Preview of Week Ahead

W/C July 14 , 2025

Hope you all had a good weekend. Below we will be previewing the upcoming Week.

Format will be: A look at the Indices, key upcoming events, upcoming earnings reports, interesting charts/set-ups and finally any notable portfolio changes in the week just gone.

Indices

Dow Jones declined 0.82% in the last week

S&P 500 advanced 0.01% in the last week

Nasdaq Composite advanced 0.38% in the last week

IWM advanced 0.16% in the last week

Distribution Days on SPX: nil in the last week. However, we did gap up and sell off on several of the days. Some leaders are also rolling over. Notable.

Key upcoming events:

Tuesday

Consumer Price Index (CPI)

NY Empire State Manufacturing Index

Major Financial Institutions JPM, WFC, Citi reporting in the AM.

Wednesday

Producer Price Index (PPI)

Retail Sales report

Thursday

Initial Jobless Claims

Philadelphia Fed Manufacturing Index

Friday

University of Michigan Consumer Sentiment survey

Also, July 14-July 18 is “Crypto Week” where the House is expected to consider and potentially vote on landmark legislation (CLARITY act, GENIUS act, Anti-CBDC Surveillance State Act) with the aim to establish a clearer regulatory framework for digital assets in the USA.

Upcoming Earnings

Earnings season kicks off in earnest. Below is infographic by Earnings Whispers for the upcoming week. Notable ones for me are:

Tuesday: JPM, Citi, WFC

Wednesday: ASML, Bank of America, Goldman, MS, UAL

Thursday: TSMC, NFLX, IBKR,

Friday: MMM, AXP

Charts

SPX

Sits currently at 6259.75, RSI 68.09. 4.97% above 50SMA.

Traded flat for the week, advancing 0.01%.

BTC (currently Long)

Currently $119,092.36. 10.8% above 50SMA

26.14% YTD.

All Key MA’s up-trending and the chart had shown steady accumulation since April, during which time it did show RS also. So, it is no surprise we broke above prev ATH of 111,980 (as stated last weekend). A multi-week breakout would be a huge boon for crypto equities.

COIN (Currently Long)

Last week I posted that chart is in a huge cup and handle and 400-420 in play. COIN had a robust week finishing +9% and an ATH weekly close. We did in fact get 400 in early hours trading on Friday. Re-test of $345 breakout could be in play again this week.

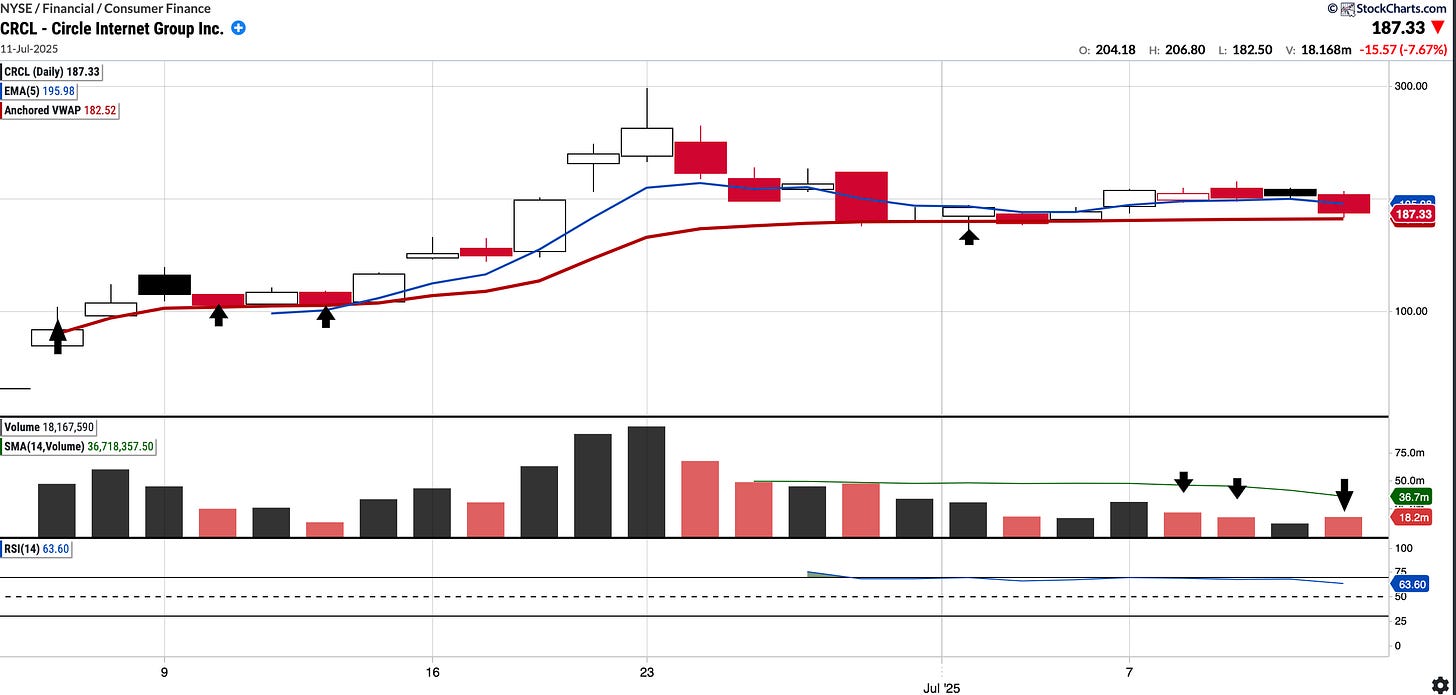

CRCL (Currently Long )

A new IPO, a key player in the digital asset and cryptocurrency infrastructure space, providing services enabling businesses to accept and send digital currency payments globally.

CRCL (plus other momentum names) sold off sharply on Friday albeit on low volume (see arrows). I am in with round 2 at average of 174, It will be interesting to see if can hold the AVWAP this week. If not may be time to cut.

OSCR (currently Long)

A retail favourite name with an interesting chart. Traded it the first time for a 50% gain in 3 sessions booking half. Now it has returned to the scene of the crime, to the potential demand zone of 13.8-14.2. Below that there is also the gap to fill from 7th of May gap at 13.33.

Notable Portfolio changes in the last week: