Stocks and Set-ups I Like Heading Into 2026

High-conviction picks

2023, 2024, and 2025 have all been great years, with the SixSigmaCapital portfolio delivering a TWR of 392.9% and a CAGR of 72.9%. I encourage you to review the most recent monthly portfolio and performance update below:

Looking forward, I generally anticipate a move away from crowded AI names. The themes featured in my list focus on AI beneficiaries, Healthcare, Value, Emerging Markets, and ‘Main Street’ (Consumer and Retail). I am not suggesting that AI cannot perform well, but I believe one has to pick their spots. For example, I would rather buy NVDA on pullbacks than an unprofitable AI data centre company that bears GPU depreciation risk.

I have highlighted 11 stocks in my list, but since I cannot include every stock, some notable mentions and alternatives to review include: META, EEM, MELI, FOUR, REGN, LLY, LULU, CMG, and SBUX. Last but not least, I include a Cash Position for the optionality it offers.

Ensure to read my post on the value it brings:

Please note that this is not financial advice; you must conduct your own due diligence before purchasing any of the assets mentioned. As a reminder, risk management is essential; always employ appropriate position sizing and utilise stop-losses to protect your capital. Ideally, look to enter positions upon confirmation of an uptrend or on a pullback to a key support level.

At any given time I may or may not own the assets mentioned although any moves will be disclosed in real time on subscriber channels (Discord and Substack).

For all readers a reminder that a premium subscription includes:

Favourite set-up Ideas, Market Memos plus Full archive

Live Portfolio updates (All Buys and Sells) in Subscriber only Channels

Monthly in depth portfolio & performance updates.

Private Discord Access (Engaged Community of >500 Investors)

If interested then consider upgrading to a premium subscription via the link below. There is currently a 10% annual discount, which saves 25% vs. monthly (forever) and is 42% cheaper than the Substack App price.

We will now take a closer look at the stocks and setups I like heading into 2026.

AI Beneficiaries and E-commerce leaders:

Amazon (AMZN)

Amazon remains the clear leader in e-commerce. Regarding AWS, I expect revenue to continue accelerating (supported by a strong backlog) and for AWS margins to improve as AI infrastructure build-out stabilizes. Ads are being rolled out to Prime Video globally, and overall ad revenue continues to grow at a high double-digit rate, rivaling or exceeding the growth of peers like Google. From a valuation standpoint, AMZN is trading at 29x forward earnings or 25x EV/EBIT. While not cheap, this puts it in the bottom decile of its historical range. Furthermore, a PEG ratio of 1.1 is very reasonable.

The progress of Amazon’s custom ASIC, Trainium, is worth monitoring closely. Amazon has invested heavily in Anthropic, which utilises Amazon’s custom AI chips (Trainium and Inferentia) to build, train, and deploy its models.

Furthermore, following yesterday’s news, Amazon is investing $10 billion in OpenAI; as part of this deal, OpenAI is expected to migrate selected training and inference workloads to Trainium3 to diversify away from its exclusive reliance on Nvidia.

For further information on Trainium, I would recommend reading the following post:

Alibaba (BABA)

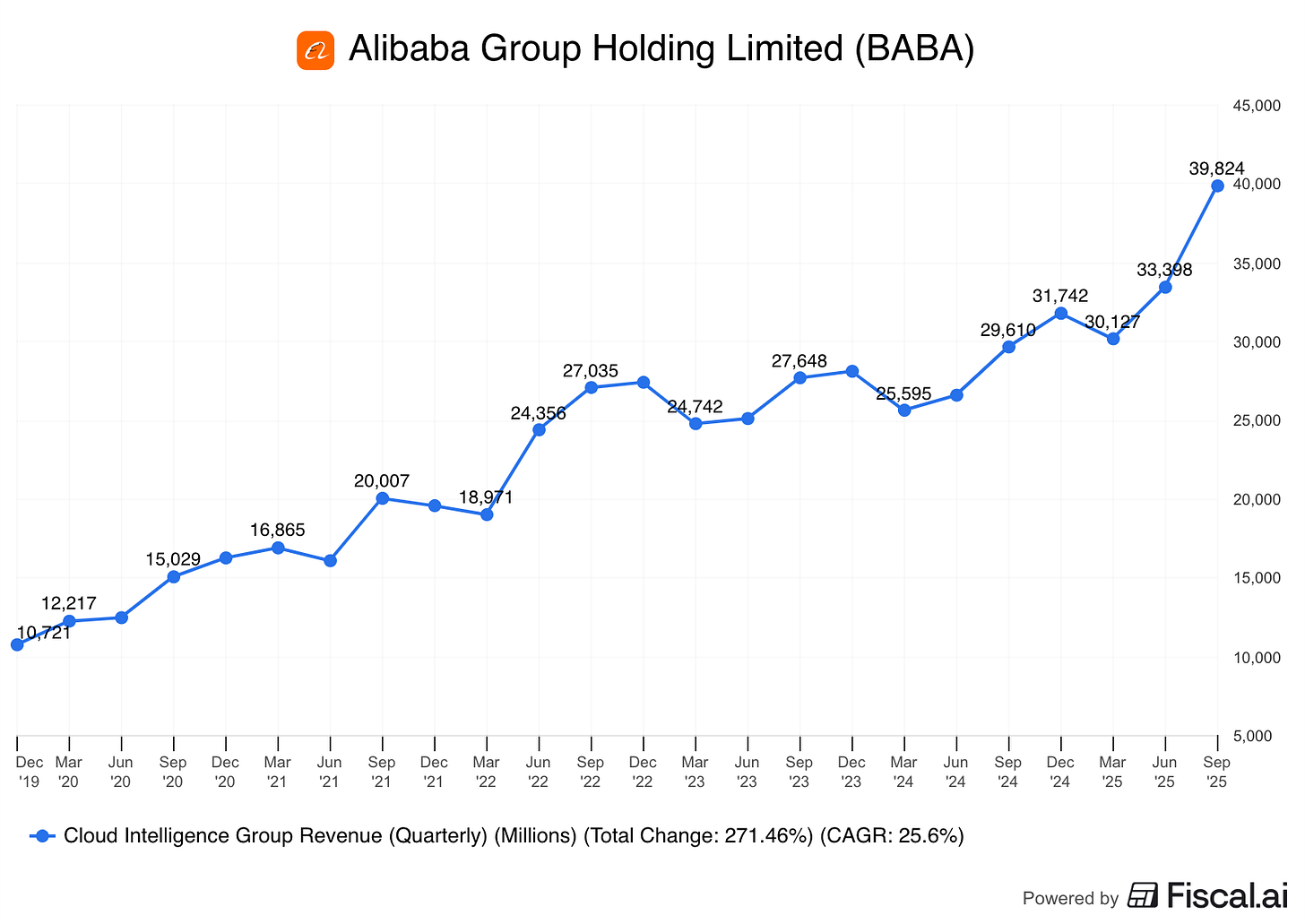

Alibaba remains a leader in AI and e-commerce, especially in China. The company continues to show decent growth, especially in its Cloud division. Robust AI demand accelerated Cloud Intelligence revenue, which grew 34% YOY. The CEO stated: ‘Certainly, we see that customer demand for AI remains very strong. In fact, we are not even able to keep pace with the growth in customer demand in terms of the pace at which we can deploy new servers.’ Furthermore, the Qwen app surpassed 10 million downloads within the first week of its public launch. The app is powered by Alibaba’s Qwen artificial intelligence models.

The quick commerce loss was disappointing but in coming quarters we can expect quick commerce investments to be sized down which will boost margins.

Alibaba has a very reasonable valuation of 19x NTM earnings and 12x 2 year forward earnings. We can expect continued capital returns in the form of buybacks and dividends also.

Below is my post reviewing their second-quarter earnings, which I would recommend reading:

Emerging Markets:

Sea Limited (SE)

Sea Limited is a prominent global consumer internet company based in Singapore. They operates three main businesses: digital entertainment, e-commerce, and digital financial services. All three are scaling profitably.

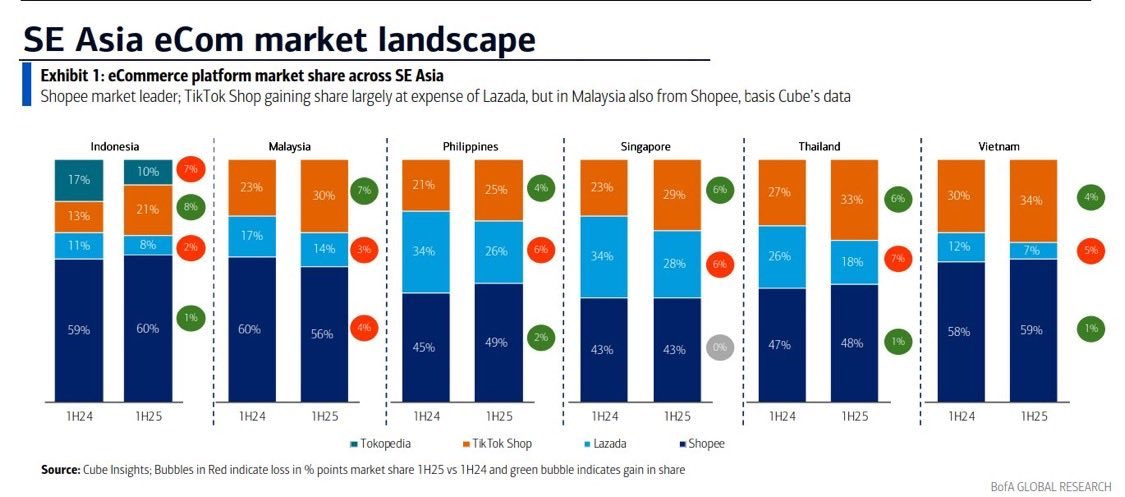

The stock has pulled back ~40% from its highs, likely because e-commerce margins decreased from 0.8% to 0.6% despite increased take rates. Furthermore, there is concern regarding competition in the e-commerce space, specifically from TikTok. To deepen the moat against competitors, management has been investing heavily in the business, particularly in logistics, fulfillment, and the Shopee VIP program. I do not see these investments as a negative. Management is guiding for a year-over-year improvement and has reiterated its target of >2% EBITDA margins for the e-commerce segment.

Addressing an analyst’s point that some ‘investors are worried about massive AI CapEx that may be affiliated or associated with any kind of new venture,’ management stated: ‘We’re not going to make LLMs or build data centers... we are going to focus more on applications and how technology built by Silicon Valley, or anywhere in the world, can transform a consumer’s daily life.’ They added, ‘We are going to have a very, very practical and bottom-up approach. We are very much focused on seeing the immediate return.’ This is positive.

SE stock trades at:

27x NTM P/E and 17x 2 years forward earnings whilst earnings are expected to grow at a CAGR of 40%. PEG ratio is 0.4.

On a free cash flow multiple it sits at EV/FCF is 16x. This stock is undervalued if SE delivers results anywhere close to what analyst expect.

dLocal (DLO)

dLocal is an emerging market ‘toll booth.’ The following quotes from CEO Pedro Arnt (who previously served as the CFO of MercadoLibre for 12 years) perfectly summarise the bull thesis for DLO:

“dLocal is riding a multi-decade tailwind in almost every key segment it is involved in. The total addressable market is massive and growing, driven by these key segments. Cross-border payments, e-commerce GMV, gig-economy are all areas where we are likely to see double-digit growth for the coming decade.

So I realised, that’s really what dLocal is. It’s a bet on emerging market and frontier market digital growth de-risked by the fact you don’t have to pick a local winner because who they serve are the world’s largest and most successful consumer digital companies” Pedro Arnt

Note that some of dLocal’s partners include Microsoft, Netflix, Amazon, Spotify, and Uber. These companies use dLocal’s API to accept local payment methods, which serves as a geographic moat because building direct banking connections across 40+ emerging nations is incredibly difficult. Therefore, it is unlikely these Big Tech giants would switch to a competitor.

“So if those companies do well across the emerging world, dLocal will do well because they’re basically a proxy for the growth of those companies across these under penetrated markets. And that to me was like, okay, this is exciting.” Pedro Arnt

dLocal is expanding into high-growth markets such as Vietnam and the Philippines, which should significantly boost payment volumes.

DLO trades at:

17x NTM P/E and 13x 2 years forward earnings whilst earnings are expected to grow at a CAGR of beyond 20%. PEG ratio is 0.6

On a free cash flow multiple it sits at EV/FCF is 15x. This is a very undemanding valuation.

Fintech:

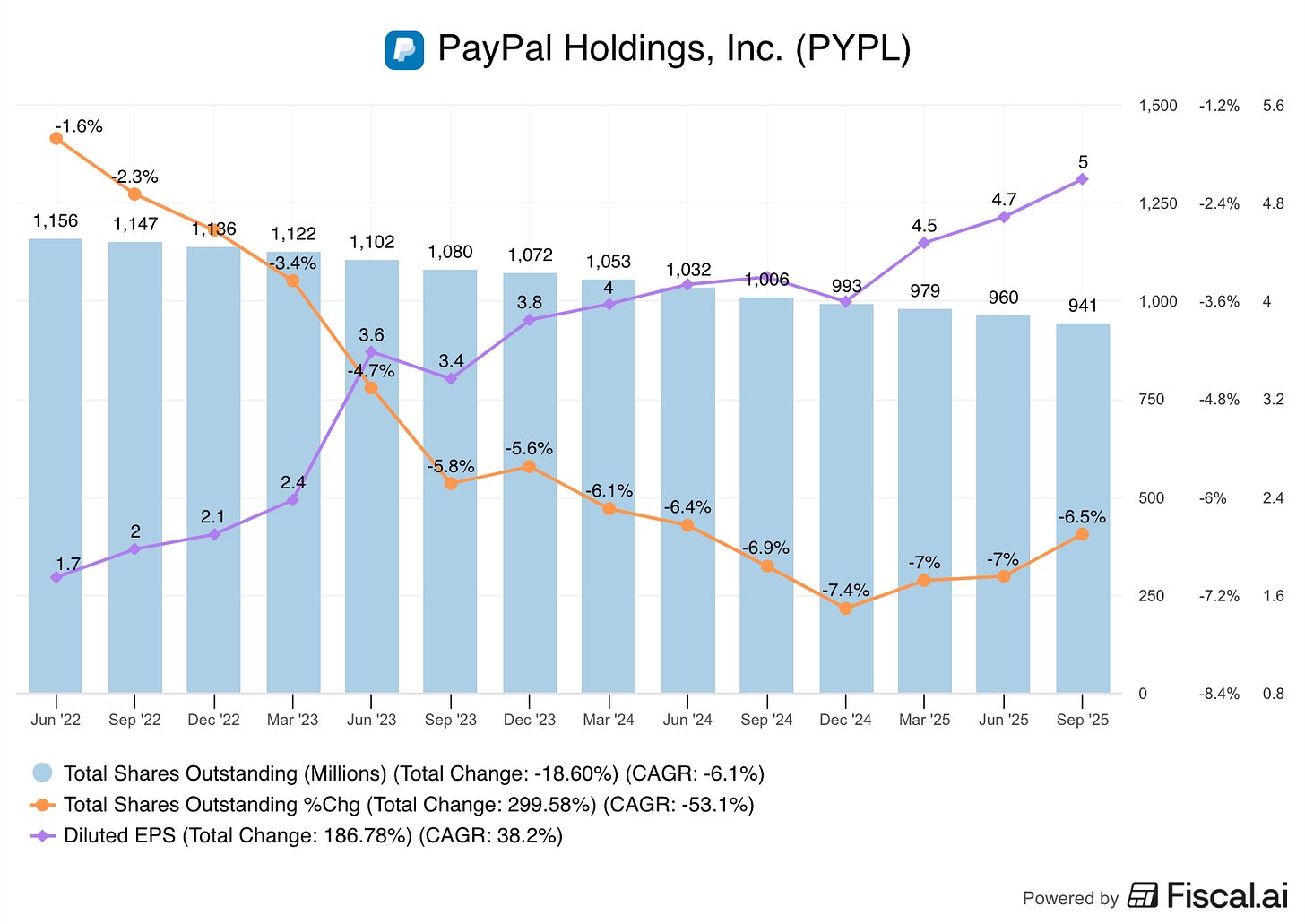

Paypal (PYPL) (Note, I sold out of this name immediately upon release of the recent earnings due to thesis change. I have however left this section in the article to keep the original list intact)

The 2026 bull case for PayPal relies on Fastlane adoption, the monetization of Venmo, and the vast capital returns the company is undertaking. The trifecta of a low starting valuation allowing for multiple expansion, continued EPS growth, and large share buybacks could lead to a sizeable gain. Furthermore, the rollout of an advertising platform is expected to generate high-margin revenue; PayPal notably hired Mark Grether, the former head of Uber’s successful advertising wing, to lead this division.

PYPL trades at:

11x NTM P/E and 9x 2 years forward earnings whilst earnings are expected to grow at a CAGR of beyond 20%. PEG ratio is 0.9

On a free cash flow multiple it sits at EV/FCF is 7.4x.

Block XYZ

XYZ has been a difficult stock to hold or endorse in recent years, but the setup looks more compelling now. Below are three drivers for the stock in 2026, as contributed by an XYZ Bull:

Neighbourhood - the bridge that finally connects Square’s ecosystem with Cash App. It will help Cash App to get back to MAU growth. It will also help Square retain Sellers and gain new ones. Merchants want to tap in to young demographic that 58M Cash App Users offer.

Growth reaccelaration leading to multiple expansion. Current multiples are at record lows, due to slowing growth past few years. Once growth picks up, multiples will grow and stock will rerate.

Product velocity increase leading to financial contribution. Maniacal focus on automation leading to margin expansion

Beyond this, the company has guided to achieve and sustain a ‘Rule of 40’ score. Management has projected Gross Profit (GP) growth of 17%, which implies an Adjusted Operating Income Margin of greater than 23%. If achieved, this suggests the shares are currently undervalued, trading at approximately 3.5x EV/Gross Profit.

If one believes we are entering a ‘Small Business Resurgence’ characterised by accelerating local commercial activity then XYZ is one of the purest ways to play that theme. Through its ecosystem, the company essentially collects a royalty on the growth of the ‘Main Street’ economy, benefiting directly from increased transaction volumes and merchant expansion. Likewise, FOUR benefits from the same dynamics.

XYZ trades at:

21x NTM P/E and 14x 2 years forward earnings whilst earnings are expected to grow at a CAGR of beyond 33%. PEG ratio is 0.85

On a free cash flow multiple it sits at EV/FCF is 13x.

Below is a comparison of PYPL and XYZ across three key metrics: P/E ratio, PEG ratio, and FCF/EV yield.

Healthcare

Novo Nordisk (NVO)

NVO is a global leader in the treatment of diabetes and obesity. These are both vast and growing markets in which NVO enjoys a duopoly position. For my full thesis on the company, I recommend reading my detailed write-up below:

While 2025 was a poor year for the stock, there have been several significant changes of late: a new CEO, a comprehensive board overhaul, and a major restructuring that included cutting approximately 11% of the workforce. On the clinical front, Wegovy has received approval for several new indications, including MASH, heart failure, and cardiovascular risk reduction.

In terms of the pipeline:

Wegovy (Oral): The OASIS 4 trial demonstrated that a high-dose oral Semaglutide offers weight loss nearly identical to the injectable version. An FDA decision is expected shortly.

CagriSema: This remains the “crown jewel” of the pipeline, showing superior weight loss in the Phase 3 REDEFINE trials. Novo Nordisk has officially filed for FDA approval of CagriSema, the first once-weekly combination of GLP-1 and amylin analogues for chronic weight management.

Amycretin: Following impressive early-stage data, Amycretin is scheduled to enter Phase 3 trials in 2026.

Wegovy “Step-up”: Novo has filed for a higher “step-up” dose of Wegovy to further optimize patient outcomes.

The new CEO has trimmed back the financial guide and also stated that Novo is sharpening their focus on key areas of Diabetes and Obesity. I think this sets well for 2026.

NVO trades at:

12.5x NTM P/E and 12x 2 years forward earnings whilst earnings are expected to grow at single digits.

On a free cash flow multiple it sits at 23x EV/FCF (NVO is currently spending on facilities hence the higher Capex)

Harrow Inc (HROW)

Harrow, Inc. is a U.S.-based pharmaceutical company exclusively dedicated to the discovery, development, and commercialisation of ophthalmic therapies. The U.S. ophthalmology market is experiencing long-term growth driven by an ageing population and an increasing prevalence of eye diseases like dry eye. Increasing use of screens likely will increase this trend. Furthermore, the increasing prevalence of conditions such as Hypertension, Diabetes and Morbid Obesity means Ocular pathology will keep increasing.

Their business model is centred on providing a comprehensive portfolio of eye care medications to ophthalmologists, optometrists and patients.

Harrow’s commercial portfolio includes a range of branded products designed to address several eye conditions. This table below neatly presents them by product name, active ingredient and indication.

Beyond its branded products, Harrow also operates ImprimisRx which is its compounding pharmacy segment. ImprimisRx provides customised ophthalmic formulations. The company's strategy involves both acquiring established ophthalmic products and developing its own pipeline of new therapies.

For my full thesis on the company, I recommend reading my detailed write-up below:

HROW trades at:

38x NTM P/E and 16x 2 years forward earnings whilst EPS is expected to grow from 0.62 to 2.73 in that time frame.

On a free cash flow multiple it sits at 24x EV/FCF. This is a very undemanding valuation.

I should mention that HROW is a very volatile stock, which creates opportunities to trade around a core position: selling when extended and buying on pullbacks. I got in at $33, but I’ve already realised nearly my entire cost basis just by trading around the core. $41 and the $33-$34 zone below it have both served as key areas of interest.

The chart below illustrates just how volatile the stock has been. It is currently forming an inverse Head and Shoulders pattern; a clean break above $50 could trigger a bullish move, while $41 and the $33–$34 zone serve as key support levels below.

Clearpoint Neuro (CLPT)

CLPT is a company that enables precision neurosurgery and access to the nervous system. The core business can be viewed mainly as four pillars: 1) Biologics and Drug Delivery, 2) Neurosurgery Navigation, 3) Laser Therapy, and 4) Cranial Irrigation and Aspiration (which allows CLPT to enter the substantial Intracranial Haemorrhage market).

It is a razor-and-blades type business model. However, the real reason I am invested is the huge potential of commercial drug delivery. Currently, they have 60 active biopharma partners, including nine partner programs accepted for FDA expedited review. If and when any of their partners get FDA approval then the high-margin commercial revenue from these partners would cover all their operating costs and likely lead to a re-rating of the stock. If they get several partners, that is a blue-sky scenario.

In September, one of their partners, uniQure (QURE), released strong data showing AMT-130 slowed disease progression by 75% compared to external controls. QURE stock went from ~$14 to >$70 and CLPT went from $10 to $30 in a few days. QURE was planning for accelerated approval in the new year, but then, at the beginning of November, the FDA did a 180, stating that the “Phase I/II data compared to external controls were unlikely to be sufficient to support an application.” Consequently, both stocks have come back down. QURE is planning to meet the FDA again in Q1 2026.

Now that the whole move has round-tripped and the “QURE premium” has been removed, I have started to rebuild my position. Most recently adding at 12.87 and 12.5 See chart:

CLPT currently trades at:

12x trailing EV/S and 8x NTM EV/S.

17x EV/Gross Profit TTM

They have 38.22M cash and equivalents, this should last them between 9 and 12 quarters based on their current burn rate.

Consumer and Retail

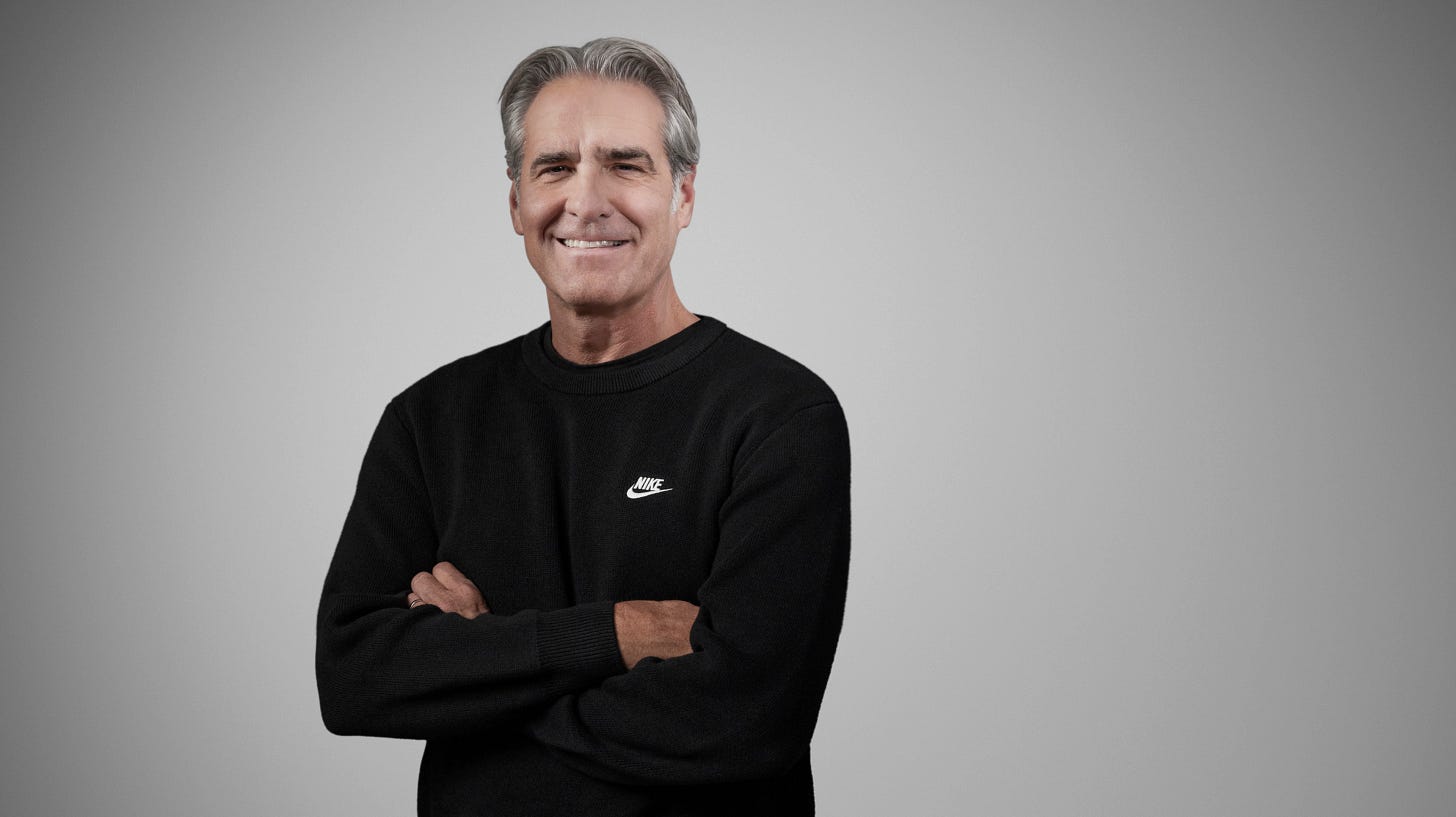

Nike Inc (NKE)

In recent times, Nike has undergone a change in management and strategy. This is not surprising given that the stock is down over 50% in the last five years and remains essentially flat over the last decade. The company previously executed a ‘Direct-to-Consumer’ pivot that performed well during the pandemic; however, digital growth has since hit a ceiling. By removing products from third-party shelves, Nike created a vacuum that was quickly filled by competitors.

In one of the most significant retail strategy reversals in recent history, management is now looking to maximise market share and win back shelf space. This involves rebuilding relationships with wholesalers like Foot Locker, where Nike has restored its ‘pole position’ inventory status.

Elliott Hill, a Nike veteran who has been with the firm since the 1980s, has taken over as CEO. He replaces John Donahoe, who had more of a tech and consulting background. Hill’s stated goal is to make Nike ‘easy to do business with again.’”

Regarding the 2026 outlook, Nike is expected to shift inventory back toward retail stores to recapture physical shelf space. The 2026 World Cup will serve as a massive marketing tailwind; as a premier kit provider for top nations, Nike will have unrivaled brand visibility.

Furthermore, its new ‘Air’ lineup is debuting, and it will be interesting to see if these product innovations can help the company recapture the serious runner demographic.

NKE trades at:

34x NTM P/E and 21x 2 years forward earnings whilst EPS is expected to grow from 1.65 in FY 26 to 3.07 in FY 28.

On a free cash flow multiple it sits at 33x EV/FCF.

So Nike is not especially cheap and to go long one has to believe this year reflects bottom of the barrel earnings and a turn around will take place subsequently to this “reset year”.

Importantly with NKE, they have earnings on the 18th of December so it may be wise to let them pass first before considering a position.

Greggs Plc (GRG.L)

Greggs is a leading food-on-the-go retailer in the UK. The company is vertically integrated, owning its own supply chain, which allows it to offer exceptional value while maintaining healthy margins. Greggs has successfully diversified its locations beyond the high street into travel hubs and roadside locations where footfall is more consistent.

While the stock is down approximately 40% year-to-date, the core business remains intact, as demonstrated by robust same-store sales growth driven by the expansion of its evening trade.

Key catalysts include the path to over 3,000 stores (particularly in higher-margin travel locations) and continued supply chain efficiencies.

Another noteworthy development is the emergence of two activist investors in late 2025: David Mercurio of Singapore-based Lauro Asset Management and Silchester International Investors.

David Mercurio has labeled Greggs’ management as ‘timid’ and argues that, given its ‘pristine balance sheet with almost no debt,’ the company should be returning cash to shareholders. He is calling for £20 million in annual cost cuts and the immediate launch of a share buyback program. Mercurio has warned that if management does not act to boost the share price, Greggs could become a cut-price acquisition target for private equity firms.”

Meanwhile, Silchester International Investors disclosed a 5.04% stake in late November. Silchester is known for working behind the scenes to influence management toward higher shareholder returns and operational efficiency. Its entry coincided with a sharp rebound in the share price (see chart) as the market likely views its involvement as a signal that a value floor has been reached. This pressure appears to be yielding results; Greggs recently appointed Richard Smothers as a Non-Executive Director, a move seen as a direct response to demands for greater financial discipline.

GRG.L trades at:

13.4x NTM P/E and 12.4x 2 years forward earnings whilst earnings are expected to grow mid single digits.

Greggs is currently free cash flow negative, as it has been aggressively investing in its supply chain. Management has emphasised that 2025 represents the peak investment year; consequently, we should see cash generation improve significantly starting in 2027 once these major infrastructure projects become operational.

Thank you for reading, ensure to like/repost if possible and see you for the next one!