkable resilience. This is notable and the market continues on it’s merry way, for now?

I am not a fan of large Tariffs. My belief is if they proceed as intended by the Administration my belief is this will hurt the average American and SMB. However, on the tariff front there has been progress with the announced Trade deal with Japan and the EU.

With regards to a potential China tariff deal, a 90-day extension to a tariff truce moved the expiration date to November 10, 2025. The extension capped U.S. tariffs on Chinese imports at 30% and Chinese retaliatory tariffs at 10% on U.S. goods, preventing an increase to even higher rates.

In June we had another inflationary print with regards to the PCE (Feds preferred metric). Core PCE printed at 2.8% YOY and 0.3% MOM. Furthermore, in July Core PCE increased 2.9% YOY and 0.3% MOM. This has not gone unnoticed.

At Jackson Hole, Chairman Powell acknowledged the complexities of the current economic landscape, noting that “risks to inflation are tilted to the upside, and risks to employment to the downside.” Remember also that previous PCE numbers were revised up and Employment numbers were revised down. With regards to GDP, the US revised Final Q2 GDP growth up to 3.8%. Most market participants were expecting a cut in September and the Fed did reduce the federal funds rate by 25bps, lowering the target range for the federal funds rate to 4.00% to 4.25%.

Last month, I suggested that things could be changing after the recent market run, given that institutions have much more significant exposure and seasonality no longer favours the bulls. Although we had some weakness at the beginning of September, markets have continued to move higher. I have continued to shift my portfolio slowly away from what’s been working to what I expect to work in months from now. More on that later in this update.

Format for the rest of the update is as follows:

Indices Review

Key Indicators

SixSigmaCapital Swing trades Recap

SixSigmaCapital Performance: YTD and since Inception

Current Positions in size order

Portfolio changes in the last month

Watchlist and Favourite set-ups over next few months

Closing Thoughts

If it is your first time here ensure to check out what SixSigmaCapital premium readers are saying below:

For all readers a reminder that a premium subscription includes:

Favourite set-up Ideas, Subscriber-only Content plus Full archive

Live Portfolio updates (All Buys and Sells) in Subscriber only Channels

Monthly in depth portfolio & performance updates.

Market Memos and Weekly preview email

If interested in the above then consider upgrading to a paid subscription via the link below. New annual members still get their membership extended by one month, at no additional cost.

Indices:

S&P 500:

Currently trades at 6,604.72 (12.54% YTD)

It is 2.35% above the 50SMA. RSI is 58.66.

Trading at 25.3x trailing earnings and 21.85x forward earnings (per WSJ)

Nasdaq Composite:

Currently trades at 22,384.70 (16.1% YTD)

It is 3.76% above the 50SMA. RSI is 61.35.

Trading at 32.65x trailing earnings and 26.63x forward (per WSJ)

Key Indicators:

10 Year T-Note: 4.172%. Now -8.81% YTD. It has decreased by 2.68% in the last month.

CPC (Put to Call Ratio) is subdued at 0.89. >1 can indicate Fear and >1.5 can be Extreme.

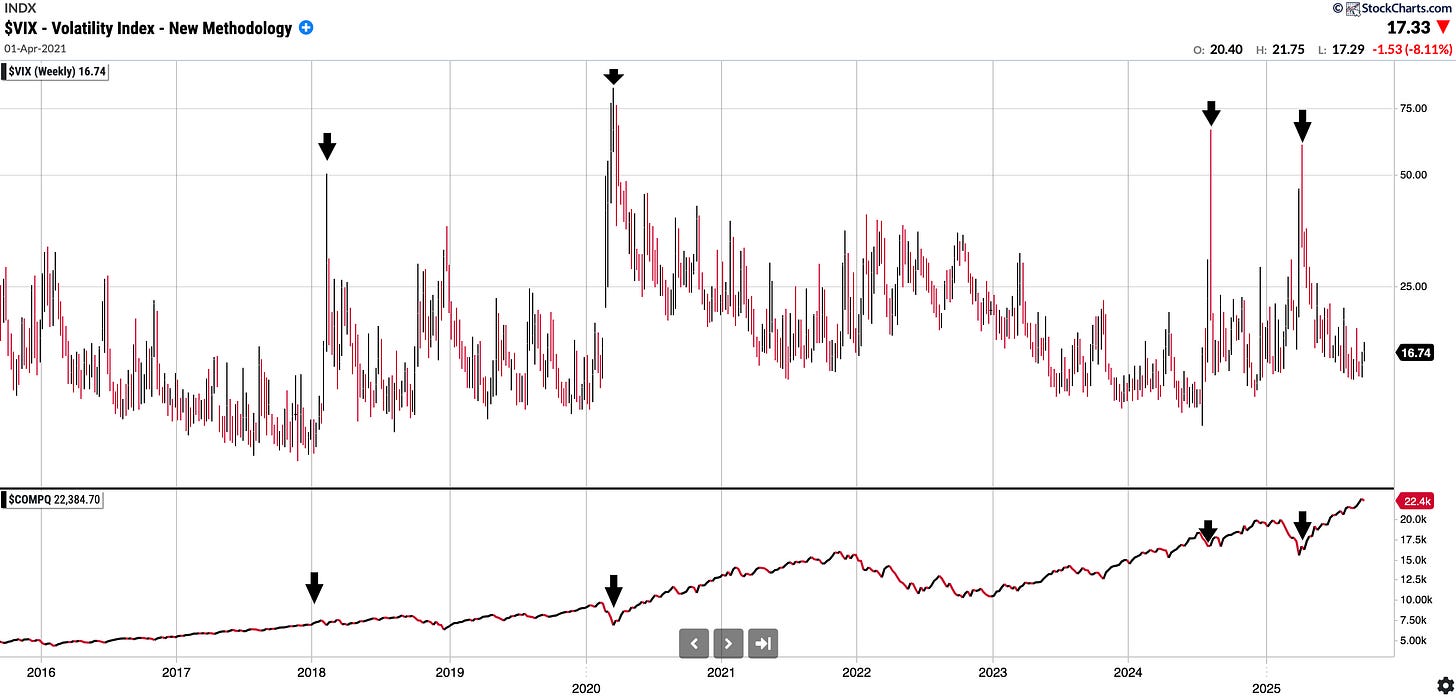

VIX: is 16.74. That is in the lower range of where we have been in the last 6M. Note that in April we did get a >60 print. I have included a chart below showing the VIX over time and Nasdaq Comp underneath it: you can see extreme readings always have been a buying opportunity in medium term.

British Pound vs USD: 1.335 and up 7.93% YTD! $ has weakened significantly YTD.

Fear and Greed Index currently reads 52 which is in the ‘Neutral’ sentiment zone.

NAAIM Exposure Index is 86.24.

SixSigmaCapital Swing trades in the last Month:

September has been quite an active month having partaken in a several opportunistic swing trades plus some portfolio changes (discussed further below)

Entered HIMS at 42.00 end of August, sold for 23% gains on 17th September.

Sold OSCR at 17.45 for a roughly 20% win on the 3rd of September.

Traded around a core with TGEN, bought additional shares at average of $7 (Sept 3rd and 8th) and sold for ~41% gains at $9.9 on 23rd September.

Traded around a core on TMDX, added at average of 106.5 on 2nd and 4th of September, sold on 23rd September at 127.00 for +19% gain in 19 days.

Traded around a core on HROW, sold early August adds for +53% on 23rd September at 49.75.

Bought ADBE 12th September at 342, sold on the 18th September at 367 for 7% gains in 5 sessions.

Bought CHYM on the 18th September, sold on the 23rd of September for 5% gains in 4 sessions.

Bought DUOL on the 8th and 9th September at average of 265, sold on the 11th of September for +$45/Share or 16% gains in 2 days. (Have since re-bought on round 2)

Picked up UNH 1st of August at ~240, now >345

Fully exited my HOOD on the 9th September for 360% gains.

Sold 1/4 BTBT for a 3% loss on 18th September (although re-added those due to the WYFI asset ownership)

Have other swing trades open (discussed below)

Performance: YTD and since Inception of SixSigmaCapital (Equities Only)

2023: +94%

2024: +61%

2025: +56.7% YTD (As of Monday 29th September Market close)

TWR since Inception of SixSigmaCapital is thus 389.44%or a 4.89x of the portfolio. The CAGR is ~78.16%.

TWR of S&P 500 in the same period is +80.08%. or a 1.8x return.

SixSigmaCapital has achieved a +309% outperformance in that time period.

Equity curve since switching to my current brokerage in the last few years is below:

Current Positions in Size Order with Cost Basis (CB)