Preview of the Week Ahead

W/C October 13, 2025

Hope you all are having a good weekend. Below we will be previewing the upcoming week and providing a Portfolio Update as usual.

Format for what is covered in this weekly preview:

A look at the indices

Key upcoming economic events

Upcoming earnings reports

Charts

Notable portfolio changes from the previous week

Current Portfolio Holdings (Position size, cost basis, and commentary on each holding regarding the intended holding period and any planned activity)

If it is your first time here, check out the post below on how to navigate the SixSigmaCapital Website and subscribe to the option that suits.

Indices

Dow Jones declined 2.86% in the last week

S&P 500 declined 2.71% in the last week

Nasdaq Composite declined 2.95% in the last week

IWM declined 4.02% in the last week

Key upcoming events:

Monday, October 13

U.S. Market Holiday (Columbus Day/Indigenous Peoples’ Day):

U.S. Stock Markets are open with regular trading hours

U.S. Bond Market (Treasuries) will be closed.

Tuesday, October 14

NFIB Business Optimism Index

Speeches from Federal Reserve Officials: Notably, Chairman Powell is scheduled to speak at the National Association for Business Economics annual meeting.

IMF/World Economic Outlook Release

Wednesday, October 15

Consumer Price Index (CPI) (September)

NY Empire State Manufacturing Index (8:30 AM ET)

Federal Reserve Beige Book (2:00 PM ET)

Thursday, October 16

Producer Price Index (PPI) (September) (8:30 AM ET)

Retail Sales (September) (8:30 AM ET)

Initial Jobless Claims (Weekly)

Philadelphia Fed Manufacturing Index (8:30 AM ET)

Friday, October 17

Housing Starts & Building Permits (September) (8:30 AM ET)

Industrial Production & Capacity Utilisation (September) (9:15 AM ET)

This week has key inflation reports and also marks the start of the U.S. Corporate Earnings Season (Q3), with major financial institutions reporting.

Upcoming Earnings

Last week was a quiet week with no portfolio positions reporting. Likewise, there are no portfolio positions reporting this week but Q3 Earnings season kicks off in earnest with JPM, GS, Citi and WFC on Tuesday.

Charts

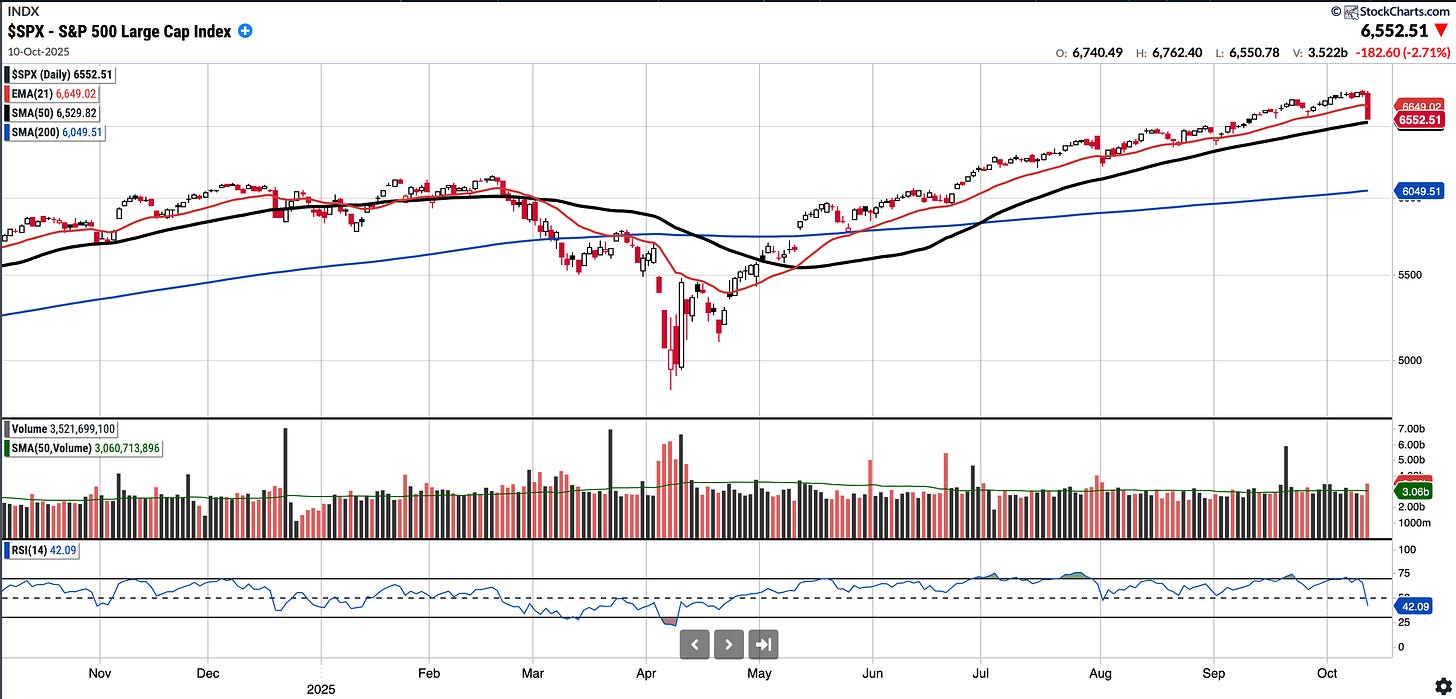

SPX

Sits currently at 6552.51, RSI 42.09, 0.35% above a rising 50SMA.

11.65% YTD

We had yet another week in which the S&P 500 made a new ATH (6762.40) although a sharp reversal to end the week.

Distribution days in the last week: 1

COMPQ

Sits currently at 22204.43 RSI 45.29, 1.17% above a rising 50SMA.

15.16% YTD

Distribution days in the last week: 3 (although 4 in the last 6 sessions(!)

BTC (currently Long)

Currently $110,037, 3.77% below the 50SMA and 3.13% above 200SMA.

16.57% YTD.

BTC had made an ATH last weekend and then had been robust until the deleveraging on Friday at which point we saw BTC drop from 123k to below 106k in hours. Has rebounded a little but now sits below the 112k level of interest.

BABA (currently Long at $72 average)

Currently trades at $159.01 RSI 44.56 and 30.47% above 200SMA.

+90.34% YTD

I had stated last week that “BABA has traded up for 9 weeks now and is amidst a stage 2 breakout. For the last several weeks I have been stating that my BABA target was 175-180… We have clearly surpassed those levels, and given that the RSI is over 82 on the weekly chart, some consolidation or backfill may be due before a possible move to 220”

The backfill/pullback came on Friday after the Trump tweet which led BABA to correct almost 8.5% on the day. The mid 140’s would be a logical area on continued weakness for a re-test of the breakout level and the SMA 50. Watching.

IREN (No position)

Currently trades at $59.77 RSI 72.71 and 278.92% (!) above 200SMA

471.41% YTD

IREN is a company that has pivoted from Bitcoin mining to hosting AI infrastructure recently. It has a market cap of ~14B now and is expected to do ~1.2B revenue (which has been revised up from ~700M at the start of the year). This is a company I mentioned last week that am looking at but felt too difficult to buy it 246% above above the SMA 200. Well this week after a pullback it now sits at 278% above the 200SMA!! I would like to see it consolidate over time or ideally by price. I am in other AI/HPC companies instead at present.

PATH (No position)

Currently trades at $17.05 RSI 72.71 and 38.09% above 200SMA

31.86% YTD

PATH bulls would say is a leader in the Robotic Process Automation (RPA) industry. It provides an AI-powered end-to-end automation platform that enables organizations to create, deploy, and manage software robots to automate repetitive and complex business tasks.

Has an interesting chart, having filled the gap created from last June and broke above the 16 resistance on volume. Of course, it did pullback on Friday. Could be one to watch in coming days to weeks especially on pull backs.

Now we will take a look at notable portfolio changes from the previous week and then Current Portfolio Holdings (Position size, cost basis, and commentary on each holding regarding the intended holding period and any planned activity)

Notable portfolio changes in previous week (all updated live in subscriber channels):

Exited DUOL for +23% returns in <1M

Exited BTBT for +20% returns

Exited CIFR for 50% returns in 7 sessions

Initiated 3 positions in Biotech/Life sciences: