Preview of the Week Ahead

W/C November 3, 2025

Hope you all are having a good weekend. Below we will be previewing the upcoming week and providing a portfolio update as usual.

Format for what is covered in this weekly preview:

A look at the indices

Key upcoming economic events

Upcoming earnings reports

Charts

Notable portfolio changes from the previous week

Current Portfolio Holdings (Position size, cost basis, and commentary on each holding regarding the intended holding period and any planned activity)

Ensure you check out the most recent Monthly Portfolio and Performance Update (including Market Overview) below if you have not done so.

If it is your first time here, read the below post on how to navigate the SixSigmaCapital Website and subscribe to the option that suits.

Indices

Dow Jones advanced 0.21% in the last week

S&P 500 declined 0.13% in the last week

Nasdaq Composite advanced 0.88% in the last week

IWM declined 2.06% in the last week

Key upcoming economic events:

Monday, November 3

ISM Manufacturing PMI (October)

S&P Global Final Manufacturing PMI (October)

Construction Spending (September)

Tuesday, November 4

International Trade in Goods and Services (September)

Manufacturers’ Shipments, Inventories, and Orders (M3) (September)

Wednesday, November 5

ADP National Employment Report (October)

ISM Non-Manufacturing (Services) PMI (October)

S&P Global Final Services PMI (October)

Consumer Credit (September)

Thursday, November 6

Productivity and Costs (Q3 Preliminary)

Wholesale Trade (September)

Friday, November 7

Non-Farm Employment Situation (Jobs Report) (October)

Note: As it is an official government release it is liked to be delayed due to the current shutdown.

Prelim University of Michigan Consumer Sentiment (November)

Upcoming Earnings

Last week was an extremely busy schedule notably with the hyper-scalers reporting plus other key names. This week is another packed schedule and I have several portfolio names reporting.

Below is the infographic by Earnings Whispers:

Charts

SPX

Currently trades at 6840.2, 3.01% above a rising 50SMA and 11.92% above 200SMA.

RSI 61.46

16.56% YTD

On both Tuesday and Wednesday the SPX made ATH levels and on Wednesday 6900 was breached.

Distribution days in the last week: 2

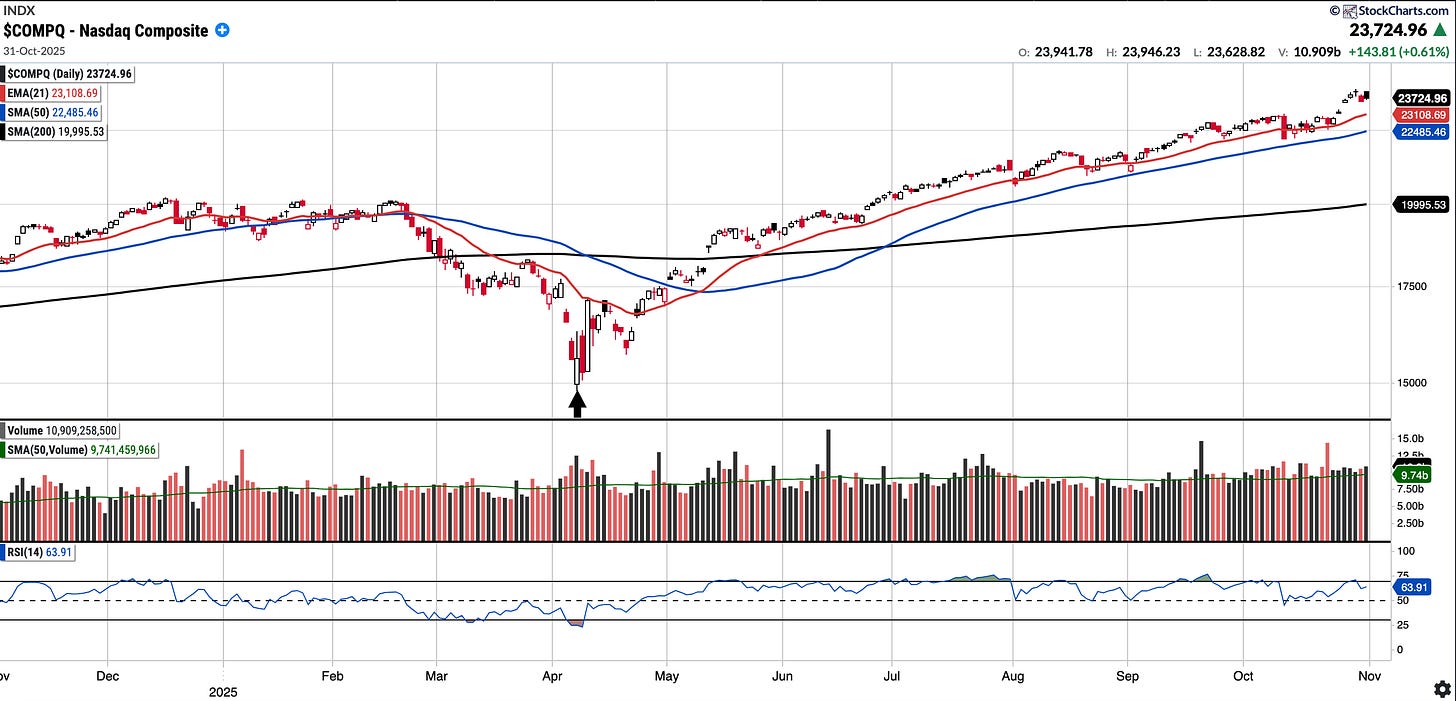

COMPQ

Currently trades at 23,724.96, 5.51% above a rising 50SMA and 18.65% above 200SMA.

RSI 63.91

23.05% YTD

Distribution days in the last week: 1 in the last week and 5 in the last 15 days.

BTC (currently Long)

Currently trades at $109,625.82, 3.69% below the 50SMA and 0.11% below the 200SMA.

RSI 44.91

16.1% YTD.

BTC is down ~3% in the last week and is currently below the SMA 50, SMA 200 and the 112k level the prior support now turned resistance level.

Over the weekend there has been positive news re China and US relations but crypto markets have not displayed any optimism. As always, the 112k is the level to surpass or else we could see a move <105,000. 120k will be the initial level to watch on the upside.

SE (currently Long)

Currently trades at $156.25, 13.09% below the 50SMA and 3.00% above the 200SMA.

RSI 33.81

+48.99% YTD

SE has had a strong couple of years and remains in an uptrend. It has pulled back from its recent high of $199 on almost no known news. Notable level to watch in my view is ~$150 which coincides with gap fill and SMA 200 level. We are approaching those levels and the SMA 200 has held thus far (see chart). Reports earnings November 11.

Remarkably it trades at PEG of ~0.6 and at current prices ~28x FY26 earnings and ~20x FY27 earnings. I will probably be looking to add some for the long term at such levels.

IREN (Currently Long)

Currently trades at 60.75, 33.94% above a rising 50SMA and 211.02% above the 200SMA.

RSI 56.87

480.78% YTD

IREN has been a tremendous winner this year and kudos goes to those who have captured the move. On a personal level, I only entered at average of ~51 2 sessions ago after waiting for an entry at the 49/50 support level.

For new buyers, given how extended the chart is buying up here may not offer the best Risk/Reward. I had stated last week that at some point IREN will consolidate, either over time or by price. A pullback to the SMA 50 which is currently 45.36 or $49-$50 support may offer up a better entry.

Notably, the Hyper-scalers this week reported and alluded to the fact they need more compute; IREN is a company with the physical infrastructure and GPU’s to fulfil that. They will be reporting earnings on the 6th of November so this week could be volatile for IREN.

Notable portfolio changes in previous week (all updated live in subscriber channels):

Exited UNH for +49% (but may revisit if opportunity arises)

Current Positions in Size Order with Cost Basis: