Robinhood Q2 2025 Earnings

Below we will briefly review Robinhood’s Q2 2025 Earnings. However, before we do that you may recall I recently wrote about why Robinhood can be a good short at the right time. If not already read, I highly recommend reading.

TLDR for why I think Robinhood can be a short at the right time:

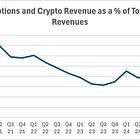

Transaction revenues are increasingly reliant (>50%) on Options speculation and Crypto revenues. They are highly cyclical and of a low quality.

Net Interest is a high margin source of revenue which has become a bigger proportion of Total Revenues and a contributor to the Bottom Line. It is at threat for 2 main reasons:

With significant rate cuts almost guaranteed when Chairman Powell steps down, logically Net interest will come under threat.

Furthermore at present, interest earned on segregated cash, securities and deposits (i.e customers cash) is larger than the Interest on corporate cash and investments. In a Bear Market, customers hold less cash on the platform if past trends play out.

We could be entering peak cycle in coming quarters and HOOD has a >27x sales multiple. For a cyclical company this is a red flag.

Cascade of the above factors: cyclicality, lower rates, less cash on the platform plus a Market correction/Bear Market would be deadly for the stock.

With that in mind lets take a look at Q2 2025 earnings next.

Robinhood reported a strong Q2 25:

Revenues: $989M, +45% YoY

Adjusted EBITDA: $549M, +86% YOY

$EPS: $0.42 , +100% YoY

Total AUC: $279B, +99% YoY

Net Deposits of +$13B, up 76% YoY

3.5M Gold Subscribers, +90% YoY

Bought back 3M shares at $41

$151 ARPU, +34% YoY

Very impressive earnings. However, a few interesting things I wanted to point out are:

Transaction Revenues fell QOQ for the second consecutive quarter driven mainly by lower crypto Revenues QOQ also for the second consecutive quarter. We also saw this in the 2021 Bull Market where Crypto volume drop off was a leading indicator.

Net Interest Revenue accounted for 36% of Total Revenues (!)

Interest on Corporate Cash has decreased for 6 of the last 7 quarters. It was $75M in Q3 23 and is now $46M in Q2 ‘25.

Interest on segregated cash, securities, and deposits on the other hand has grown YOY and QOQ.

Margin Interest has increased for each of the last 6 quarters.

In other words the Net interest revenue increase is primarily due to the interest earned on Customers Cash or from Margin Interest paid by customers. In a Bear Market/Correction we know that retail investors keep less cash on platform and also drop their margin levels so logically we expect those to drop. Furthermore, Rates are likely to come down which will hurt Net Interest revenues also.

Whilst HOOD has been delivering impressive results it is not a surprise to see HOOD red after the most recent quarter. The market likely will start to notice the same things I have been pointing out today and previously.

I trimmed some HOOD pre-earnings at 105.77 (from average of 33) and have 60% of original shares remaining.

However, at some point I do believe it will be a good short given the points I laid out in my write-up and above.

Thank you for reading, ensure to subscribe to the plan that suits (free or premium) and see you for the next one!