My thoughts on Tesla

I have owned and studied TSLA 0.00%↑ for many years , exited December last year at 420.69 for a ~21x return. It has again been prominently in the news today after Elon and Trump clashing with Elon accusing Trump of ‘partying’ with Epstein and Trump accusing Musk of being high on Ketamine.

Below is a once over of my thoughts on the stock

Bull Case

Long term I think Bulls would agree Tesla has become a bet on them not only solving but monopolising FSD and Robotics. Tesla has been able to scale Hardware in the past so it isn’t farfetched to think they could do it again this time with Humanoids. Their FSD strategy can scale and achieve virality given the approach they have decided to go with. The chart with cumulative miles driven with FSD has shown hockey Stick growth (See chart below). Anecdotally FSD has definitely really come on leaps and bounds.

Having Elon back as “Wartime CEO” sleeping on the floor is not bearish. Furthermore, the energy business has been strong with impressive growth and Margins. See chart below (a SixigmaCapital chart)

Bear Case

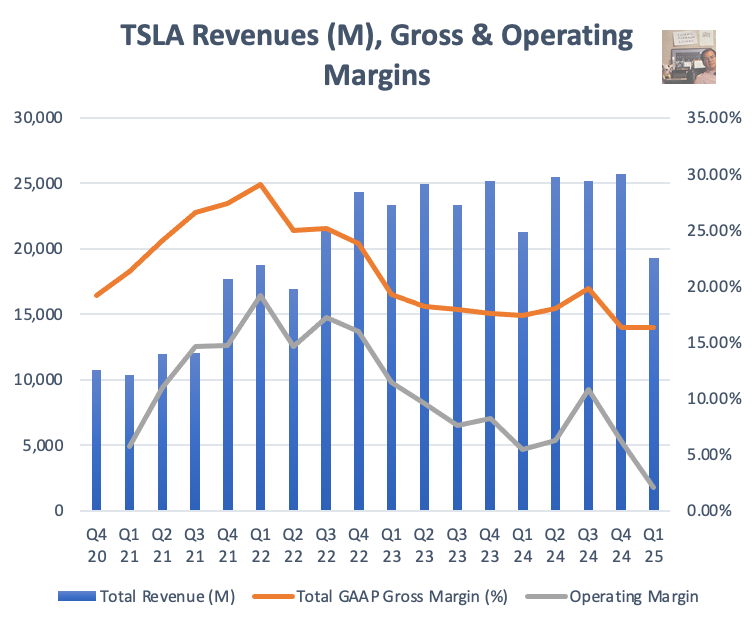

Bears would argue the core business has completely deteriorated and Operating Margins are now 2% from peak in high teens. Gross Margins were close to 30% at their peak and now 16.3%. Revenue flat-lining and EPS declining. See charts below:

Bears would further argue the brand is tainted, point to the fact demand worldwide has diminished and they are likely to report a 3rd year in a row with declining revenue growth.

The FSD and Robotics timelines are too optimistic and I agree with this. We are probably 5 years away at least from widespread FSD in North America and longer for FSD around the world.

We know that Tesla benefits greatly from regulatory credits and they could be under threat especially after the events of today whereby Elon and Trump had public fall out, to and fro which culminated in the following:

Another second order effect of the falling out could mean that the Trump Admin is not so favourable towards being lenient with regulation; this could thwart their Robotaxi plan.

Valuation

Valuation wise stock trades at around 160x trailing earnings and 135x NTM earnings which doesn’t adjust for any potential loss of credits. This is very expensive for a company likely to report 3rd year in a row of rev decline and a quarter or more with negative Operating Margins.

How am I trading it or when will I get involved based on my experience of the stock?