Webull

Below we will take a quick look at Webull the company, their recent Quarter, the deal with YorkVille and my plans with regards to taking a position.

What they do:

Webull (BULL) is a commission-free online brokerage that offers retail investors a platform for trading a wide variety of securities. Has gained significant traction among a younger, tech-savvy demographic and provides a suite of tools for trading stocks, exchange-traded funds (ETFs), options, and cryptocurrencies.

At its core, Webull operates on a "zero-commission" model, i.e. it does not charge its users fees for executing trades. The company generates revenue through several alternative streams. A significant portion of its income is derived from "payment for order flow" (PFOF), a practice where Webull is compensated by market makers for directing user trades to them. Additionally, Webull earns interest on uninvested cash in customer accounts, and generates income from margin lending, where it charges interest to users who borrow money to trade. Webull also offers paid subscriptions for advanced market data and analysis tools.

The bull case for Webull hinges on its continued ability to attract and retain a growing user base, both domestically and internationally. Has a user-friendly interface, advanced charting tools that appeal to more active traders, and its expansion into new markets as key growth drivers. The current macro environment is also favourable for platforms like BULL and HOOD whereby retail investors are self-directing their investments.

Conversely, the bear case centres on the sustainability of its revenue model and the intense competition in the online brokerage space. The practice of PFOF has faced regulatory scrutiny in the past and any potential changes to these regulations could significantly impact Webull's profitability. There is stiff competition from established firms like Robinhood, Fidelity, and Charles Schwab, all of whom offer similar zero-commission trading. Webull has only just switched to operating at a profit sustaining this will remain a key concern. Furthermore, reliance on active trading also makes it susceptible to market downturns, which can lead to reduced trading volumes and, consequently, lower revenue. It is a cyclical business.

Webull's valuation is undemanding although has only reported 1 quarter as a publicly traded company as yet.

Q1 2025:

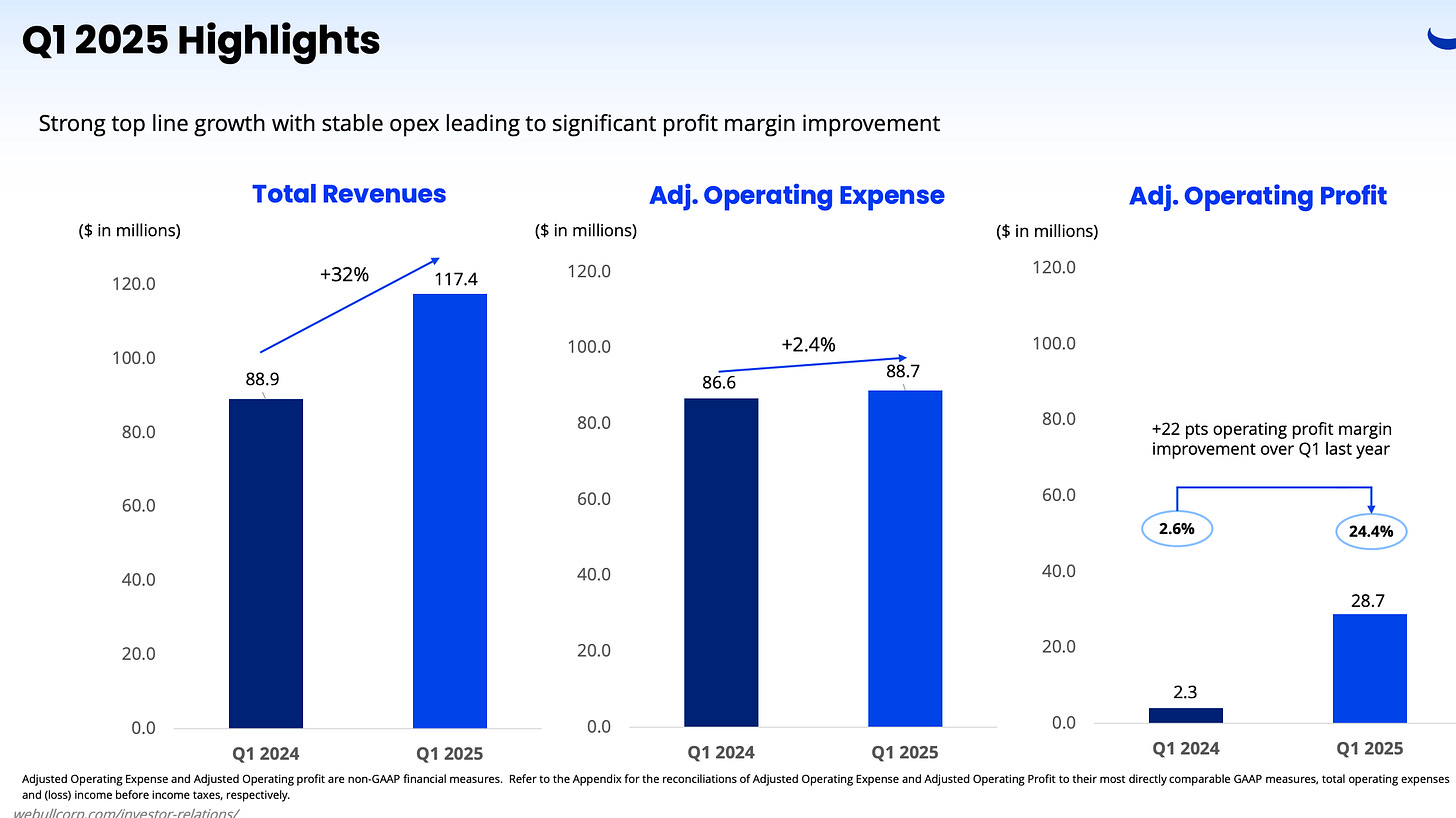

Total revenues grew 32% YOY to $117M, reflecting strong account and trading volume growth Customer assets increased 45% year-over-year, driven by increased customer net deposits Disciplined execution alongside robust revenue growth driving profitability. Evidence of this is the fact total operating expenses decreased 2% YOY meanwhile revenues expanded by 32%.

First Quarter Business and Financial Highlights

• Total revenues increased 32% YOY to $117.4 million. (Trading-related revenue increased 52% YOY)

• Total operating expenses decreased 2.0% YOY to $96.8 million.

• Adjusted operating profit totaled $28.7 million for the quarter, representing an increase of $26.4 million year-over-year and a 22 percentage point improvement in operating margin to 24.4%.

• Net income attributable to the Company increased $25.5 million year-over-year from a loss of $12.6 million to income of $12.9 million.

• Customer assets totaled $12.6 billion, representing 45% year-over-year growth, driven by strong net deposits, which grew 66% year-over-year.

• Registered users increased 17% year-over-year to 24.1 million users (Funded accounts 20% YOY)

• Options contracts volume grew to 121 million, an 8% year-over-year increase.

Webull also have ~$1.2B in cash albeit ~906.7M of that is “Cash and cash equivalents segregated under federal and foreign requirements”. I.e. these are funds that legally have to be kept separate from the firm's own operational cash. Of course, they are still earning Net Interest Income on that money.

Overall, most recent quarter was clearly a strong one. Things to like is BULL is showing impressive growth, demonstrating operating leverage all whilst growing Funded Users at 20% as per recent Q.

Impressive developments in recent Months:

In February, BULL partnered with Kalshi, the first CFTC-regulated exchange with prediction markets, to offer our users the ability to trade binary event contracts on the Webull platform.

In March, they launched Webull Premium which is a subscription-based membership service that unifies the Company’s best-in-class products and offers an elevated investing experience for our users.

In May, partnered with BlackRock to offer model portfolios. Webull Advisors platform now delivers “intelligent, automated wealth management tools “to U.S.-based customers.

Again in May, they announced their collaboration with Visa on the U.S. platform. This allows Webull users to efficiently transfer money between their Webull brokerage account and external bank accounts through Visa Direct.

Bombshell YorkVille Deal

On Friday AH press-release came out which revealed BULL had agreed a $1B standby equity agreement with Yorkville Advisors. (Curiously, all YorkVille deal announcements come out Friday AH)

Stock sold off AH by ~6%. One may think well actually it isn’t so bad because they now get access to significant capital with a Flexible funding structure (no obligation to draw full amount). Furthermore, the Purchase Agreement gives Webull the option, at it’s discretion to issue upto $1.0B in Class A shares to YorkVille over 3 years. In the press release, there seems to be a statement of intent by the CEO to use the capital the Purchase agreement will provide. See below:

The optics of this SEPA are terrible especially just a couple of weeks after de-SPAC and with the stock down in the low teens when it was as high as $70 recently. However, what’s worse in my view is the Firm they have chosen to do this deal with.

YorkVille is a company with a notorious past with accusations of fraud, gross misconduct and of being predatory in nature. They were involved in a multi-year legal battle with the SEC which ended in 2018.

Track record also leaves a lot to be desired. They have previously done similar deals often with distressed companies, many of which went bankrupt in the months after entering the deal. Examples are: VinFast, Canoo, Faraday Motors, Nikola and most recently NMAX in April.

NMAX deal was $1.2B available over 24M duration. The stock chart is not a pretty sight and like BULL they entered a SEPA shortly after going public. Since the deal their stock has fallen from close to $50 to now $15.

Management have to also be questioned as to why they chose YorkVille as a partner and why specifically they chose to raise money in this way i.e. via a Standby Equity Purchase Agreement. Traditional Financing Routes would have been preferred by shareholders I am assuming.

Will I be taking a position?

Whilst nothing has changed in the fundamentals it seems like an unnecessary risk to invest in BULL. Their may be incoming allegations of Fraud and there could viably be a rush for US clients to remove their assets from the Webull platform. If Webull also choose to access capital, shares will be sold on the open market. This cascade of events could be nasty.

If I was long, I would probably be selling at current market price.

Please note, I am not telling anybody else to do so and advise everybody to make the decision that suits them.

Thank you for reading, subscribe if not done so already and see you for the next one.