Nvidia Earnings Update: A quick look

Today, NVDA released its financial report for Q3 2025. The quarter was stellar, to say the least, and I am most impressed with the results.

If it is your first time here, read the below post on how to navigate the SixSigmaCapital Website and subscribe to the option that suits.

To begin, I have included remarks from Jensen Huang regarding whether AI is a bubble and Nvidia’s role in the AI ecosystem:

“There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.

As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI, from pre-training and post-training to inference. And with our two-decade investment in CUDA acceleration libraries, we are also exceptional at science and engineering simulations, computer graphics, structured data processing to classical machine learning.

The world is undergoing three massive platform shifts at once, the first time since the dawn of Moore’s Law. Nvidia is uniquely addressing each of the three transformations.

The first transition is from CPU general-purpose computing to GPU-accelerated computing. As Moore’s Law slows, the world has a massive investment in non-AI software, from data processing to science and engineering simulations, representing hundreds of billions of dollars in compute and cloud computing spend each year. Many of these applications, which ran once exclusively on CPUs, are now rapidly shifting to CUDA GPUs. Accelerated computing has reached a tipping point.

Secondly, AI has also reached a tipping point and is transforming existing applications while enabling entirely new ones. For existing applications, generative AI is replacing classical machine learning in search ranking, recommender systems, ad targeting, click-through prediction, and content moderation, the very foundations of hyperscale infrastructure.

Meta’s GM of foundation models for ad recommendations, trained on large-scale GPU clusters, exemplifies this shift. In Q2, Meta reported over a 5% increase in ad conversions on Instagram and a 3% gain on Facebook Feed, driven by generative-AI-based GM. Transitioning to generative AI represents substantial revenue gains for hyperscalers.

Now a new wave is rising: AI systems capable of reasoning, planning, and using tools, from coding assistants like Cursor and Cloud Code to radiology tools like iDoc, legal assistants like Harvey, and AI chauffeurs like Tesla FSD and Waymo. These systems mark the next frontier of computing.

The fastest-growing companies in the world today — OpenAI, Anthropic, xAI, Google, Cursor, LLM-focused startups like Lovable, Replit, Cognition AI, OpenEvidence, Abridge, Tesla — are pioneering agentic AI.

So there are three massive platform shifts. The transition to accelerated computing is foundational and necessary, essential in a post-Moore’s Law era. The transition to generative AI is transformational and necessary, supercharging existing applications and business models. And the transition to agentic and physical AI will be revolutionary, giving rise to new applications, companies, products, and services.

As you consider infrastructure investments, consider these three fundamental dynamics. Each will contribute to infrastructure growth in the coming years.

Nvidia is chosen because our singular architecture enables all three transitions and does so for any form and modality of AI, across all industries, across every phase of AI, across all of the diverse computing needs in the cloud, and also from cloud to enterprise to robots. One architecture” Jensen Huang, CEO

Key Financial Highlights

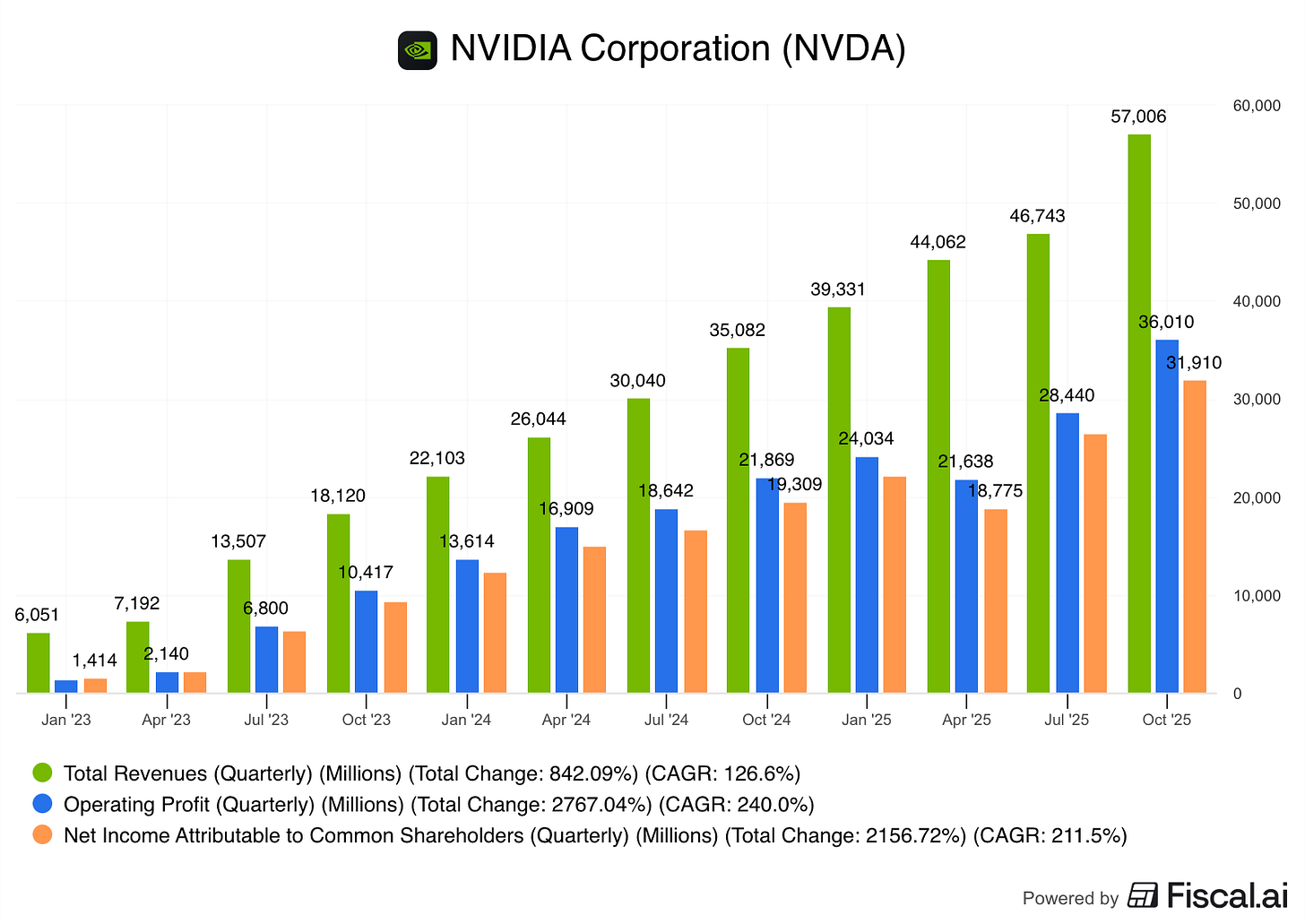

Total revenue: $57 billion, a 62% year-over-year increase and a 22% sequential growth.

Data Center revenue: $51 billion, growing 66% year-over-year, with compute up 56% and networking more than doubling.

Gaming revenue: increased 30% year-over-year to $4.3 billion.

Professional Visualisation revenue: grew 56% year-over-year to $760 million.

Automotive revenue: rose 32% year-over-year to $592 million.

Non-GAAP gross margins: 73.6% which exceeded outlook.

Inventory increased 32% quarter-over-quarter, and supply commitments rose 63% sequentially, preparing for future growth.

Key Takeaways

$500 billion in Blackwell and Rubin projected through 2026:

The company’s annual product cadence, exemplified by Rubin’s anticipated X-factor performance leap over Blackwell in the second half of 2026, is critical to maintaining its leadership in an estimated $3-$4 trillion annual AI infrastructure market by the end of the decade.

This growth is fuelled by hyperscalers’ increasing CapEx which is now projected at roughly $600B for 2026, and the exponential scaling of foundation model builders like Anthropic, which now has annualised revenue rate of $7 billion.

Significant new developments:

Proliferation of agentic AI across industries, driving demand for NVIDIA’s stack in enterprise software and robotics, and major AI factory projects totalling 5 million GPUs, including xAI’s gigawatt-scale Colossus 2 and a 150,000-accelerator deployment with AWS and Humane.

Challenges in China:

H20 sales at only $50 million due to geopolitical issues and competition.

NVIDIA’s networking business:

It is the largest in the world, growing 162% year-over-year, with NVLink expanding through strategic collaborations with Fujitsu, Intel, and Arm, solidifying its unique position as an end-to-end AI infrastructure provider.

Performance Leadership:

Evident in Blackwell Ultra delivering 5x faster training than Hopper and achieving 10x higher performance per watt and 10x lower cost per token on Mixture of Experts models compared to H200.

Strategic Investing:

NVIDIA is strategically investing in key AI companies like OpenAI and Anthropic, securing deep technical partnerships and compute commitments (e.g., Anthropic’s initial 1 gigawatt commitment with Grace Blackwell and Vera Rubin systems) to expand the CUDA ecosystem and ensure optimal model performance across its platforms. These investments, coupled with efforts to build supply chain resiliency reinforce NVIDIA’s comprehensive strategy to capitalise on the accelerating AI revolution.

Guidance

For the fourth quarter, NVIDIA projects total revenue of $65 billion, plus or minus 2%, implying a 14% sequential growth at the midpoint, driven by continued momentum in the Blackwell architecture.

This guidance explicitly excludes any data centre compute revenue from China.

Gross margins:

Non-GAAP gross margins projected at 75%, plus or minus 50 basis points.

For FY 27, NVDA aims to maintain gross margins in the mid-70s, despite anticipated increases in input costs, through ongoing cost improvements, cycle time optimisations, and mix management.

Operating expenses for Q4 are estimated at approximately $5 billion on a non-GAAP basis, reflecting continued investment in innovation across engineering and business teams.

Current position and final thoughts:

I remain in awe of the numbers NVDA puts up each quarter. Even at this market cap, it offers exceptional growth relative to its valuation. I do not have a position, but it goes without saying that NVDA remains the most important company in the world. The AI train rolls on.

As always, amazing article. What a beast of a company