Actionable Stock Set-up 6: Tecogen (TGEN)

We will be taking a look at the Investment Case for Tecogen (TGEN) in this write-up. It is tentatively the 6th entrant into the Actionable Set-ups series, this time for the Longer term.

Layout:

Brief look at Data Centre Thermal Management

Overview of Tecogen

Management

Fundamentals and Valuation

Chart and Technicals

My current position and plans

Data Centre Thermal Management

As the backbone of the digital world, Data centres are packed with high-performance computing equipment that generate a huge amount of heat; the immense heat generated by the electrical components must be removed to prevent failure. Keeping these facilities cool is thus critical. Several specialised companies have emerged as leaders in the field of data centre thermal management. These key players can be broadly categorised into several areas, from traditional air-based cooling and innovative liquid cooling to airflow management and the software that oversees it all.

This table below neatly groups them into their respective Category:

Vertiv and Schneider Electric are often cited as top-tier providers in the data centre cooling space. They both offer extensive portfolios that cover the entire thermal management landscape.

Below we will be looking specifically at Tecogen (TGEN); a small newcomer in this space who has recently entered into a strategic partnership with Vertiv.

Tecogen (TGEN)

TGEN essentially designs, manufactures, and services high-efficiency, natural gas-powered combined heat and power (CHP) systems, as well as chillers and heat pumps. These products are at the forefront of the growing trend towards decentralised energy production (energy generation that occurs closer to where it's consumed, rather than at large, centralised power plants) . This offers commercial, industrial, and residential clients a way to reduce energy costs, ensure power reliability, and lower their carbon footprint.

The investment case for TGEN centres on its innovative and efficient clean energy solutions.

Tecogen's core business revolves around its proprietary technology that utilises natural gas engines to produce both electricity and useful thermal energy (hot water or steam) from a single fuel source. This process, known as cogeneration or Combined Heat and Power (CHP) is significantly more energy-efficient than traditional methods of generating electricity from a central power plant and producing heat with a separate boiler.

The company operates through three main segments:

Services: Ongoing maintenance and service contracts for its installed base of equipment, providing a recurring revenue stream. Accounts for ~70% of Revs.

Products: The design, manufacturing, and sale of its CHP systems (InVerde e+ and TecoPower), chillers (Tecochill), and heat pumps. These are sold to a diverse range of clients such as: hospitals, schools, hotels and industrial facilities. Accounts for ~20% of Revs.

Energy Production: In some cases, Tecogen installs and operates its own equipment at a customer's site and sells the energy produced back to the customer through a long-term agreement. Accounts for ~10% of Revs.

A very significant recent development is a strategic collaboration with Vertiv (VRT). Vertiv is a global leader in critical digital infrastructure. This partnership will see Vertiv offer Tecogen's natural gas-powered chillers to data centres, a sector with rapidly growing energy demands and a pressing need for efficient, reliable cooling solutions.

The Bull Case for TGEN

Favourable Macro Trends: The increasing focus on energy efficiency, grid resilience, and reducing greenhouse gas emissions provides a strong tailwind for Tecogen's products. The growing demand for decentralised energy solutions and the expansion of the CHP market are central to the bull thesis.

Superior Efficiency and Cost Savings: Tecogen's CHP systems can achieve total energy efficiencies of over 80%, compared to the roughly 35-50% efficiency of traditional electricity generation. This could mean substantial cost savings for customers, making a compelling economic argument for adoption. See image below:

Strategic Partnership with Vertiv: The collaboration with Vertiv is not only a validation of TGENs technology but it provides them with access to a vast customer base and established sales channels within the data centre industry. As AI and other high-performance computing applications drive up energy consumption in data centres, Tecogen's efficient cooling solutions offer a compelling value proposition. Further data centre deals would be huge catalysts and help get to the $30M revenue mark which Management have stated is an estimated EBITDA breakeven point.

Recurring Revenue from Services: The company's service contracts provide a predictable revenue stream, which can help to smooth out the lumpiness of product sales.

Technological Expertise: TGEN has a long history in the industry. They have developed a strong portfolio of intellectual property and engineering expertise in natural gas engine technology and clean energy applications.

Limited to Zero Impact from Tariffs: Management have said as they have a predominantly domestic supply chain, tariff impact will be negligible. Plus in the case of Inverde they have inventory to last until ‘26.

Recent Up list to NYSE American: Has increased liquidity and visibility for the company. Also TGEN have stated this will give them the ability to hire and retain talent critical to growth.

Bear Case for TGEN

Some risks and challenges facing the company:

History of Financial Losses: Tecogen has a track record of net losses and is yet to reach profitability. They were at ~$4M Cash recently although they just did an offering to raise $17M (which should shore up cash to fund operations and growth activities in the nearer term)

Dependence on Natural Gas: The company's technology is reliant on natural gas as a fuel source. While currently abundant and relatively inexpensive in many regions, price fluctuations and long-term environmental concerns about methane emissions could impact the company's value proposition.

Competition: The market for decentralised energy and CHP systems is becoming increasingly competitive with larger, more established players. Likewise in the Data Centre Cooling Market there are players with extensive portfolios that cover the entire thermal management landscape. such as Vertiv, Schneider Electric and Eaton.

Sales Cycle and Project-Based Revenue: Sales of large capital equipment can have long and unpredictable cycles leading to lumpy revenue.

In conclusion:

Investing in TGEN is a bet on the continued growth of the decentralised energy market and the company's ability to capitalise on this trend with its innovative technology.

The core value proposition is Tecogen's ability to provide cooling via natural gas-powered chillers, thereby freeing up valuable electrical capacity that data centres can use for computing – which is their primary revenue source.

The partnership with Vertiv is a significant step in the right direction and any data centre deals would serve as upward catalysts for the stock. They remain currently unprofitable although are Free Cash Flow positive for the last 2 years. The recent offering has shored up cash for ongoing operations.

Management:

CEO

Dr Abinand Rangesh is the CEO. Prior to his appointment as CEO he was the CFO of the company since 2021. He has been with the Company since 2016 and has held roles in various divisions including sales, business development and strategy. Prior to joining Tecogen, he was the CTO of Lumisolair, a solar and wind powered off-grid energy company, COO of Peek You a software company and CEO of Lumi Ventures.

COO and President

Robert Panora has served as President of Tecogen since 2000. He has been with the company since 1984 in which time he has held several roles and has been responsible for sales and marketing, engineering, service and manufacturing. He contributed to the development of the CM-60 cogeneration module (TGEN’s first product) and was Program Manager for the cogeneration and chiller projects that followed.

Both have acquired shares recently.

Financials

TTM Performance

Revenue is 23,711.21 (M). FY 24 achieved revenue was 22,619.54 (M)

FCF is 1,642.70. Achieved FCF in FY 24 was 3,091.38 (M)

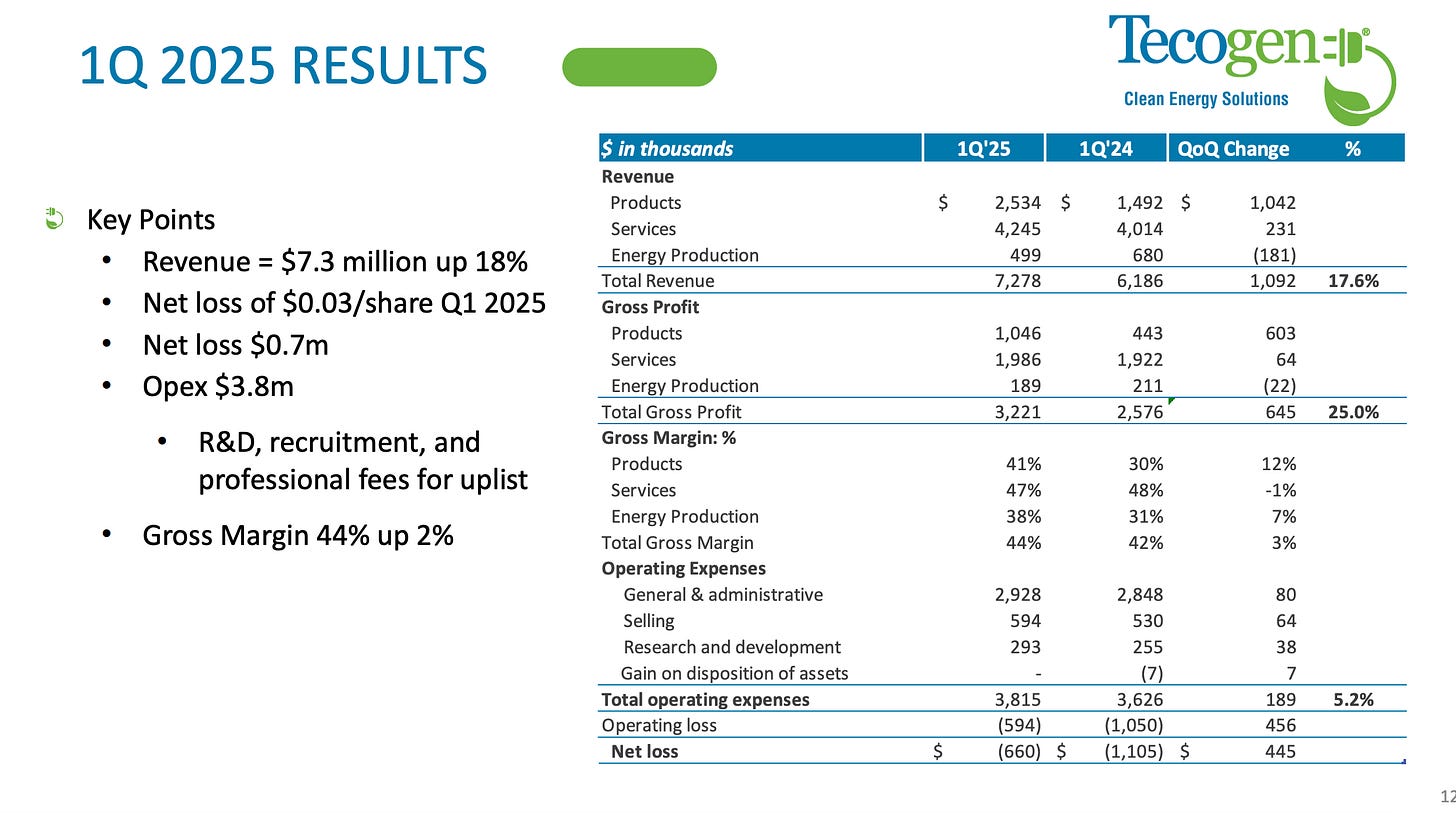

Q125 Highlights:

Revenue $7.3 million up 18%

Gross Margin 44% up 2%

Net loss $0.7m

TGEN has a MarketCap of 195M. They had $4M in Cash now 21M after the Offering. Debt of 3.95M but no near term debt obligations.

Pre-offering there were 25.57M shares outstanding and the offering will raise $17M at $5/share. This will increase the company's total shares outstanding from 25.57 million to 28.97 million.

This dilution is notable but a positive twist would be that cash per share has gone from ~$0.16/share pre-offering to ~$0.72/share post the offering.

TGEN trades at 7.6x EV/S and ~110x FCF(!). TGEN is pricey but the bet is any data centre deal will cause a huge inflection in Revenue. Management have cited Interest from larger projects recently.

Chart

TGEN is trading at $7.10, RSI is 51.59. It is ~19% above SMA 50 and ~150%(!) above 200SMA. Clearly very extended vs 200SMA.

Recently sold off on big volume for 3 days but subsequently found support at horizontal support and rising SMA 50. On Friday it rose >35% and put in a Highest Volume Ever (HVE) candle . This is a positive expectation setter often.

Today was down 8% in cash session. Some backfill to key MA’s is not out of the question.

My current position and plans

I went long on Thursday 17th and Friday 18th AM between $5.7 and $5.8. Did not expect the stock to rise ~40% in the day so sold 40% of shares at $7.82 to book some of the gains (“Bird in the hand is worth two in the Bush”).

With the offering priced at $5 I think we could get some backfill closer to the mid $5 levels where it would be a better set-up than right now.

As TGEN is a high uncertainty bet, my position sizing will reflect that. I will probably keep it a ~2% position when full.

Thank you for reading, ensure to subscribe to the plan that suits and see you for the next one!

Thanks, it was an executive review.

Great write up as always. The position size and potential entry point highlights are really helpful