Preview of the Week Ahead

W/C December 1, 2025

Hope you all are having a good weekend. Below we will be previewing the upcoming week and providing a portfolio update as usual.

Format for what is covered in this weekly preview:

A look at the indices

Key upcoming economic events

Upcoming earnings reports

Charts

Notable portfolio changes from the previous week

Current Portfolio Holdings (Position size, cost basis, and commentary on each holding regarding the intended holding period and any planned activity)

Closing Thoughts

Highly recommend to check out the most recent Monthly Portfolio and Performance Update (including Market Overview) below if you have not done so.

If it is your first time here, read the below post on how to navigate the SixSigmaCapital Website and subscribe to the option that suits.

Indices

Dow Jones advanced 3.78% in the last week

S&P 500 advanced 4.29% in the last week

Nasdaq Composite advanced 5.39% in the last week

IWM advanced 7.86% in the last week

Key upcoming economic events:

Monday, December 1

ISM Manufacturing PMI

S&P Global Manufacturing PMI (Final)

Construction Spending

Tuesday, December 2

State JOLTS (August Data)

Wednesday, December 3

ADP Non-Farm Employment Change

ISM Services PMI (expansion indicated if the reading >50 and contraction if <50.)

Fed Beige Book

Thursday, December 4

Weekly Initial Jobless Claims

Friday, December 5

U. of Michigan Consumer Sentiment

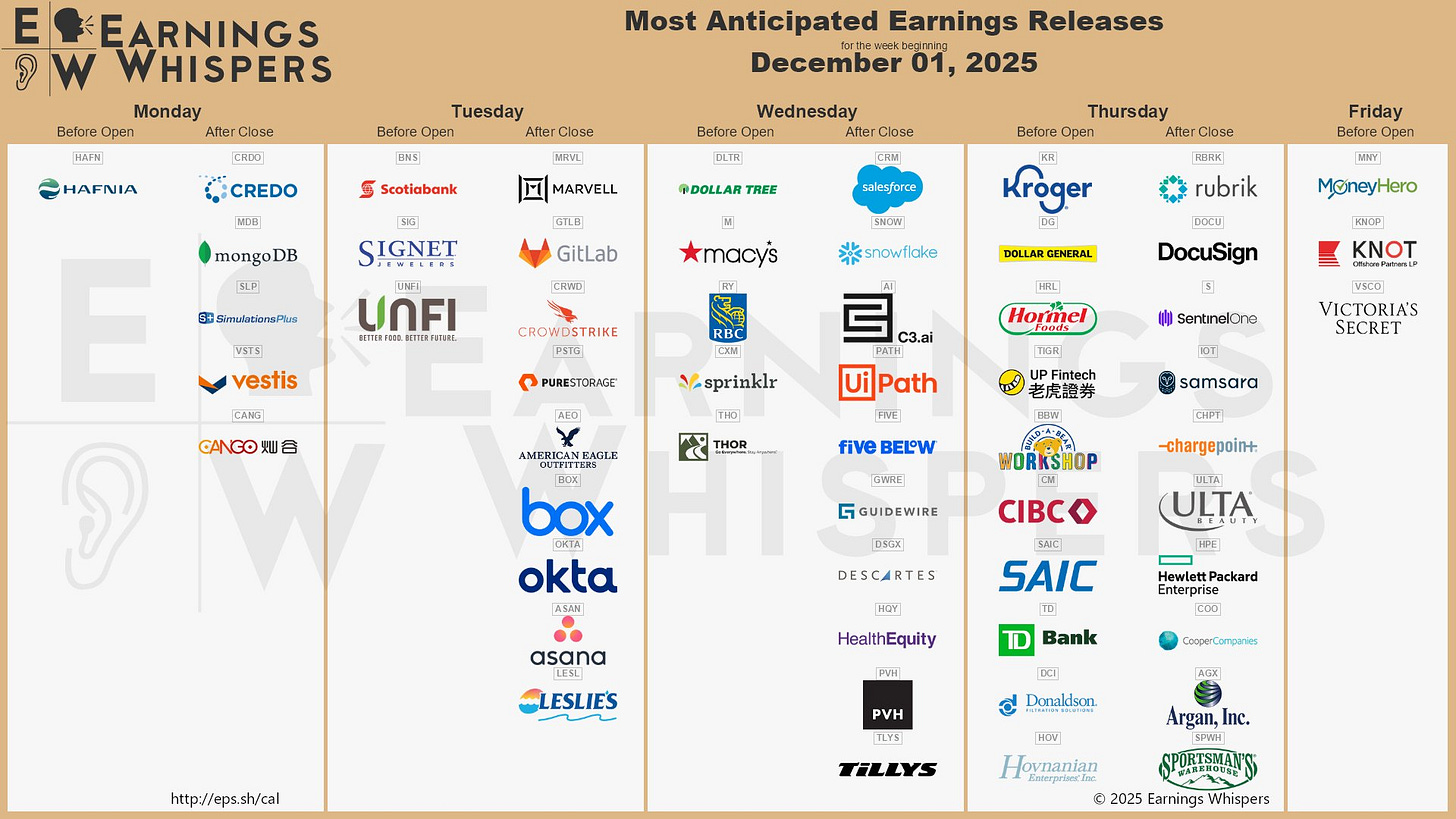

Upcoming Earnings

Last week was a quiet week and I only had Alibaba report earnings. It was a good quarter and you can see my review below:

This week there are a few notable software companies reporting but I have no portfolio companies reporting. Below is the infographic by Earnings Whispers:

Charts

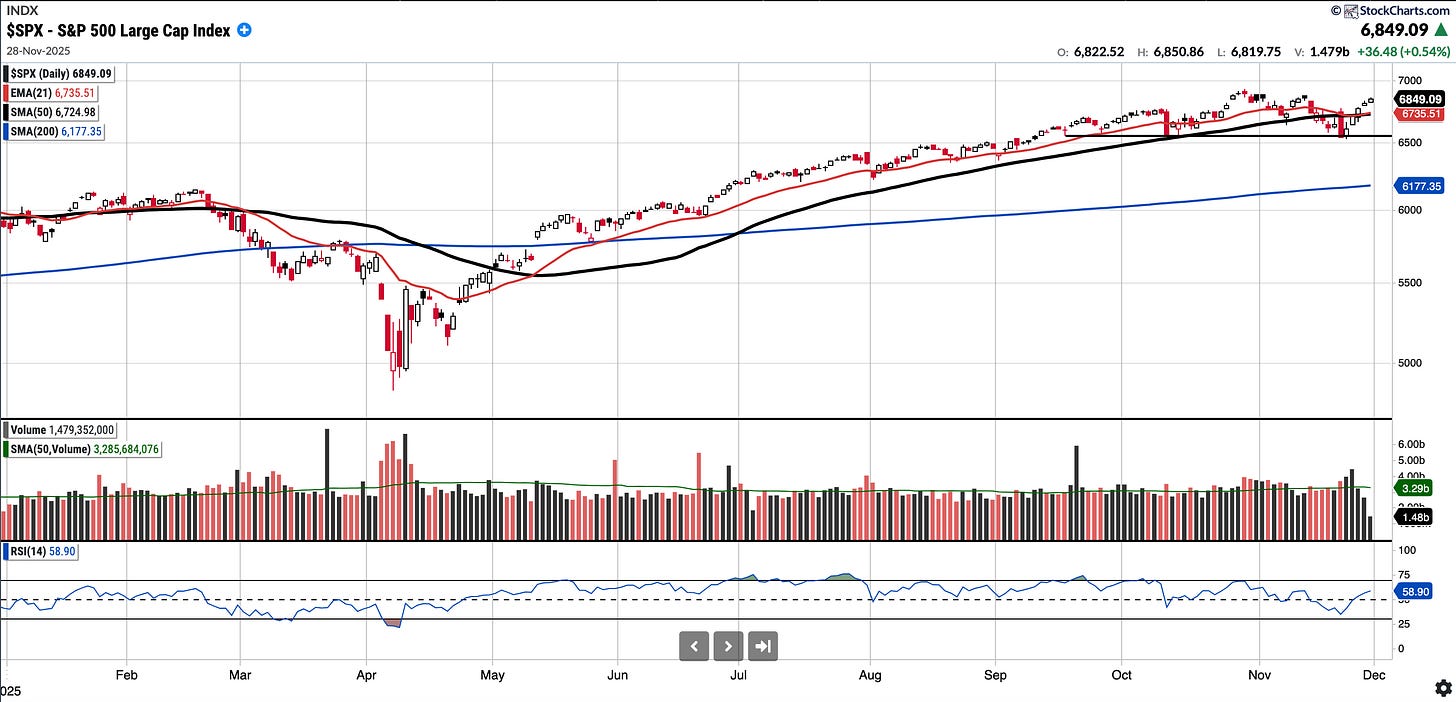

SPX

Currently trades at 6849.09, 1.85% above a rising 50SMA and 10.87% above 200SMA.

RSI 58.9

16.71% YTD

Distribution days in the last week: 0

The SPX was green each day reclaiming both the EMA 21 and the SMA 50. It was remarkable strength to end the month.

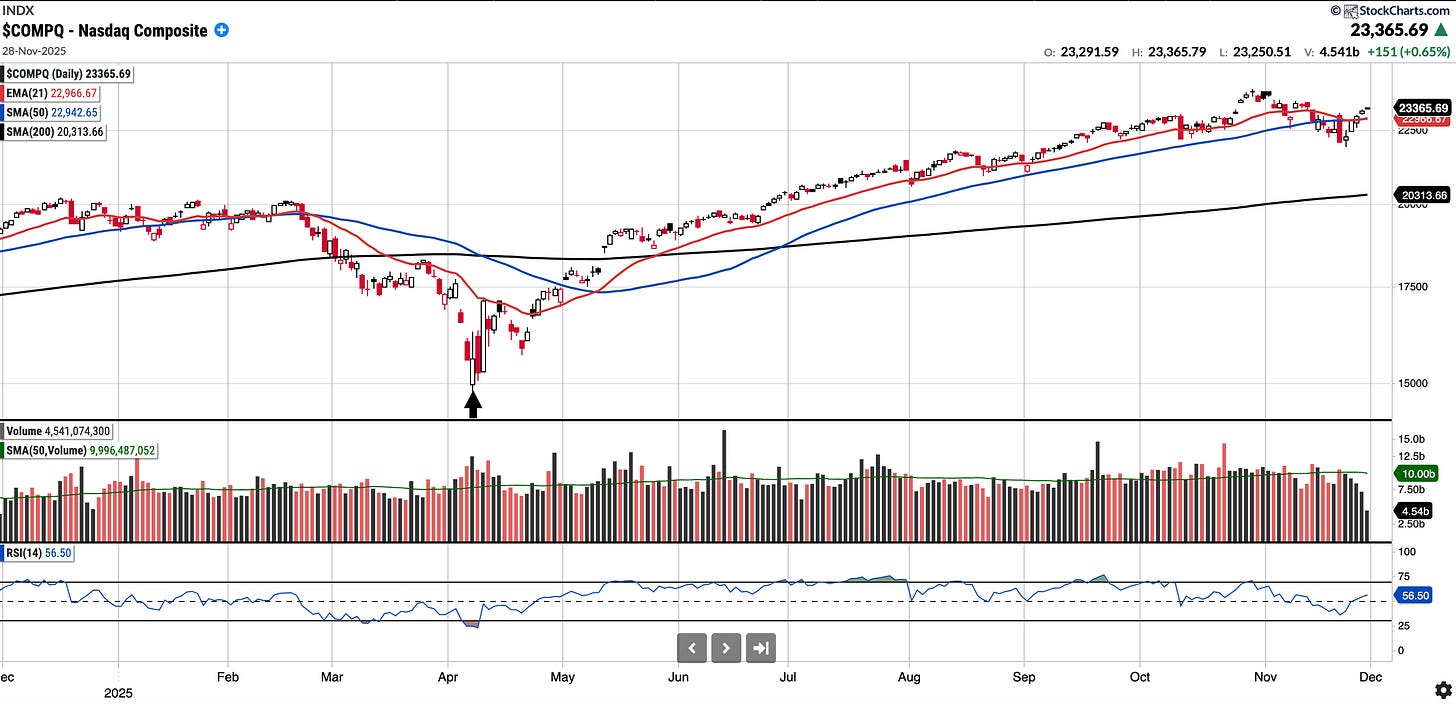

COMPQ

Currently trades at 23,365.69, 1.84% above a rising 50SMA and 15.02% above 200SMA.

RSI 56.50

21.19% YTD

Distribution days in the last week: 0

Like the S&P 500, the Nasdaq Composite was green each day this week and reclaimed all key moving averages.

BTC (currently Long)

Currently trades at $91,374.43, 10.46% below the 50SMA and 16.73% below the 200SMA.

RSI 41.76

-2.15% YTD.

BTC has continued to perform poorly since the liquidation event on October 10th and recently printed a death cross. It has been making higher highs and higher lows but it remains firmly below all key moving averages.

The BTC chart requires significant work to look constructive again. Previous bottoms have typically featured a large green candle and a small retest, followed by a subsequent move up.

BABA (currently Long)

Currently trades at $157.3, 6.59% below the 50SMA and 17.19% above the 200SMA.

RSI 44.67

+85.17% YTD

BABA reported earnings this week and ended the week up 3% or so. I will be looking to see if it can hold the $145 support level, below that the SMA 200 and the AVWAP from ATH which has more more recently served as support. The AVWAP sits at 120.47.

IREN

Currently trades at 47.81, 12.84% below a rising 50SMA and 102.67% above the 200SMA.

RSI 44.16

357.07% YTD

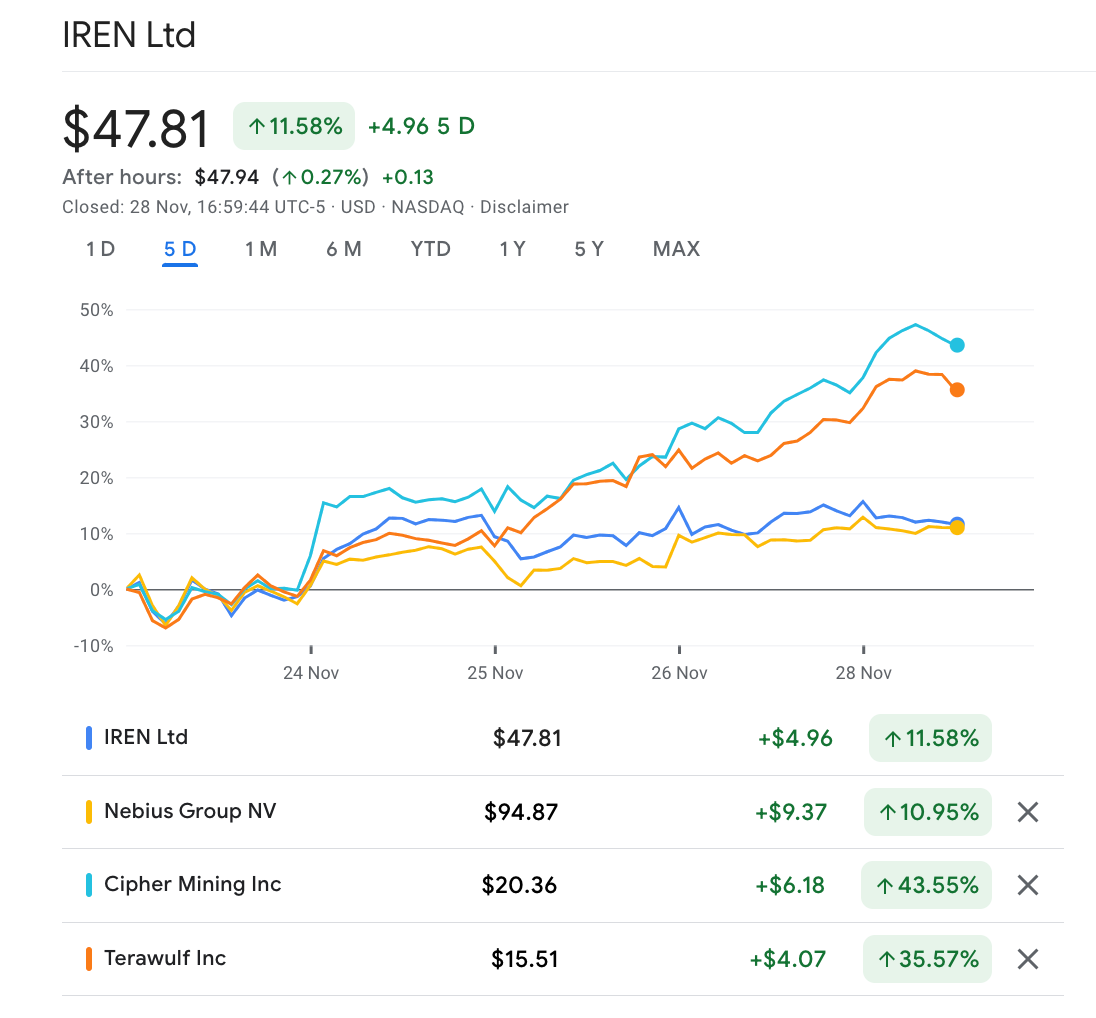

IREN bounced back 11.58% this week, but notably, it and NBIS have been underperforming their counterparts, CIFR and WULF. The narrative is that the market is worried about GPU hardware depreciation risk and views them as OpenAI proxies. In contrast, CIFR and WULF do not face this specific risk and are seen as Google proxies. See chart comparing their price action:

IREN bulls would like it to reclaim the EMA 21 and the SMA 50 with conviction before can feel good about a resumed uptrend. I would say Bears remain firmly in charge, for now.

Notable portfolio changes in previous week (all updated live in subscriber channels):

Exited REGN for +39% gain