The Great SaaS Sorting (Guest Post)

When it’s all said and done... what software companies aren’t zeroes?

In the post below, @undrvalue takes a sober look at the SaaS space and articulates his latest views. I hope you enjoy the read; if you do, be sure to give Undrvalue a follow.

As a reminder, none of this is financial advice from me or the author. Please do your own research.

When it’s all said and done... what software companies aren’t zeroes?

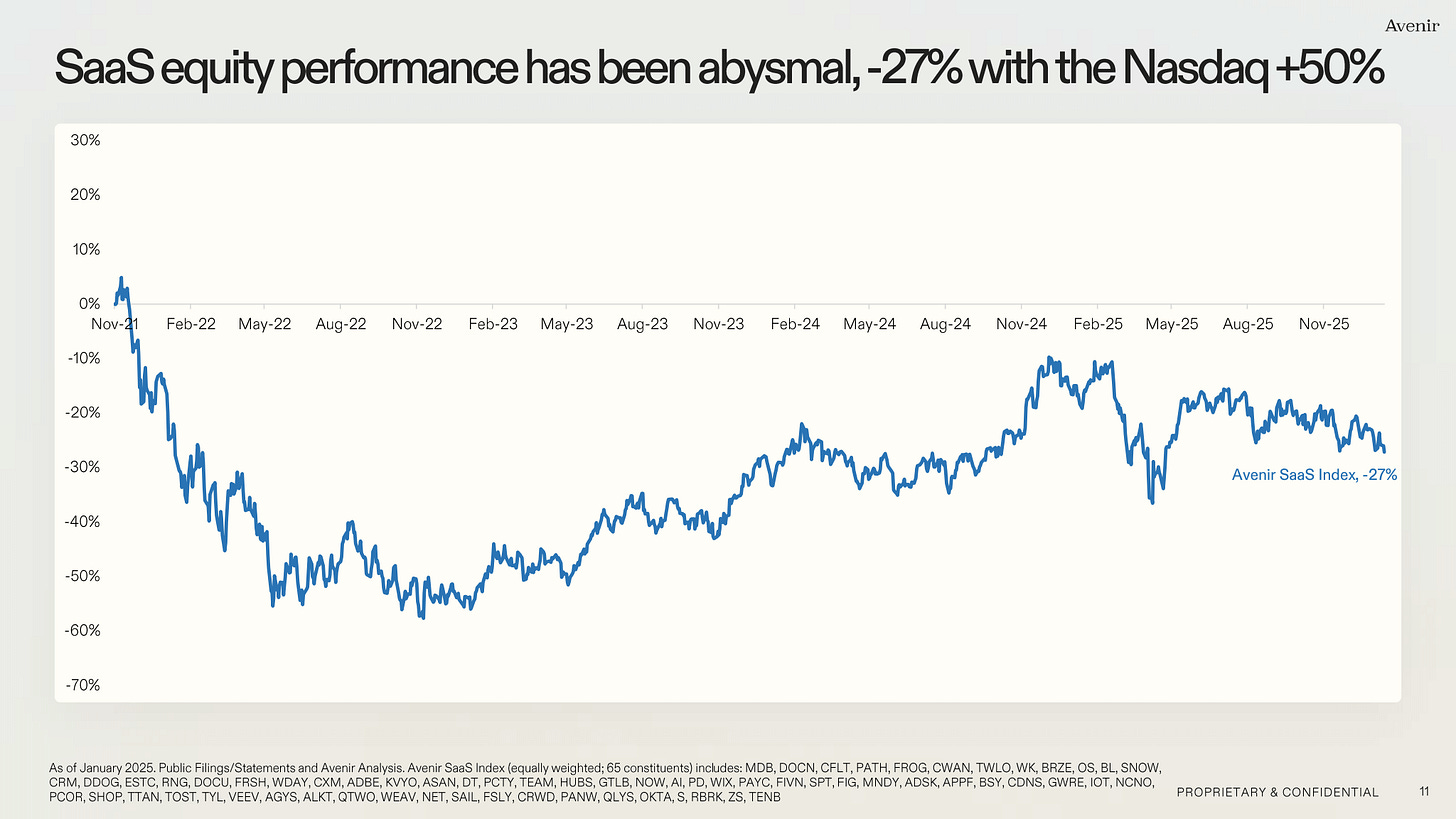

Software is down 20% from October. IGV has dropped 16% in January alone. ServiceNow, Salesforce, HubSpot, Atlassian - all hitting 52-week lows.

My instinct is to buy. That’s what’s worked for the last five years. Every dip, every panic, every “this time is different” - rewarded within months.

I’m not sure the playbook holds this time, at least not everywhere.

Here’s what’s changed since 2020.

Retail’s Reflexive Dip-Buying

Retail investors now account for a third of daily market volume, up from roughly 10% a decade ago [1]. In the first half of 2025, they added $1.55 trillion to US markets. When tariffs hit in April, retail bought $4.7 billion in a single day - the highest on record - and $30 billion that week [2].

The conditioning runs deep. The 2020 bear market lasted 33 days. Full recovery in four months. Every subsequent selloff followed the same script: panic, retail buys, passive flows stabilize, V-shaped recovery.

This pattern has trained a generation of investors to treat drawdowns as discounts.

The structural forces underneath are worth understanding.

Passive investing creates what academics call “inelastic demand” - price changes have less impact on trading volume because index funds buy and sell mechanically [3]. Cap-weighted indices add after strong performance, remove after weakness. Retail buying provides a floor. The combination creates powerful mean-reversion... until it doesn’t.

JPMorgan found 2025 dip-buying was 50% higher than the prior year, and 14% above the 2021 meme-stock peak [2]. The reflexes are stronger than ever.

But here’s the thing. The pattern assumes drawdowns are cyclical. What happens when the threat is structural?

A Deep-Seated Pricing Issue

The software selloff isn’t sentiment. It’s business model erosion.

Generative AI doesn’t just compete with SaaS products - it threatens the unit of value they monetize. Seat-based licensing assumes humans doing work. AI agents doing work breaks that assumption.

The math is uncomfortable. Even if you raise prices 25%, if your customers need 40% fewer seats because AI makes workers more productive, you lose a quarter of your revenue [4]. The better AI gets, the worse this equation becomes.

This isn’t theoretical. Publicis Sapient is actively cutting SaaS licenses by 50% - including Adobe - and replacing them with AI tools [5]. Klarna ended its relationships with Salesforce and Workday entirely, driven by internal AI initiatives [6]. These are real companies making real decisions.

IDC predicts pure seat-based pricing will be obsolete by 2028, with 70% of vendors refactoring around consumption, outcomes, or organizational capability [7].

The innovator’s dilemma is acute.

Salesforce knows the threat. They launched Agentforce - free to existing customers, $2 per conversation. Intercom bolted on AI as an optional add-on. Slack, GitHub, Notion - same playbook. Charge for seats, tack on AI usage.

But this is a delaying tactic, not a solution. If AI agents become “digital labor,” then the vendor faces a choice: either charge per unit of work, or keep charging per human and hope the seats are still needed [8].

Hoping is not a strategy.

The SaaS Dispersion

What’s interesting is the dispersion within software.

Not all software faces the same threat. The determining factor isn’t brand or even data - it’s whether the core system is deterministic or probabilistic [9].

But there’s a third category the market may be mispricing.

Tier 1: Data infrastructure. Databricks, Snowflake, MongoDB, Datadog. Deterministic systems that become more valuable in an AI world - the essential plumbing that AI needs to accomplish tasks. Clear winners. Already priced like it.

Tier 2: Platforms and systems of record. Salesforce, ServiceNow, Workday. These sit in a contested middle. Yes, they face seat-based pressure. But they also own the data AI agents need to act on - customer records, tickets, employee data. They’re not just workflow tools; they’re execution layers with massive switching costs. This is my favorite from a value perspective.

Consider: if an AI agent needs to update a customer record, it’s writing to Salesforce. If it needs to resolve a ticket, it’s operating within ServiceNow. The platforms don’t disappear - they become the rails. OpenAI runs its entire comms on Slack. That’s not luck.

The risk for Tier 2 is real - Klarna leaving Salesforce shows it can happen. But these are deeply embedded systems of record, not easily ripped out. The market is pricing them like commodity SaaS when they are data infrastructure in disguise.

Tier 3: Horizontal productivity tools. Atlassian, Asana, Notion, Adobe creative tools. Probabilistic systems - workflow software, anything an LLM can replicate. Direct AI competition with weaker switching costs. These face genuine cannibalization.

The valuation gaps reflect partial understanding. Databricks trades at $120B while traditional SaaS hits 52-week lows. Same $5 billion ARR as Snowflake, but 55% growth versus 29% - a 2x valuation gap [10]. Growth is the determinant, but growth tied to AI infrastructure versus growth tied to seat expansion matters.

And worth noting the sorting isn’t totally binary. Some call it “the haves and have-nots” [12]. But within the have-nots, some may be very mispriced.

The Rotation to Atoms

Meanwhile, capital is fleeing SaaS and rotating to atoms. This increases the bleeding.

The Russell 2000 is up 8% year-to-date versus Nasdaq’s 2%. Russell outperformed Nasdaq for 10 consecutive sessions - the longest streak in 30 years [13].

The thesis is straightforward: AI commoditizes bits. Not everyone can build real physical products. The next wave of value creation shifts to atoms.

The numbers support it. $3 trillion in reshoring investments announced since 2025 [14]. Private manufacturing construction spending tripled from $76 billion in 2021 to $230 billion by early 2025 [15]. TSMC alone invested $150 billion in US facilities over three years. Hyperscaler CapEx is running $400 billion - well above the $250 billion expected - and flowing to physical infrastructure.

Policy tailwinds help. The OBBBA act provided $285 billion in stimulus with favorable treatment for capital-intensive firms. R&D expensing benefits domestic manufacturing. Interest deductibility rules favor levered industrials.

The atoms trade has constraints worth noting.

2.1 million manufacturing jobs are forecast to go unfilled by 2030. If reshoring accelerates, that shortfall grows to 3 million [16]. The ISM manufacturing PMI stayed below 50 for much of 2025. Trade uncertainty remains the top concern for manufacturers.

Physical investment has execution risk that bits don’t. You can’t deploy a factory with a git push.

But maybe that’s the point. Scarcity creates value. The difficulty is the moat.

A Few Versions of the Future

So where does this leave us?

Here are three scenarios (among many)

1) The playbook holds. Software bounces broadly, retail buying provides a floor, V-recovery within months. All three tiers rise together as “oversold” names catch a bid. The atoms rotation pauses as growth-seekers return to tech.

2) Structural re-rating. The tiers separate. Tier 1 infrastructure holds or expands multiples. Tier 2 platforms stabilize at lower but defensible valuations as the market recognizes switching costs and data moats. Tier 3 productivity tools continue compressing as AI substitution becomes undeniable. Capital rotates to atoms gradually.

3) The playbook breaks. Even Tier 2 platforms can’t escape the gravitational pull of a true cyclical bear. Passive outflows accelerate as indices rebalance away from the sector entirely. Retail dip-buyers run out of appetite. Prolonged drawdown, worse than 2022.

The tiers will separate. Tier 1 infrastructure continues winning. Tier 2 platforms find a floor as the market distinguishes systems of record from commodity software, and some names like CRM and NOW catch a bid from token monetization. Tier 3 faces ongoing pressure.

My Approach

The framework I’m using:

Within software

Long infrastructure and platforms at the right price (Databricks, Salesforce, Pinterest). Cautious but more optimistic than most on seat-based SaaS facing agentic disruption (GitLab, Docusign).

Across sectors

Atoms have a multi-year tailwind, but it’s crowded narrative now. I still like energy, materials, supply chain bottlenecks.

On timing

Retail is buying this dip. The question is whether the bid holds and we see a V shape or the trade gets overwhelmed by structural selling.

The V-shaped pattern has worked for five years. Maybe it works again. But for the first time since 2020, I’m genuinely uncertain whether the bounce is a buying opportunity or a trap.

Sources:

[1] JPMorgan: A Decade in the Market -

[2] CNBC: Retail Investors’ Best Year Ever -

https://www.cnbc.com/2025/12/31/retail-investors-dip-buying-taco-trade-strong-2025.html

[3] UCI: The Dominance of Passive Investing -

[4] Janus Henderson: AI Disruption Reshaping Software -

[5] The Great SaaS Unbundling -

[6] IDC: Is SaaS Dead? -

[7] IDC: Rethinking the Future of Software -

[8] McKinsey: Evolving Models in AI SaaS Era -

[9] Bain: Will Agentic AI Disrupt SaaS? -

https://www.bain.com/insights/will-agentic-ai-disrupt-saas-technology-report-2025/

[10] SaaStr: Databricks vs Snowflake -

https://www.saastr.com/databricks-vs-snowflake-at-5b-arr-same-revenue-2x-valuation-gap-heres-why/

[11] Menlo Ventures: State of Generative AI -

https://menlovc.com/perspective/2025-the-state-of-generative-ai-in-the-enterprise/

[12] Seeking Alpha: Software Stocks Fall -

[13] The Great Rotation of 2026 -

[14] Deloitte: 2026 Manufacturing Outlook -

[15] Global X: Manufacturing Revival -

[16] Reshoring Initiative: 2024 Annual Report -

https://reshorenow.org/content/pdf/2024-1Q2025_RI_DATA_Report.pdf

That quote/claim is dubious: "Publicis Sapient reports actively reducing traditional SaaS licenses by approximately 50%—including major platforms like Adobe". No sources except the UncoverAlpha substack itself. Publicis Sapient is a huge Adobe's partner and they actually integrate Adobe's AI tools into Publicis' platform. It's very unlikely they would say or do something like that.