Tesla Q2 2025

Bull and Bear Perspective.

Below we will take a very quick look at Tesla Q2 2025 Earnings

Headline numbers:

EPS $0.40, $0.40 Est

Revenue $22.5B, $22.4B Est

Revenue declined 12% YOY and the reasons given were:

Decline in Vehicle Deliveries (384,122 vs 443,956)

Lower Regulatory credits

Reduced vehicle average selling price (ASP)

Decline in Energy Generation and Storage due to lower ASP (2789M vs 3014M)

Profitability

Operating income decreased 42% YoY to $0.9B, resulting in a 4.1% operating margin. Note operating Margins were in the high teens in 2022.

Positives/Glass half full perspective:

Revenues, Gross Profits and EPS improved QOQ.

Operating Cash Flow increased QOQ

Energy Generation Storage and Revenue Gross Profits and Margins Increased YOY and QOQ (see image below)

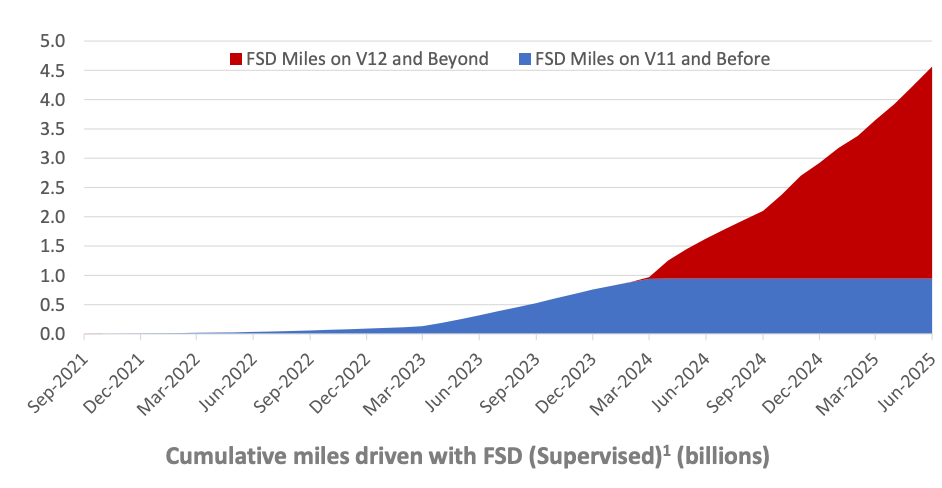

Cumulative miles driven with FSD is showing impressive growth.

Tesla Ecosystem Infographic below shows how huge the potential opportunity for Tesla is

Negatives/Glass half empty perspective:

Whilst this Q was weak the Bears would rightly point out that the Core Business has been deteriorating for the last few years with Tesla likely to report 3 consecutive years of declining revenue also.

Tesla Revenues, Gross Margins and Operating Margins all faltering

Tesla GAAP EPS trend for the last 19 Q

Demand for vehicles is down. The overall trend in last few quarters is lower deliveries and higher Inventory Days. Furthermore, Tesla is on a Run-rate to deliver ~1.44M cars this year vs 1.79M last year

Tesla has benefited greatly from EV federal tax credits especially from a profitability perspective, and these are going away by September 2025.

Thank you for reading, ensure to subscribe to the plan that suits (free or premium) and see you for the next one!