Harrow Health Inc. Earnings Update: A quick look

Yesterday HROW submitted their Financial report for Q3 2025. The thesis remains firmly on track for me and I was impressed with the quarter.

Ensure to check out my free to read, easy to understand write up on HROW if not familiar with this company:

To start with I have included the CEO’s closing remarks as I feel similarly about the opportunity ahead:

“As we look into the future, I remain confident in where we’re heading. We’ve built a solid foundation. We’ve brought together an outstanding leadership team and defined a clear strategy that touches every part of our business. We have a portfolio of best-in-class products and expanding access for patients and physicians and driving a culture that thrives on focus and execution.

It positions Harrow for sustained growth and long-term value creation. The opportunities that we have ahead of us with TRIESENCE and VEVYE and IHEEZO are tremendous, and we are ready to capture them.” Mark Baum, CEO.

Key Financial Highlights

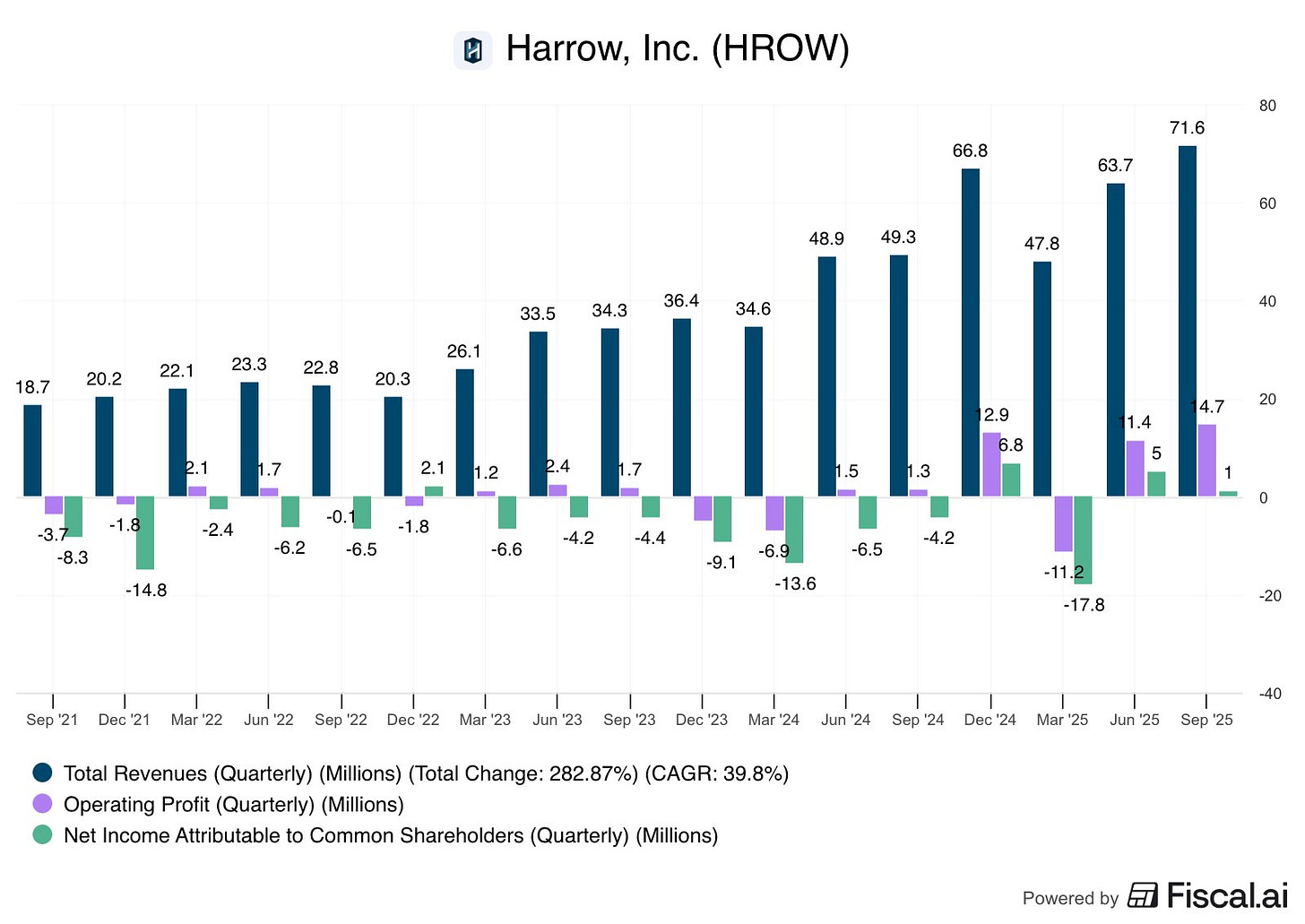

Total Revenue: $71.6 million in Q3 2025, a 45% increase year-over-year and 12% sequential increase.

VEVYE : $22.6 million in Q3 2025, a 22% sequential increase.

IHEEZO: $21.9 million in Q3 2025, a 20% sequential increase.

TRIESENCE & Specialty Branded Portfolio: $6.9 million in Q3 2025, a 33% sequential increase.

ImprimisRx: $20.1 million in Q3 2025.

Year-to-Date Revenue: $183.2 million for the first nine months of 2025.

Adjusted EBITDA: $22.7 million in Q3 2025.

GAAP Net Income: $1 million in Q3 2025.

Key Takeaways

Harrow’s strong third-quarter performance is primarily driven by the accelerating momentum of its key growth products, VEVYE and IHEEZO.

VEVYE :

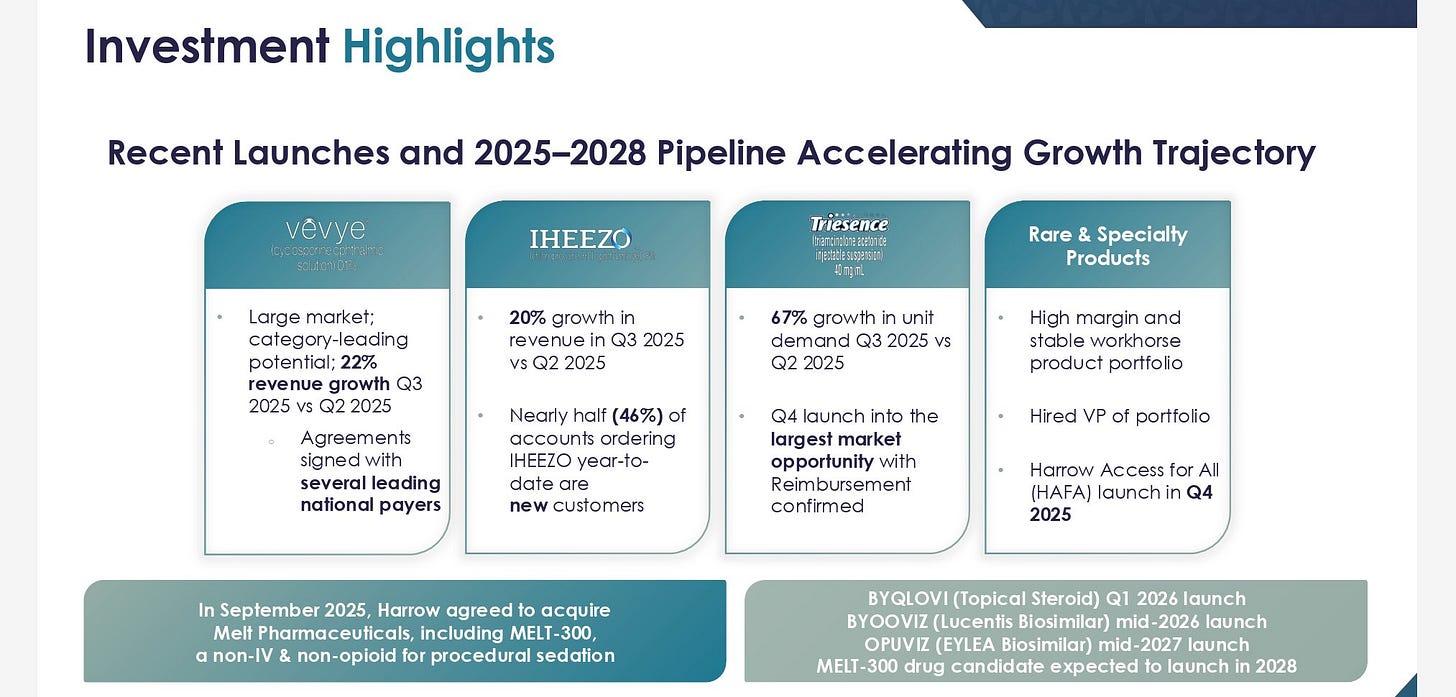

VEVYE has secured agreements with several leading national payers, including the largest U.S. PBM, for preferred product status on multiple new formularies starting January 2026. This is expected to significantly improve coverage for tens of millions of lives, leading to a higher proportion of covered prescriptions, improved pricing stability, and potential prescription transfers from competing dry eye products.

VEVYE’s market share in the dry eye market has doubled in two quarters(!), reaching 10.5% by the end of Q3.

IHEEZO:

IHEEZO delivered strong growth despite seasonal slowdowns, with unit demand up 47% year-over-year. The retina pivot strategy and the “IHEEZO for All” education initiative are successfully driving adoption, with nearly half of new accounts this year being new customers and an 86% reorder rate.

TRIESENCE:

TRIESENCE is gaining traction in retina with four-times growth since its October 2024 relaunch and 67% sequential unit demand growth.

The official launch into the ocular inflammation market, its largest opportunity, is showing encouraging early feedback and is expected to be a significant growth catalyst.

HROW has adjusted TRIESENCE’s pricing to be more competitive in the ocular inflammation market, which is typically 20-25% lower.

Melt Pharmaceuticals Acquisition:

The impending acquisition of Melt Pharmaceuticals and its non-opioid procedural sedation candidate, Melt 300, is central to Harrow’s vision for opioid, IV, and drop-free cataract surgery.

Commercial Infrastructure Expansion:

Harrow plans to invest further in VEVYE’s commercial infrastructure, opening 10 additional sales territories in the near term and aiming for approximately 100 total territories by mid-2026, specifically targeting markets with new VEVYE coverage.

ImprimisRx:

Harrow is actively communicating with the California Board of Pharmacy for a global resolution regarding ImprimisRx’s license renewal, which is due December 1, 2025.

An inventory shortage in October is expected to cause a $4-$6 million decrease in ImprimisRx’s Q4 revenue.

Guidance

Harrow have updated full-year 2025 revenue outlook to a range of $270-$280 million from prior guide of over $280M. They anticipate operating expenses to moderately increase in Q4 2025 and into 2026 due to further investments in commercial infrastructure but they are expected to generate immediate returns on revenue.

A typical seasonal decline from Q4 2025 to Q1 2026 is expected, consistent with prior patterns.

Current position and plans:

I continue to believe that HROW offers exceptional growth for the valuation profile and thus I plan to hold my current position. The investment thesis will be systematically monitored each quarter.