Stop-Loss

Strategic Use Cases, Placement Strategies and Managing them for active trades

This is slightly different from my usual style of posts, but I wanted to share some thoughts on stop losses. Note that this is not meant to be an exhaustive guide. Rather, it covers some basics and how they can be strategically used.

Stop-Loss Orders

A stop-loss is a tool that automatically sells a security when its price reaches a predetermined level. By dictating that a security is bought or sold at market price once it hits a specific trigger, traders can effectively manage and limit risk exposure.

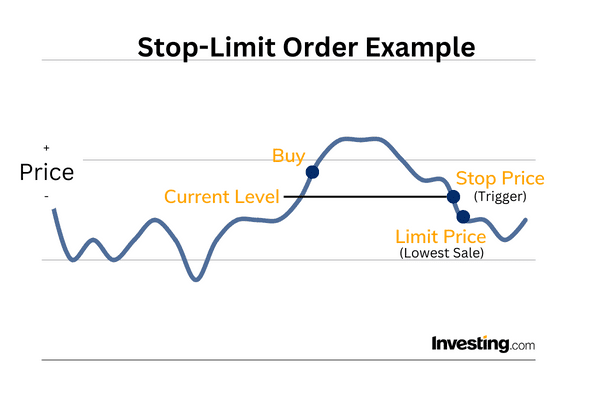

Unlike a stop-limit order, which may not execute if the price gaps past your limit, a stop-loss order guarantees execution when the stop price is met, provided there are active market participants.

A stop-limit order combines a stop-loss trigger with a limit order. This allows traders to control both the timing and the specific price of a trade to manage risk more precisely.

Strategic Use Cases

Long-term investors often find they do not need stop-loss orders. This is because they may prefer to endure volatility or use market downturns as buying opportunities to accumulate more shares. I also have many investments where I would no consider using a stop loss. However, stop losses do serve a vital purpose for active trading or when holding speculative positions.

Furthermore, Stop losses remove or minimise the emotion from a trade. To be effective, they must be established before a trade is even entered.

Placement Strategies

A stop-loss should be set at a logical area where the original trade thesis is no longer valid. If a specific level is broken, it signals that it is time to exit. Common technical areas include:

Prior support levels: Previous price floors or horizontal levels of support

Key Moving Averages: The MA one should use is the one the stock previously was respecting

Session Lows: The low of the current or prior day.

If these areas are violated, the support you defined no longer exists, meaning it no longer makes sense to stay in the position as price is going against you.

Another approach is to align the stop-loss with the maximum percentage of your total account you are willing to risk on a single trade, i.e. a Risk-Based Stop. For example, if your maximum risk per trade is 0.5% of your total account and you take a 10% position in a stock, a 5% downward move in that stock would trigger your stop. This ensures you adhere to your maximum loss rules.

Managing a stop-loss

Once a trade is active and the price appreciates in your favour, you can adjust the stop-loss upward. One strategy is to move the stop to breakeven to ensure you cannot lose money on the position. A strategy I tend to employ is to sell a portion of the position into strength to cover the initial risk, move the stop-loss to the entry price, and then re-evaluate the stop level before each new market session.

Ultimately, a stop-loss is just one tool for managing risk which should also be accompanied by appropriate position sizing. Please revisit my previous notes on risk management and especially Minimising Drawdowns below:

I have also included a link to an article on stop-limit orders from Investopedia:

https://www.investopedia.com/terms/s/stop-limitorder.asp

Thank you for reading, ensure to subscribe to the plan that suits and see you for the next one!

I never used stop losses. In hindsight, I should've used it in some speculative trades I made.

I had insane swing trade gains in September, but went greedy and forgot it was a swing trade.

Good tips.