Preview of the Week Ahead

W/C December 15, 2025

Hope you all are having a good weekend. Below we will be previewing the upcoming week and providing a portfolio update as usual.

Format for what is covered in this weekly preview:

A look at the indices

Key upcoming economic events

Upcoming earnings reports

Charts

Notable portfolio changes from the previous week

Current Portfolio Holdings (Position size, cost basis, and commentary on each holding regarding the intended holding period and any planned activity)

Closing Thoughts

Highly recommend to check out the most recent Monthly Portfolio and Performance Update (TWR +392.9% since Jan ‘23) below if you have not done so.

If it is your first time here, read the below post on how to navigate the SixSigmaCapital Website and subscribe to the option that suits.

Indices

Dow Jones advanced 1.22% in the last week

S&P 500 declined 0.67% in the last week

Nasdaq Composite declined 1.98% in the last week

IWM advanced 0.70% in the last week

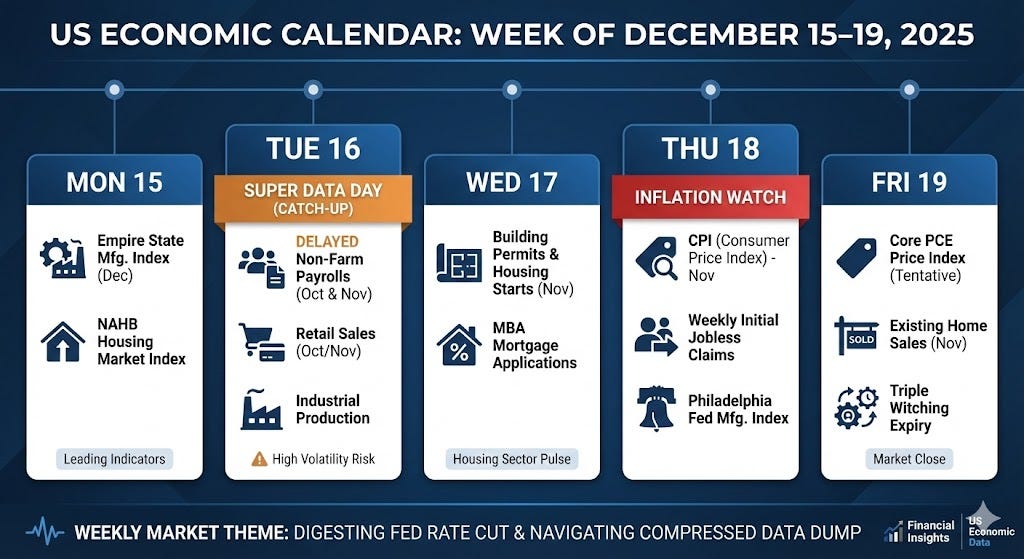

Key upcoming economic events:

Monday, December 15

Empire State Manufacturing Index (Dec)

NAHB Housing Market Index

Tuesday, December 16

Non-Farm Payrolls: The report will be covering both October and November.

US Retail Sales (Oct/Nov)

Industrial Production:

Wednesday, December 17

MBA Mortgage Applications

Building Permits & Housing Starts (Nov)

Thursday, December 18

CPI

Weekly Initial Jobless Claims

Philadelphia Fed Manufacturing Index

Friday, December 19

Core PCE Price Index: (Tentative)

Existing Home Sales (Nov)

“Triple Witching” Expiry: Stock options, stock index futures, and stock index options all expire.

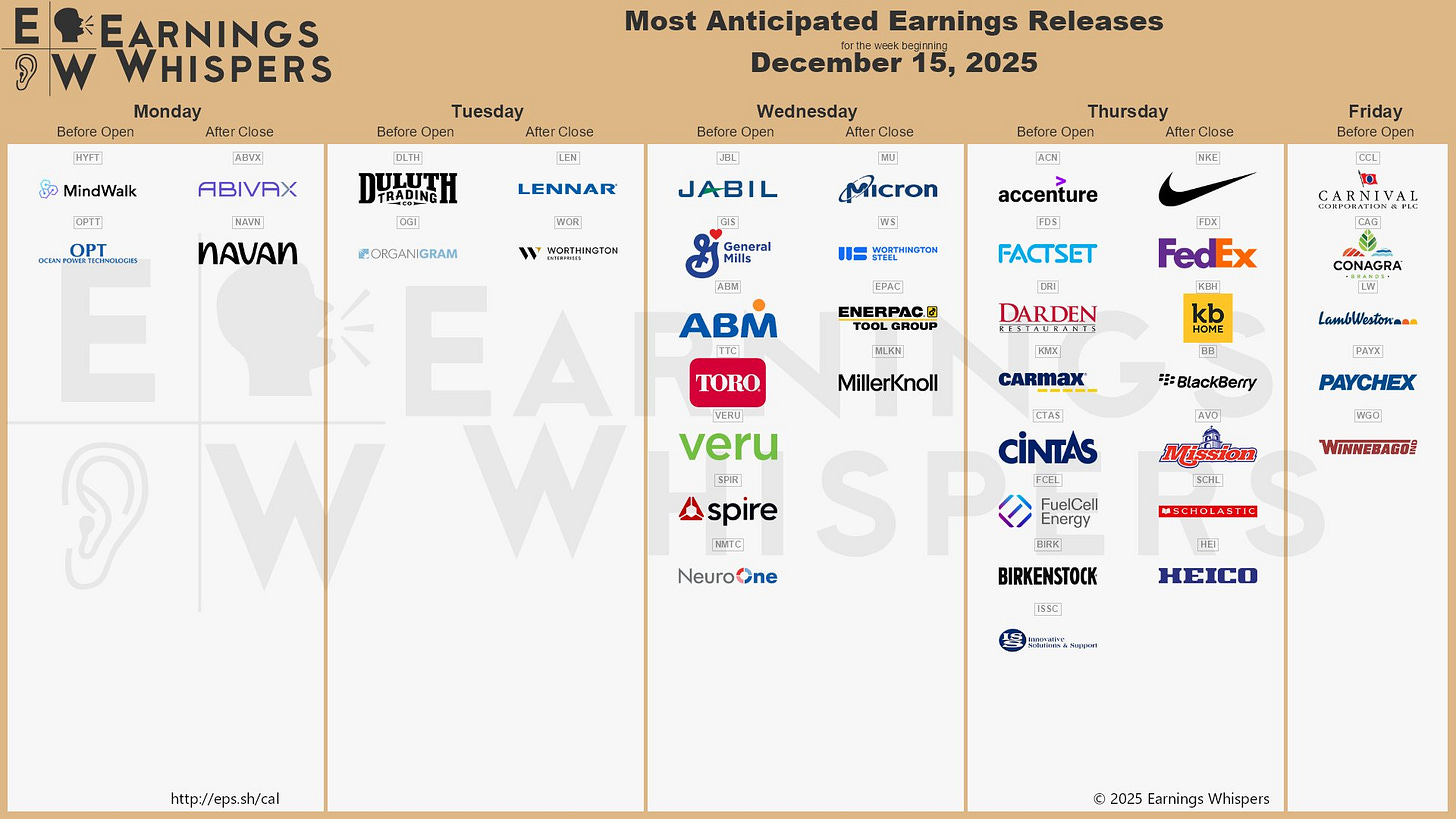

Upcoming Earnings

Last week was a quiet week. This week is also pretty bare although there are some notable companies reporting such as Micron, Accenture, Nike and FedEx. Below is the infographic by Earnings Whispers:

Charts

SPX

Currently trades at 6827.41, 0.97% above a rising 50SMA and 9.8% above 200SMA.

RSI 53.12

16.34% YTD

Distribution days in the last week: 1

The SPX achieved a highest close during this week as the rally broadened out although there was a sell off to end the week on Friday. It still remains above both the EMA 21 and the SMA 50.

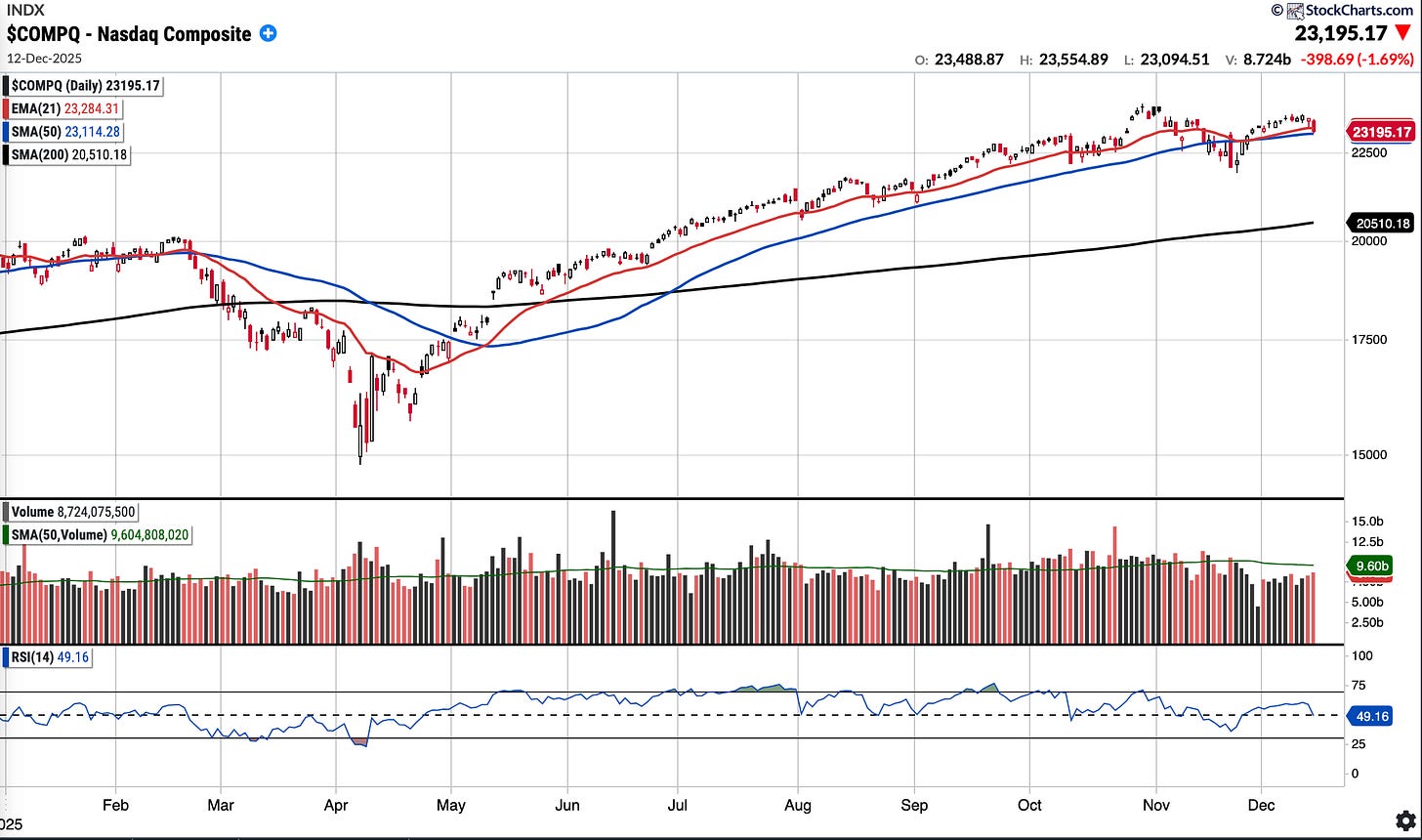

COMPQ

Currently trades at 23,195.17, 0.35% above a rising 50SMA and 13.09% above 200SMA.

RSI 49.16

20.3% YTD

Distribution days in the last week: 1

The Nasdaq Composite tested and held the SMA 50 on Friday although remains below the EMA 21.

BTC (currently Long)

Currently trades at $90,382.61, 6.39% below the 50SMA and 16.75% below the 200SMA.

RSI 44.97

-4.26% YTD.

BTC continues to perform poorly since the liquidation event on October 10th. It has at least been making higher highs and higher lows since it’s recent low on the 21st of November but it remains firmly below all key moving averages.

The BTC chart requires significant time and work to look constructive again.

BABA (currently Long)

Currently trades at $155.68, 5.76% below the 50SMA and 14.7% above the 200SMA.

RSI 43.92

+83.26% YTD

BABA stock seems to be consolidating just above the 145 breakout level on low volume. I will be looking to see if it can hold the $145 support level, below that the SMA 200 and the AVWAP from ATH which has more more recently served as support. The AVWAP sits at 120.58

META (currently Long)

Currently trades at $644.23, 3.48% below the 50SMA and 3.93% below the 200SMA.

RSI 48.13

+7.51% YTD

META sold off sharply post-earnings and actually reached more oversold levels than the April low. It has since started to turn a little, bouncing roughly 14% from the recent lows. There was news last week that Meta is looking to cut 30% of the Metaverse spend within Reality Labs. This could be a catalyst to turn the stock around.

For the chart to look more constructive, META needs to reclaim the SMA 200 and then a logical upside target is the gap fill to $743. Note the 5EMA has recently ticked above the EMA 21 which is a constructive initial sign.

IREN

Currently trades at 40.13, 26.88% below a rising 50SMA and 58.83% above the 200SMA.

RSI 38.13

283.65% YTD

IREN recently announced they were selling shares to buy back debt. Alongside the share sale which closed on December 8, 2025, they announced a private offering of $2 billion in new low interest, convertible senior notes not due until 2032 and 2033.

The IREN chart whilst in an uptrend on a longer time frame, has lost some key moving averages most recently the 100SMA. IREN bulls would like it to hold the $39 level which has served as support and then reclaim key moving averages before can feel good about a resumed uptrend. I would say Bears remain firmly in charge for now.

Notable portfolio changes in previous week (all updated live in subscriber channels):