$OSCR summary including Bull and Bear Cases

Oscar Health, Inc. (OSCR) is a healthcare technology company that aims to simplify the health insurance experience through its proprietary full-stack technology platform. The company operates primarily by offering health plans in the individual market, including plans available through the Affordable Care Act (ACA) marketplaces. These plans cover various metal categories like Catastrophic, Bronze, Silver, Gold, and Platinum.

Beyond its direct insurance offerings, Oscar Health also leverages its technology through its "+Oscar Platform," providing services and technology to other players within the healthcare system, including providers and payers. This dual approach emphasises their commitment to using technology to enhance and streamline healthcare operations and delivery.

Below will discuss the bull and bear cases for OSCR:

Bull Cases for OSCR

Technology-Driven Disruption and Efficiency: The primary bull case for Oscar revolves around its innovative, full-stack technology platform. This platform is designed to make healthcare simpler, more intuitive, and ultimately, more affordable. By leveraging AI, data analytics, and a user-friendly mobile app, Oscar aims to:

Improve Member Engagement and Outcomes: Features like telemedicine, dedicated care teams, and personalized health recommendations can lead to better preventive care and more efficient use of healthcare services, potentially lowering long-term costs.

Enhance Operational Efficiency: Oscar's tech stack can streamline administrative processes, claims management, and provider interactions, leading to lower SG&A (Selling, General, and Administrative) expenses. Recent reports indicate they've achieved their lowest SG&A ratio in history.

Data-Driven Underwriting: Their data capabilities could allow for more precise risk assessment and pricing, leading to a healthier member mix and improved profitability.

Growing Market Share in ACA: Despite regulatory uncertainties (discussed in the bear case), Oscar has shown impressive membership growth, particularly in the Affordable Care Act (ACA) marketplaces. As larger, more traditional insurers sometimes exit or scale back their ACA offerings (like Aetna recently), Oscar's tech-forward model and focus on this market could allow it to capture a significant portion of displaced members.

Strong Financial Position and Path to Profitability: Oscar has reported strong revenue growth (over 40% year-over-year in Q1 2025) and has made strides towards profitability, reporting positive net income in Q1 2025. They also boast a strong balance sheet with a substantial cash position, providing flexibility for future growth investments and weathering potential headwinds. Management has affirmed its 2025 outlook for revenue and operational earnings.

Scalable "+Oscar Platform": Beyond its direct insurance business, Oscar's "+Oscar Platform" offers its technology and services to other healthcare players. This represents a potentially significant, high-margin revenue stream that diversifies Oscar's business and allows them to monetize their technology even without directly insuring members.

Experienced Leadership: The appointment of Mark Bertolini, former CEO of Aetna, as Oscar's CEO has instilled confidence among some investors, given his extensive experience in the traditional insurance industry.

Bear Cases for OSCR

Regulatory Uncertainty and ACA Subsidies: The most significant headwind for Oscar is the ongoing regulatory uncertainty surrounding the Affordable Care Act (ACA) and, specifically, the enhanced premium tax credits that are set to expire by December 2025. If these subsidies are not extended or replaced, it could lead to a significant increase in premiums for millions of ACA enrollees, potentially causing a drop in marketplace enrollment and disproportionately impacting Oscar's membership. The proposed shortening of ACA open enrollment periods could also negatively impact new enrollments.

Intense Competition in a Highly Regulated Industry: The health insurance market is notoriously competitive and heavily regulated. Oscar faces competition from much larger, more established players like UnitedHealth Group, Anthem, and Centene, who have deeper pockets, broader networks, and longer-standing relationships. Navigating complex state and federal regulations, licensing requirements, and compliance issues is a constant challenge for any insurer, particularly a relatively young one.

Profitability Challenges and Medical Loss Ratio (MLR) Volatility: While Oscar achieved profitability in Q1 2025, consistently achieving and maintaining profitability in the insurance business is challenging. Medical loss ratios (MLR - the percentage of premiums paid out in claims) can be volatile due to healthcare cost inflation, unexpected utilization, and the risk adjustment process. An increase in MLR can quickly erode profits.

Scaling Technology as a Service: While the "+Oscar Platform" is a bull case, successfully scaling it and securing large, sticky contracts with other healthcare entities can be challenging. Early reports indicated some implementation snags with past clients, suggesting that the "tech as a service" model requires significant execution capability.

Negative Public Perception/Allegations: There have been past allegations (e.g., concerning the misuse of the No Surprises Act to delay payments or underpaying health systems in California) that could impact the company's reputation and lead to regulatory scrutiny or legal challenges. While these are allegations, they add a layer of risk.

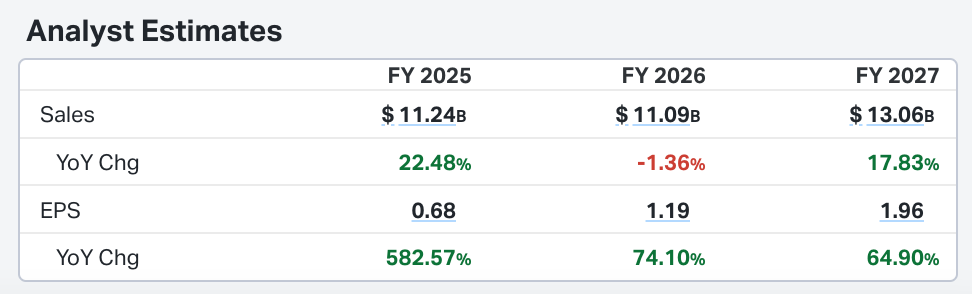

Valuation: Despite recent stock decline, analysts might still view Oscar's valuation as stretched given its relative youth and the inherent risks of the health insurance industry. Its forward P/E ratio is 35 however, analysts expect significant growth EPS growth in coming years. See table below from Koyfin:

Thank you for reading this initial brief post on OSCR (keen readers will note it is different than my usual posts).

There will be more posts with critical analysis in upcoming weeks. Whilst you are here check out the other pieces, subscribe to the tier that suits you (if not done already) and see you for the next one!

Oscar Health embodies Nick Sleep's "shared economies of scale" concept: while traditional insurers use scale to boost margins, Oscar passes scale benefits to customers through lower premiums (10% below UHC) and better service (12% vs 23% claim denials). This customer-first approach creates a Costco-like virtuous cycle where better service attracts more members, generating more scale to share.

Nice write-up. I’ve been studying this one recently too, as it looks promising. As a European, I find the U.S. healthcare system so different from what we’re used to over here, so I’ve been spending most of my time trying to get comfortable with this aspect.